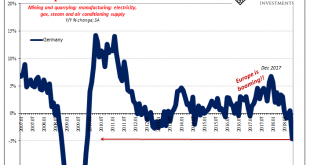

Just as there is gradation for positive numbers, there is color to negative ones, too. On the plus side, consistently small increments marked by the infrequent jump is never to be associated with a healthy economy let alone one that is booming. A truly booming economy is one in which the small positive numbers are rare. The recovery phase preceding the boom takes that to an extreme. If conditions swing the other way,...

Read More »You Know It’s Coming

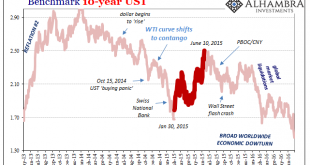

After a horrible December and a rough start to the year, as if manna from Heaven the clouds parted and everything seemed good again. Not 2019 this was early February 2015. If there was a birth date for Janet Yellen’s “transitory” canard it surely came within this window. It didn’t matter that currencies had crashed and oil, too, or that central banks had been drawn into the fray in very unexpected ways. Actually it...

Read More »If You’ve Lost The ISM…

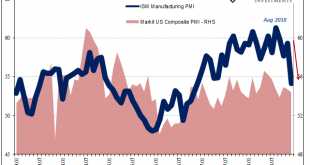

These transition periods are often just this sort of whirlwind. One day the economy looks awful, the next impervious to any downside. Today, it has been the latter with the BLS providing the warm comfort of headline payrolls. For now, it won’t matter how hollow. Yesterday, completely different story. Apple got it started downhill and the ISM pushed it off the cliff. The tech giant’s CEO admitted the global economy is...

Read More »Living In The Present

The secret of health for both mind and body is not to mourn for the past, nor to worry about the future, but to live in the present moment wisely and earnestly. Buddha Review It’s that time of year again, time to cast the runes, consult the iChing, shake the Magic Eight Ball and read the tea leaves. What will happen in 2019? Will it be as bad as 2018 when positive returns were hard to come by, as rare as affordable...

Read More »More Unmixed Signals

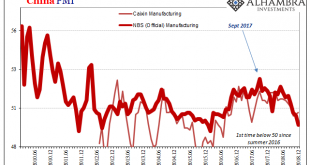

China’s National Bureau of Statistics (NBS) reports that the country’s official manufacturing PMI in December 2018 dropped below 50 for the first time since the summer of 2016. Many if not most associate a number in the 40’s with contraction. While that may or not be the case, what’s more important is the quite well-established direction. Coming in at 49.4 in December, it’s down in a straight line from 51.3 in August....

Read More »Mispriced Delusion

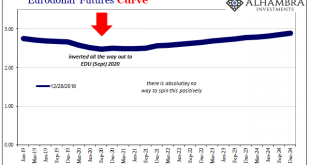

Recency bias is one thing. Back in late 2006/early 2007 when the eurodollar futures curve inverted, for example, it was a textbook case of mass delusion. All the schoolbooks and Economics classes had said that it couldn’t happen; not that it wasn’t likely, it wasn’t even a possibility. A full-scale financial meltdown was at the time literally inconceivable in orthodox thinking. A global panic, some sort of unserious...

Read More »Nothing To See Here, It’s Just Everything

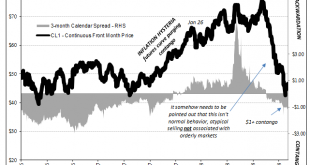

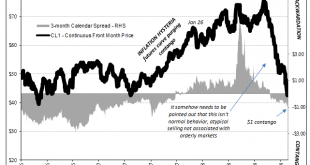

The politics of oil are complicated, to say the least. There’s any number of important players, from OPEC to North American shale to sanctions. Relating to that last one, the US government has sought to impose serious restrictions upon the Iranian regime. Choking off a major piece of that country’s revenue, and source for dollars, has been a stated US goal. In May, the Trump administration formally withdrew from the...

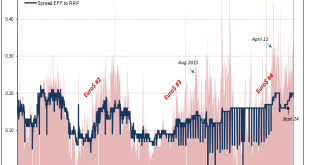

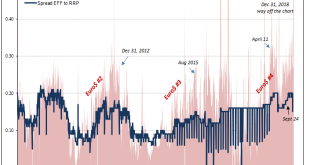

Read More »Insane Repo Reminds Us

It was only near the quarter end, that’s what made it so unnerving. We may have become used to these calendar bottlenecks over the years, but they still remind us what they are. Late October 2012 was a little different, though. On October 29, the GC repo rate for UST collateral (DTCC) surged to 52.6 bps. The money market floor, so to speak, was zero at the time and IOER (the joke) 25 bps. We also have to keep in mind...

Read More »Chart of the Week: The Dreaded Full Frown

I’m going to break my personal convention and use the bulk of the colors in the eurodollar futures spectrum, not just the single EDM’s (June) contained within each. The current front month is January 2019, and its quoted price as I write this is 97.2475. The EDH (March) 2019 contract trades at 97.29 currently and it will drop off the board on March 18. Three-month LIBOR was fixed yesterday at a fraction higher than...

Read More »Wasting the Middle: Obsessing Over Exits

What was the difference between Bear Stearns and Lehman Brothers? Well, for one thing Lehman’s failure wasn’t a singular event. In the heady days of September 2008, authorities working for any number of initialism agencies were busy trying to put out fires seemingly everywhere. Lehman had to compete with an AIG as well as a Wachovia, already preceded by a Fannie and a Freddie. If Lehman was the personification of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org