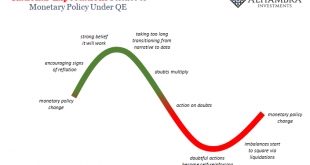

In Japan, they call it “powerful monetary easing.” In practice, it is anything but. QQE with all its added letters is so authoritative that it is knocked sideways by the smallest of economic and financial breezes. If it truly worked the way it was supposed to, the Bank of Japan or any central bank would only need it for the shortest of timeframes. That would be powerful stuff. Instead, in June last year the narrative...

Read More »China’s Big Money Gamble

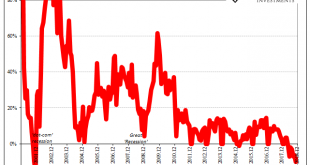

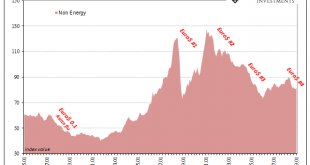

While oil prices rebounded in January 2019 around the world, outside of crude commodities continued to struggle. According to the World Bank’s Pink Sheet, base metal prices fell another 1.8% on average from December. On an annual basis, these commodities as a group are about 16% below where they were in January 2018. The last time they had fallen by that much it was May 2016. World Bank Pink Sheet Commodity Indices...

Read More »Retail Sales Landmine

Ignore Black Friday and Cyber Monday. Those are merely an appetizer, an intentional preamble to whet the appetite of hungry consumers looking to splurge. The real action comes in December. People look, some buy, after Thanksgiving, but as anyone counts down the actual twelve days of Christmas and celebrates the eight crazy nights of Hanukkah that’s when the retail industry makes its bank. In 2016, the month of December...

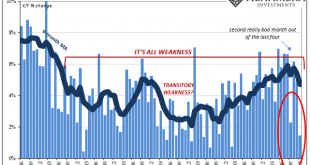

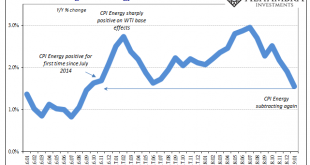

Read More »Inflation Falls Again, Dot-com-like

US inflation in January 2019 was, according to the CPI, the lowest in years. At just 1.55% year-over-year, the index hadn’t suggested this level since September 2016 right at the outset of what would become Reflation #3. Having hyped expectations over that interim, US policymakers now have to face the repercussions of unwinding the hysteria. CPI Changes On Energy 2016-2019 - Click to enlarge Live by oil, now die by...

Read More »Reserve Bank of Australia’s upbeat stance turns upside down

Dovish signals on monetary policy reduce upside for the Australian dollar.On 6 February, Philip Lowe, governor of the Reserve Bank of Australia (RBA), sent clear dovish signals, indicating that a rate cut was now as probable as a rate hike. This led to a significant decline in the Australian dollar. This change in the RBA’s stance highlights increasing concerns around the Australian economic outlook.This change in monetary stance mostly reflects increasing concerns over the accumulation of...

Read More »More Of What Was Behind December, And Not Just December

As more and more data rolls in even in this delayed fashion, the more what happened to end last year makes sense. The Census Bureau updated today its statistics for US trade in November 2018. Heading into the crucial month of December, these new figures suggest a big setback in the global economy that is almost certainly the reason markets became so chaotic. After all, money dealers don’t need this kind of statistical...

Read More »Lost In Translation

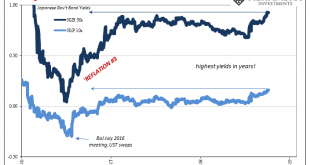

Since I don’t speak Japanese, I’m left to wonder if there is an intent to embellish the translation. Whoever is responsible for writing in English what is written by the Bank of Japan in Japanese, they are at times surely seeking out attention. However its monetary policy may be described in the original language, for us it has become so very clownish. At the end of last July, BoJ’s governing body made a split...

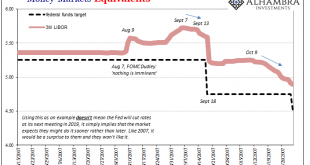

Read More »LIBOR Was Expected To Drop. It Dropped. What Might This Mean?

Everyone hates LIBOR, until it does something interesting. It used to be the most boring interest rate in the world. When it was that, it was also the most important. Though it followed along federal funds this was only because of the arb between onshore (NYC) and offshore (mainly London, sometimes Caymans) conducted by banks between themselves and their subs (whichever was located where). Unsecured markets used to be...

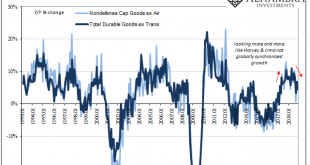

Read More »US Manufacturing Questions

The US economic data begins to trickle in slowly. Today, the reopened Census Bureau reports on orders and shipments to and from US factories dating back to last November. New orders for durable goods rose just 4.5% year-over-year in that month, while shipments gained 4.7%. The 6-month average for new orders was in November pulled down to just 6.6%, the lowest since September 2017 (hurricanes). Durable Goods New...

Read More »Fear Or Reflation Gold?

Gold is on fire, but why is it on fire? When the precious metals’ price falls, Stage 2, we have a pretty good idea what that means (collateral). But when it goes the other way, reflation or fear of deflation? Stage 1 or Stage 3? If it is Stage 1 reflation based on something like the Fed’s turnaround, then we would expect to find US$ markets trading in exactly the same way. Like 2017, when gold was last rising, there...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org