[embedded content] Weekly Market Pulse on June 21, where we look at significant things from last week’s events with Joe Calhoun. [embedded content] You Might Also Like Weekly SNB Sight Deposits and Speculative Positions: Inflation is there, CHF must Rise 2021-06-21 Update June 21 2021: SNB intervening. Sight Deposits have risen by +1.1 bn CHF, this means that the SNB is intervening and...

Read More »The FOMC Accidentally Exposes Itself (Reverse Repo-style)

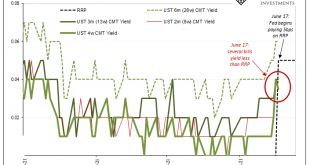

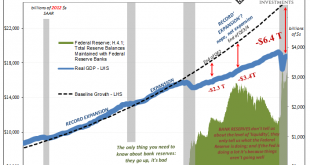

Initially, the dots got all the attention. Though these things are beyond hopeless, the media needs them to write up its account of a more fruitful monetary policy outcome because markets continue to discount that entirely. Dots look like inflationary success if possibly even now more likely, whereas yields and especially bills have (re)taken a more skeptical approach pricing almost no chance for it. Buried in the FOMC minutiae on Wednesday was an upward adjustment...

Read More »The Inflation Emotion(s)

Inflation is more than just any old touchy subject in an age overflowing with crude, visceral debates up and down the spectrum reaching into every corner of life. It is about life itself, and not just quality. When the prices of the goods (or services) you absolutely depend upon go up, your entire world becomes that much more difficult. For those at the “bottom”, that much more unbearable (hello Communism!) The real issue in that situation isn’t that narrow slice of...

Read More »Weekly Market Pulse: The Market Did What??!!

One of the most common complaints I hear about the markets is that they are “divorced from reality”, that they aren’t acting as the current economic data would seem to dictate. I’ve been in this business for 30 years and I think I first heard that in year one. Or maybe even before I decided to lose my mind and start managing other people’s money. Because, of course, it has always been this way. Economic data represents the past while markets look to the future. And...

Read More »Rechecking On Bill And His Newfound Followers

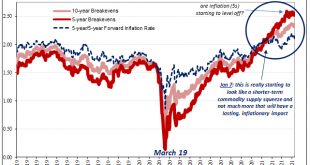

The benchmark 10-year US Treasury has obtained some bids. Not long ago the certain harbinger of bond rout doom, the long end maybe has joined the rest of the world in its global pause if somewhat later than it had begun elsewhere (including, importantly, its own TIPS real yield backyard). Even nearer-in inflation expectations have rounded off at their current top. Perhaps no more than a short-term rest before each rising again, then again with the rest of the...

Read More »Real Dollar ‘Privilege’ On Display (again)

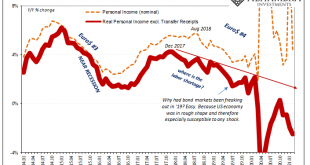

Twenty-fifteen was an important yet completely misunderstood year. The Fed was going to have to become hawkish, according to its models, yet oil prices crashed and the dollar continued to rise. Both of those things were described as “transitory” by Janet Yellen, and that they were helpful or positive (rising dollar means cleanest dirty shirt!), but domestically American policymakers’ clear lack of conviction and courage about that rate hike regime showed otherwise....

Read More »Weekly Market Pulse: Buy The Rumor, Sell The News

There’s an old saying on Wall Street that one should “buy the rumor, sell the news”, a pithy way to express the efficient market theorem. By the time an event arrives, whatever it may be, the market will have fully digested the news and incorporated it into current prices. And then the market will move on to anticipating the next event, large or small. What prompts this review of Wall Street folk wisdom is the most recent employment report. The BLS reported Friday,...

Read More »Spending Here, Production There, and What Autos Have To Do With It

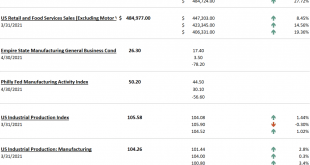

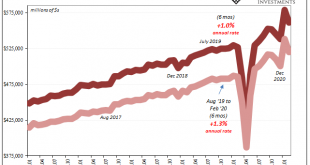

While the global inflation picture remains fixed at firmly normal (as in, disinflationary), US retail sales by contrast have been highly abnormal. You’d think given that, the consumer price part of the economic equation would, well, equate eventually price-wise. Consumers are spending, prices should be heading upward at a noticeable rate. To begin with, consumer spending – as pictured by the Census Bureau – was obviously boosted during January by the previous...

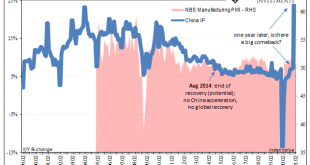

Read More »Looking Past Gigantic Base Effects To China’s (Really) Struggling Economy

The Chinese were first to go down because they had been first to shut down, therefore one year further on they’ll be the first to skew all their economic results when being compared to it. These obvious base effects will, without further scrutiny, make analysis slightly more difficult. What we want to know is how the current data fits with the overall idea of recovery: is it on track, perhaps going better than thought, or falling short. Another set of huge positives...

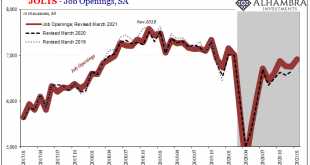

Read More »JOLTS Revisions: Much Better Reopening, But Why Didn’t It Last?

According to newly revised BLS benchmarks, the labor market might have been a little bit worse than previously thought during the worst of last year’s contraction. Coming out of it, the initial rebound, at least, seems to have been substantially better – either due to government checks or, more likely, American businesses in the initial reopening phase eager to get back up and running on a paying basis again. The JOLTS labor series annual revisions took about...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org