The “too many” Treasury argument which ignited early in 2018 never made a whole lot of sense. It first showed up, believe it or not, in 2016. The idea in both cases was fiscal debt; Uncle Sam’s deficit monster displayed a voracious appetite never in danger of slowing down even though – Economists and central bankers claimed – it would’ve been wise to heed looming inflationary pressures to cut back first. Combined, fiscal and monetary policy was, they said,...

Read More »Deja Vu: Treasury Shorts Meet Treasury Shortages

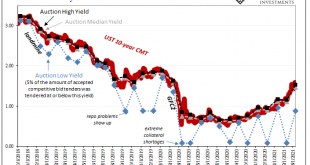

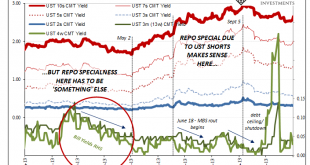

Investors like to short bonds, even Treasuries, as much as they might stocks and their ilk. It should be no surprise that profit-maximizing speculators will seek the best risk-adjusted returns wherever and whenever they might perceive them. If one, or a whole bunch, has to first “borrow” a security the one doesn’t own in order to sell something at a high price betting the price to go down, you can likewise bet there’s someone out there in the financial landscape more...

Read More »There’s Two Sides To Synchronize

The offside of “synchronized” is pretty obvious when you consider all possibilities. In economic terms, synchronized growth would mean if the bulk of the economy starts moving forward, we’d expect the rest to follow with only a slight lag. That’s the upside of harmonized systems, the period everyone hopes and cheers for. What happens, however, when it’s the leaders rather than laggards who begin to shift toward the other way? It’s a question the global economy has...

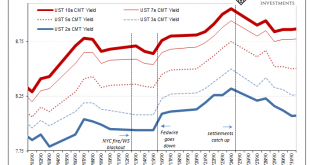

Read More »Three Things About Today’s UST Sell-off, Beginning With Fedwire

Three relatively quick observations surrounding today’s UST selloff. 1. The intensity. Reflation is the underlying short run basis, but there is ample reason to suspect quite a bit more than that alone given the unexpected interruption in Fedwire yesterday. At 12:43pm EST, most of FRBNY’s electronic services experienced an as-yet unexplained problem which interrupted service, including that of Fedwire. To this point, the New York branch has only confirmed the...

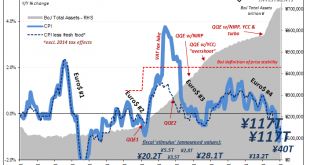

Read More »Nine Percent of GDP Fiscal, Ha! Try Forty

Fear of the ultra-inflationary aspects of fiscal overdrive. This is the current message, but according to what basis? Bigger is better, therefore if the last one didn’t work then the much larger next one absolutely will. So long as you forget there was a last one and when that prior version had been announced it was also given the same benefit of the doubt. Most people don’t like looking to Japan mainly because it is too depressing; unless one is an Economist who...

Read More »For The Dollar, Not How Much But How Long Therefore How Familiar

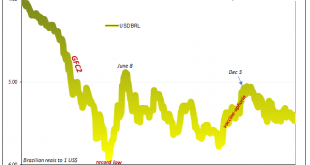

Brazil’s stock market was rocked yesterday by politics. The country’s “populist” President, Jair Bolsonaro, said he was going to name an army general who had served with Bolsomito (a nickname given to him by supporters) during that country’s prior military dictatorship as CEO of state-owned oil giant Petróleo Brasileiro SA. Gen. Joaquim Silva e Luna is being installed, allegedly, to facilitate more direct control of the company by the federal government. With the...

Read More »What Might Be In *Another* Market-based Yield Curve Twist?

With the UST yield curve currently undergoing its own market-based twist, it’s worth investigating a couple potential reasons for it. On the one hand, the long end, clear cut reflation: markets are not, as is commonly told right now, pricing 1979 Great Inflation #2, rather how the next few years may not be as bad (deflationary) as once thought a few months ago. On the other hand, over at the short end, yields are dropping toward zero again. This steepening isn’t...

Read More »Weekly Market Pulse – Real Rates Finally Make A Move

Last week was only four days due to the President’s day holiday but it was eventful. The big news of the week was the spike in interest rates, which according to the press reports I read, “came out of nowhere”. In other words, the writers couldn’t find an obvious cause for a 14 basis point rise in the 10 year Treasury note yield so they just chalked it up to mystery. Of course, anyone who’s been paying attention knows that rates have been rising for almost a year –...

Read More »Eurodollar University’s Making Sense; Episode 46; Part 3: Bill’s Reading On Reflation, And Other Charted Potpourri

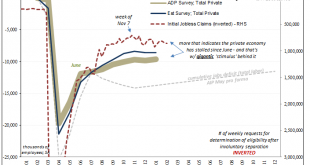

46.3 On the Economic Road to NothingGoodVilleRecent, low consumer price inflation readings combined with falling US Treasury Bill yields are cautionary sign posts that say this reflationary path may not be the road to recovery but a deflationary cul-de-sac. [Emil’s Summary] Having studied monetary policy for several years it was only natural that your podcaster spent considerable time contemplating the essential elements of fiction. Some experts say there are five...

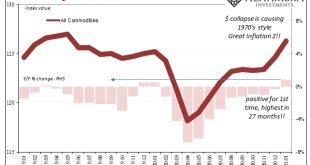

Read More »Two Seemingly Opposite Ends Of The Inflation Debate Come Together

It’s worth taking a look at a couple of extremes, and the putting each into wider context of inflation/deflation. As you no doubt surmise, only one is receiving much mainstream attention. The other continues to be overshadowed by…anything else. To begin with, the US Bureau of Labor Statistics reported today that US import prices were up on annual basis for the first time in some time. Rising in January 2021 by 0.9% year-over-year, this was actually the fastest...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org