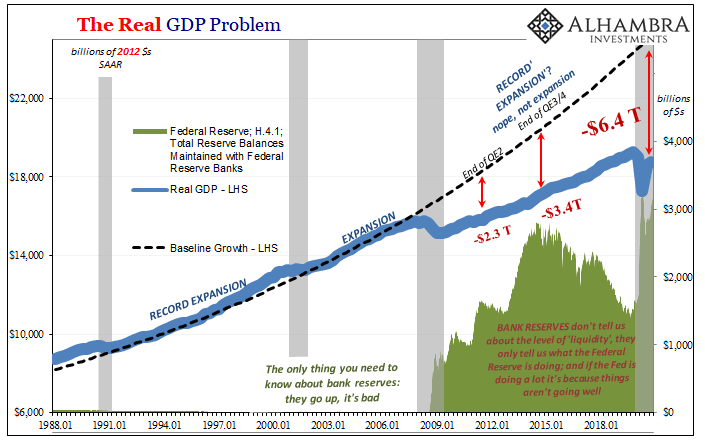

Inflation is more than just any old touchy subject in an age overflowing with crude, visceral debates up and down the spectrum reaching into every corner of life. It is about life itself, and not just quality. When the prices of the goods (or services) you absolutely depend upon go up, your entire world becomes that much more difficult. For those at the “bottom”, that much more unbearable (hello Communism!) The real issue in that situation isn’t that narrow slice of rising prices, it’s the lack of economic growth which once made it better than palatable we had long ago taken for granted long since disappeared without official acknowledgement. The Real GDP Problem, Jan 1988 - 2021 - Click to enlarge This isn’t the only emotional plea attached to the topic.

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, China, CPI, currencies, Deflation, economy, factory gate prices, Featured, Federal Reserve/Monetary Policy, fiscal deficits, inflation, Markets, money printing, newsletter, PPI, price stability, victor davis hanson

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Inflation is more than just any old touchy subject in an age overflowing with crude, visceral debates up and down the spectrum reaching into every corner of life. It is about life itself, and not just quality. When the prices of the goods (or services) you absolutely depend upon go up, your entire world becomes that much more difficult. For those at the “bottom”, that much more unbearable (hello Communism!)

The real issue in that situation isn’t that narrow slice of rising prices, it’s the lack of economic growth which once made it better than palatable we had long ago taken for granted long since disappeared without official acknowledgement. |

The Real GDP Problem, Jan 1988 - 2021 |

| This isn’t the only emotional plea attached to the topic. Another detours into politics and history, known suspects for irrationality anyway. The world and its leaders aren’t playing with fire anymore, many righteously believe, they’ve offended every god of fiscal and monetary sanity. They must, therefore, pay before the whole thing just blows up for good.

Even the venerable, decent and honest scholar/historian Victor Davis Hanson exemplified this outburst not quite a month ago, in the aftermath of the April CPI:

In this sense, inflation isn’t the goal it’s rather the proof; we told you, we repeatedly warned those idiot politicians would go too far and now with consumer prices skyrocketing the whole world can see we were right all along. You should’ve listened! |

|

| Inflation is, in this sense, first vindication before a call to arms, with everyone shoved onto the one side whether they previously liked it or not.

I actually agree with Hanson in much of what he says, yet I’m accused of all the sins in the fiscal calendar for refusing to agree it must end up in this way. It’s alleged a I’m a closet Keynesian or even a central bank shill, covering up for these reckless money printers by denying the currency and consumer price devastation in front of our very eyes, shamefully misleading the public as it happens. Those aren’t it at all, there will be Hell to pay for all the debt and fiscal deficits…at some point. That point isn’t now or indeed anytime in the foreseeable future. What I don’t agree with is the money printing part of it. Like or not, academic and official research is moving in this direction, too, including among a growing swath of the “money printers.” Because of this very different monetary reality, regardless of each worthless theory and worthy tradition, honest analysis demands setting aside all that legitimate distaste and genuine horror. So long as the situation remains this way, no money printing, quite the opposite (much thanks to QE doing real monetary harm), no matter how anyone feels about rising food prices or the out-of-control Congress and its Executive partners (of both parties) the chances of real inflation will only ever be extremely slim. To put these people in their place, to choke reason down their throats, it will require other means. We have bigger fish to fry in the meantime. |

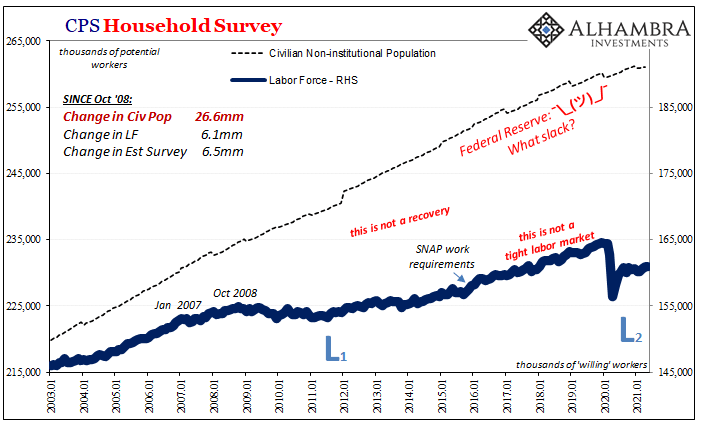

CPS Household Survey, Jan 2003 - Jun 2021 |

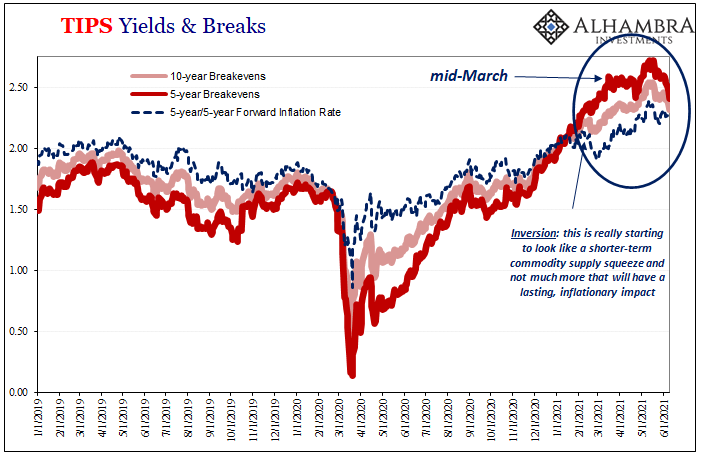

| As I keep pointing out, while inflation is a foregone conclusion in the mainstream media that’s the only place on Planet Earth this is true. Everywhere else, it continues to be quite the opposite. Start with the bond market (and all its most lucid segments) and then go outward into other markets and then the whole of the real economy. The rest of the planet is in no shape for all this nonsense.

Like it or not, even as the world tries to pull itself apart in reverse globalization it remains wedded together for better and for worse (more exclusively the latter since, oh, August 2007). |

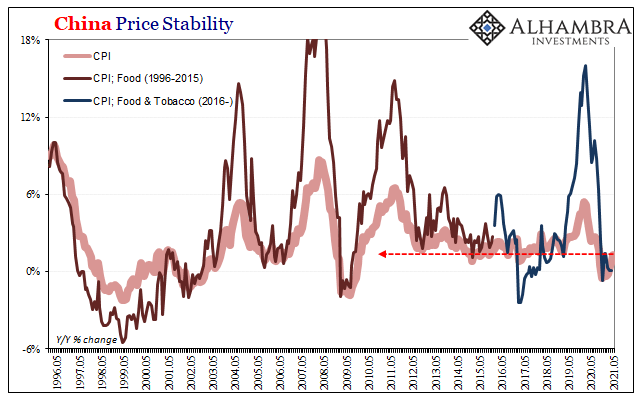

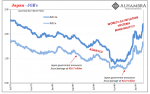

China CPI, May 1996 - 2021 |

| If the US “feels” a bit inflation-y but nowhere else, that’s truly the end of the matter. The US non-inflation inflation will ultimately (and quickly enough) prove, to borrow the Fed’s overworn phrase, transitory.

And in any cases where prices are un-leveled by other factors such as supply problems, all the quicker. |

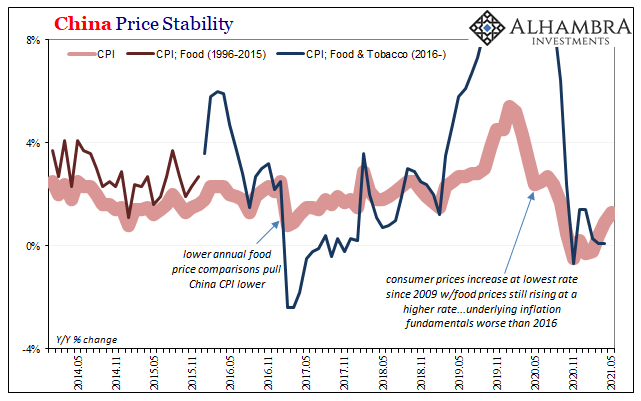

China CPI, May 2014 - 2021 |

| China is perhaps the best current example of nearly all these things simultaneously. In 2019 and early 2020, food prices had truly skyrocketed – even as the rest of the economy went backward taking with it the rest of consumer prices. Food hurts the most, yet it isn’t by itself any signal for real inflation.

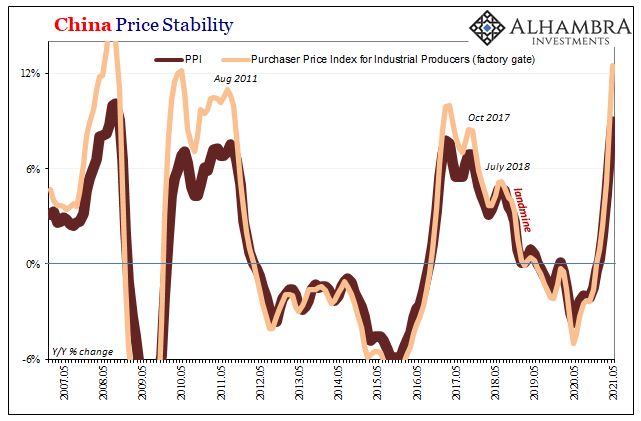

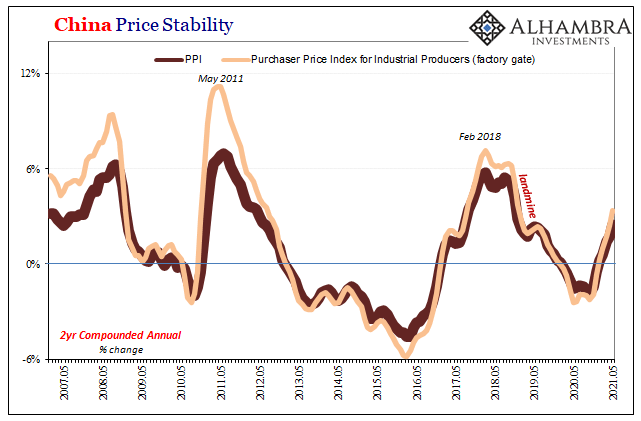

In 2021, the Chinese are up against the same pressures as the rest of the world; beginning with commodities being then compounded – in analysis – by base effects skewing perceptions. According to the latest numbers from the Chinese government, producer prices rose 9.0% year-over-year in May, factory gate prices 12.5%, each the highest in more than a decade. These comparisons have littered the internet under the guise of the same I-told-you-so Victor Davis Hanson was describing in that same month. |

China PPI, May 2007 - 2021 |

| But – and here’s the thing – nowhere does this biased discourse deal with the fact that the highest since September 2008 might actually mean something drastically different.

After all, the pace of Chinese price changes (as well as those around the rest of the world) back then was even more compelling – and yet, there was no doom at least not of the inflationary variety. While producer and consumer prices accelerated, underneath the global economic situation deteriorated, hardly conducive for the real inflation (sustained). Though big numbers, transitory. Deflation was the future. |

China PPI Factory Gate, May 2007 - 2021 |

| And there were no base effects back then, unlike now. If you distill the PPI and China’s Factory Gate estimates into 2-year changes, what you find is substantially lower rates than advertised in the yearly headlines.

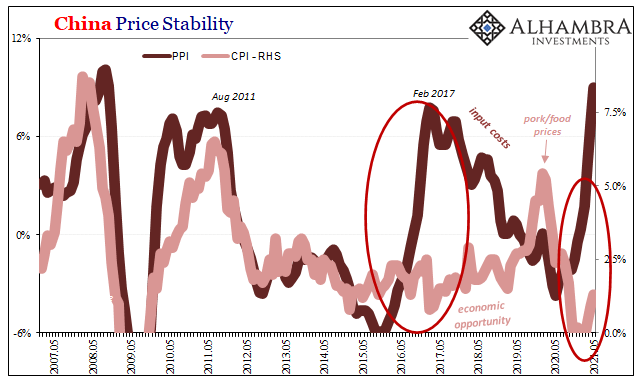

But the real comparison, or anti-comparison, is in the CPI. While producers are being hit by supply-driven price factors, China’s weak – yes, very weak – economy will not support those costs being passed along to consumers. China’s consumer prices remain less than tepid for this reason (these reasons); in May, with the fullest measure of base effects within them, the CPI increased all of 1.3% year-over-year; the core rate just 0.9%. |

China CPI/PPI, May 2007 - 2021 |

| Like Europe, Chinese consumer prices fully demonstrate these divergences: the first between the rest of the world and what’s going on in the US goods economy alone; the second between supply-driven factors and this underlying, broad-based economic weakness across the majority global economy (US, too, factoring out Uncle Sam’s helicopter) which only means, like 2017 heading into 2018, more of the same trouble ahead.

A supply/price shock showing up inside a truly weak economic climate will not result in actual inflation. That’s what happened to those big inflation numbers in 2008 even though they had closer to real inflation in them (more than just a few months, prices had been building for several years; see: 2-year changes) than the current set. |

UST Consumer Credit, Jul 2020 - Jun 2021 |

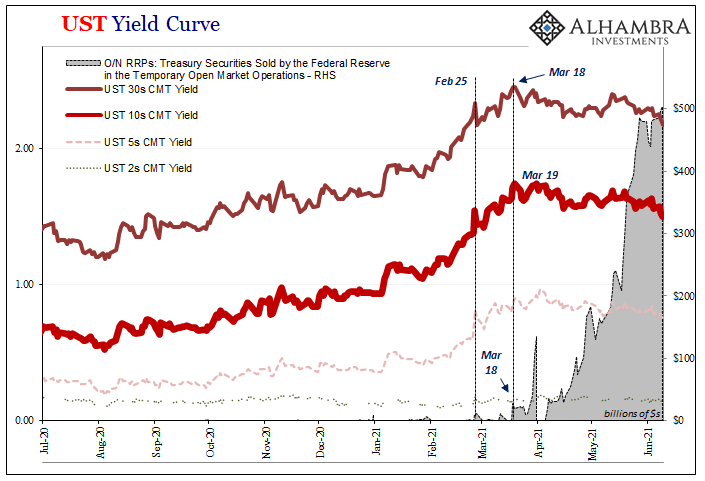

| Not only is this the base case, it is absolutely recognized as such everywhere it truly matters – which, obviously, leaves the entire financial media out of it along with much of the internet. Furthermore, since at least mid-March if not late February, what little change in inflation chances is slowly being drained back down toward zero again as new questions emerge about exactly what’s going on right now. |

TIPS Consumer Credit, Jan 2019 - Jun 2021 |

As I put it earlier today:

The hard truth here is that governments all over the world have taken advantage of these persistent deflationary circumstances to obliterate all those prior boundaries of sanity and decency. |

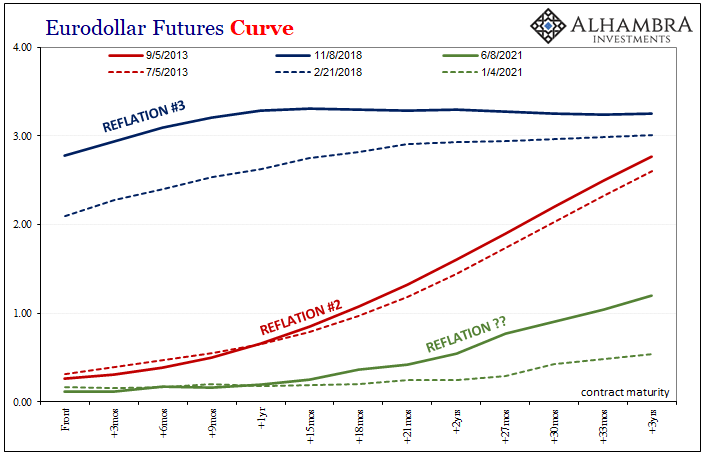

Eurodollar Futures Curve |

| In one sense, you can’t really blame the politicians because without any real answers they’re just doing what politicians always do, blindly following the Japanese because when it comes down to it they don’t know what else to do.

But to count on inflation to grab the rest of the apathetic public by the collar and slap everyone across the face if only to awaken them to this fact, that’s not happening nor is it going to anytime soon. We have other, actually bigger problems to get through first. Nearing a decade and a half later, nothing has changed in this regard; no end to the deflation is in sight (it’s actually worse now post-COVID) nor is it for the whole world’s public sector riding those deflationary coattails. |

|

Tags: Bonds,China,CPI,currencies,Deflation,economy,factory gate prices,Featured,Federal Reserve/Monetary Policy,fiscal deficits,inflation,Markets,money printing,newsletter,PPI,price stability,victor davis hanson