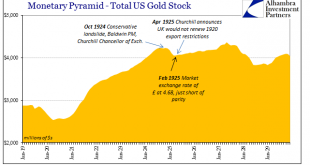

For the very few in the mainstream of economics who venture further back in history than October 1929, they typically still don’t go much last April 1925. And when they do, it is only to further bash the gold standard for its presumed role in creating the conditions for 1929. The Brits under guidance of Winston Churchill made a grave mistake, one from which gold advocates could never recover given what followed. There...

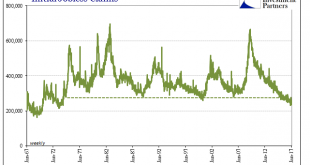

Read More »Jobless Claims Look Great, Until We Examine The Further Potential For What We Really, Really Don’t Want

Initial jobless claims fell to just 234k for the week of February 4, nearly matching the 233k multi-decade low in mid-November. That brought the 4-week moving average down to just 244k, which was a new low going all the way back to the early 1970’s. Jobless claims seemingly stand in sharp contrast to other labor market figures which have been suggesting an economic slowdown for nearly two years. Unemployment insurance...

Read More »How Problematic Is a Large Central Bank Balance Sheet?

On his blog, John Cochrane reports about a Hoover panel including him, Charles Plosser, and John Taylor. Cochrane focuses on the liability side. He favors a large quantity of (possibly interest bearing) reserves for financial stability reasons. Plosser focuses on the asset side and is worried about credit allocation by the Fed, for political economy reasons. Taylor favors a small balance sheet. Cochrane also talks about reserves for everyone, but issued by the Treasury.

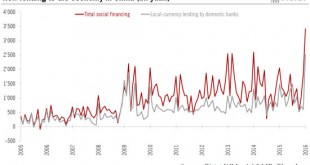

Read More »China policy moves: encouraging for the short term

Recent moves will reassure financial markets. Nevertheless, excess credit growth raises the risk of a crash in China in a few years’ time. Lending to the economy reached record levels in China in January, suggesting that the authorities are prepared to do more to support growth. A stabilisation of the yuan and an admission by the authorities of mistakes in their approach to financial markets are also positive signs. Market fears around China may therefore temporarily abate. However,...

Read More »The Fed and the Cotton Candy Market

As I have discussed previously, if you borrow cash then it’s not income. This is why no one in his right mind borrows to buy consumer goods. Those who try cannot sustain it for long.What if someone else borrows? Suppose someone else—let’s call her Jordyn—buys your house from you, at a higher price than you originally paid for it. You can spend some of the gain. Of course she is just paying you with her borrowed proceeds, but most people think this is totally different than if you borrow to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org