One of the most significant market responses to Russia's attack on Ukraine is in the expectations for the trajectory of monetary policy in many of the high-income countries, including the US, eurozone, UK and Canada. The market has abandoned speculation of a 50 bp hike in mid-March by the FOMC and the Bank of England. It has also scaled back the ECB's move to 20 bp this year from 50 bp. Even after the Russian invasion, the market had discounted a 75% chance that...

Read More »US CPI Reaches Seven On US Goods Prices, With Disinflation Setting In Everywhere Else (incl. US Services)

How is that US Treasury rates out in the independent longer end of the yield curve have now “suffered” a seven percent CPI to go along with double taper and triple maybe quadruple (if the whispers are to be believed) rate hikes this year, yet have weathered all of that allegedly bond-busting brutality with barely a market fluctuation? The short end of the curve, as noted here, is being pressured by only the last of those things, rate hikes, and from them creating...

Read More »One Shock Case For ‘Irrational Exuberance’ Reaching A Quarter-Century

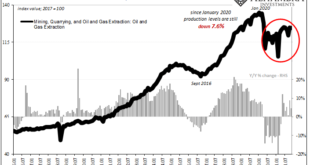

Have oil producers shot themselves in the foot, while at the same time stabbing the global economy in the back? It’d be quite a feat if it turns out to be the case, one of those historical oddities that when anyone might honestly look back on it from the future still hung in disbelief. Let’s start by reviewing just the facts. First up, yesterday the Federal Reserve published the November 2021 estimates for Industrial Production in the United States. As has been the...

Read More »Short Run TIPS, LT Flat, Basically Awful Real(ity)

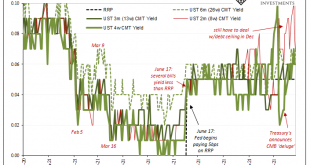

Over the past week and a half, Treasury has rolled out the CMB’s (cash management bills; like Treasury bills, special issues not otherwise part of the regular debt rotation) one after another: $60 billion 40-day on the 19th; $60 billion 27-day on the 20th; and $40 billion 48-day just yesterday. Treasury also snuck $60 billion of 39-day CMB’s into the market on the 14th to go along with the two scheduled 119-day CMB’s during this period. That’s a quick $220 billion...

Read More »Perfect Time To Review What Is, And What Is Not, Inflation (and why it matters so much)

It is costing more to live and be, so naturally people are looking for who it is they need to blame. Maybe figure out some way to stop it. You know and feel for the basics since everyone’s perceptions begin with costs of just living. This is what makes the subject of inflation so difficult, even more so in the era of QE. Money printing, duh. By clarifying the situation – demonstrating over and over how there is no money printing therefore there can’t be inflation –...

Read More »Weekly Market Pulse: Time For A Taper Tantrum?

The Fed meets this week and is widely expected to say that it is talking about maybe reducing bond purchases sometime later this year or maybe next year or at least, someday. Jerome Powell will hold a press conference at which he’ll tell us that markets have nothing to worry about because even if they taper QE, interest rates aren’t going up for a long, long time. That statement might have more credibility if the Fed had been right about just about anything over the...

Read More »Weekly Market Pulse: Time For A Taper Tantrum?

The Fed meets this week and is widely expected to say that it is talking about maybe reducing bond purchases sometime later this year or maybe next year or at least, someday. Jerome Powell will hold a press conference at which he’ll tell us that markets have nothing to worry about because even if they taper QE, interest rates aren’t going up for a long, long time. That statement might have more credibility if the Fed had been right about just about anything over the...

Read More »Weekly Market Pulse: As Clear As Mud

Is there anyone left out there who doesn’t know the rate of economic growth is slowing? The 10 year Treasury yield has fallen 45 basis points since peaking in mid-March. 10 year TIPS yields have fallen by the same amount and now reside below -1% again. Copper prices peaked a little later (early May), fell 16% at the recent low and are still down nearly 12% from the highs. Crude oil has recently joined in, falling 7% from its recent high. Energy stocks are in a full...

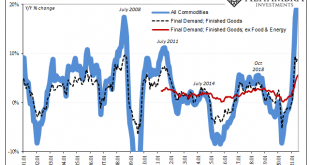

Read More »And Now Three Huge PPIs Which Still Don’t Matter One Bit In Bond Market

And just like that, snap of the fingers, it’s gone. Without a “bad” Treasury auction, there was no stopping the bond market today from retracing all of yesterday’s (modest) selloff and then some. This despite the huge CPI estimates released before the prior session’s trading, and now PPI figures that are equally if not more obscene. The BLS reports today that its main producer price index (PPI), the one for finished goods, was up 9.19% year-over-year in June 2021....

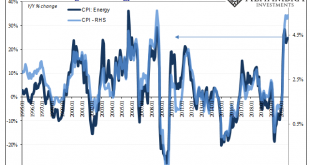

Read More »Third CPI In A Row, Yet All Eyes On That 30s Auction

Three in a row, huge CPI gains. According to the BLS, headline consumer price inflation surged 5.39% (unadjusted) year-over-year during June 2021. This was another month at the highest since July 2008 (the last transitory inflationary episode). The core CPI rate gained 4.47% last month over June last year, the biggest since November 1991. U.S. Core CPI, Jan 1990 - Jan 2021(see more posts on U.S. Core CPI, ) - Click to enlarge More impressive (or worrisome,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org