Summary:

The Fed meets this week and is widely expected to say that it is talking about maybe reducing bond purchases sometime later this year or maybe next year or at least, someday. Jerome Powell will hold a press conference at which he’ll tell us that markets have nothing to worry about because even if they taper QE, interest rates aren’t going up for a long, long time. That statement might have more credibility if the Fed had been right about just about anything over the last decade. But they haven’t and we are left to wonder how exactly Jerome Powell will be wrong this time. Will the economy slow so quickly that he can’t even credibly start tapering? Or will the economy re-accelerate to such a degree that he has no choice but to stomp on the brakes? I’m not sure but I

Topics:

Joseph Y. Calhoun considers the following as important:

5.) Alhambra Investments,

Alhambra Research,

bonds,

cfnai,

commodities,

commodity indexes,

Consumer Sentiment,

COVID,

CPI,

currencies,

economy,

employment,

extended unemployment benefits,

Featured,

Federal Reserve/Monetary Policy,

gsci,

Housing Market,

import prices,

inflation,

japanese stocks,

Markets,

newsletter,

Quantitative Easing,

Real estate,

Retail sales,

small cap stocks,

stocks,

taper tantrum,

unemployment rate,

US dollar

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Fed meets this week and is widely expected to say that it is talking about maybe reducing bond purchases sometime later this year or maybe next year or at least, someday. Jerome Powell will hold a press conference at which he’ll tell us that markets have nothing to worry about because even if they taper QE, interest rates aren’t going up for a long, long time. That statement might have more credibility if the Fed had been right about just about anything over the last decade. But they haven’t and we are left to wonder how exactly Jerome Powell will be wrong this time. Will the economy slow so quickly that he can’t even credibly start tapering? Or will the economy re-accelerate to such a degree that he has no choice but to stomp on the brakes? I’m not sure but I think there are reasons to lean towards the latter over the next few months.

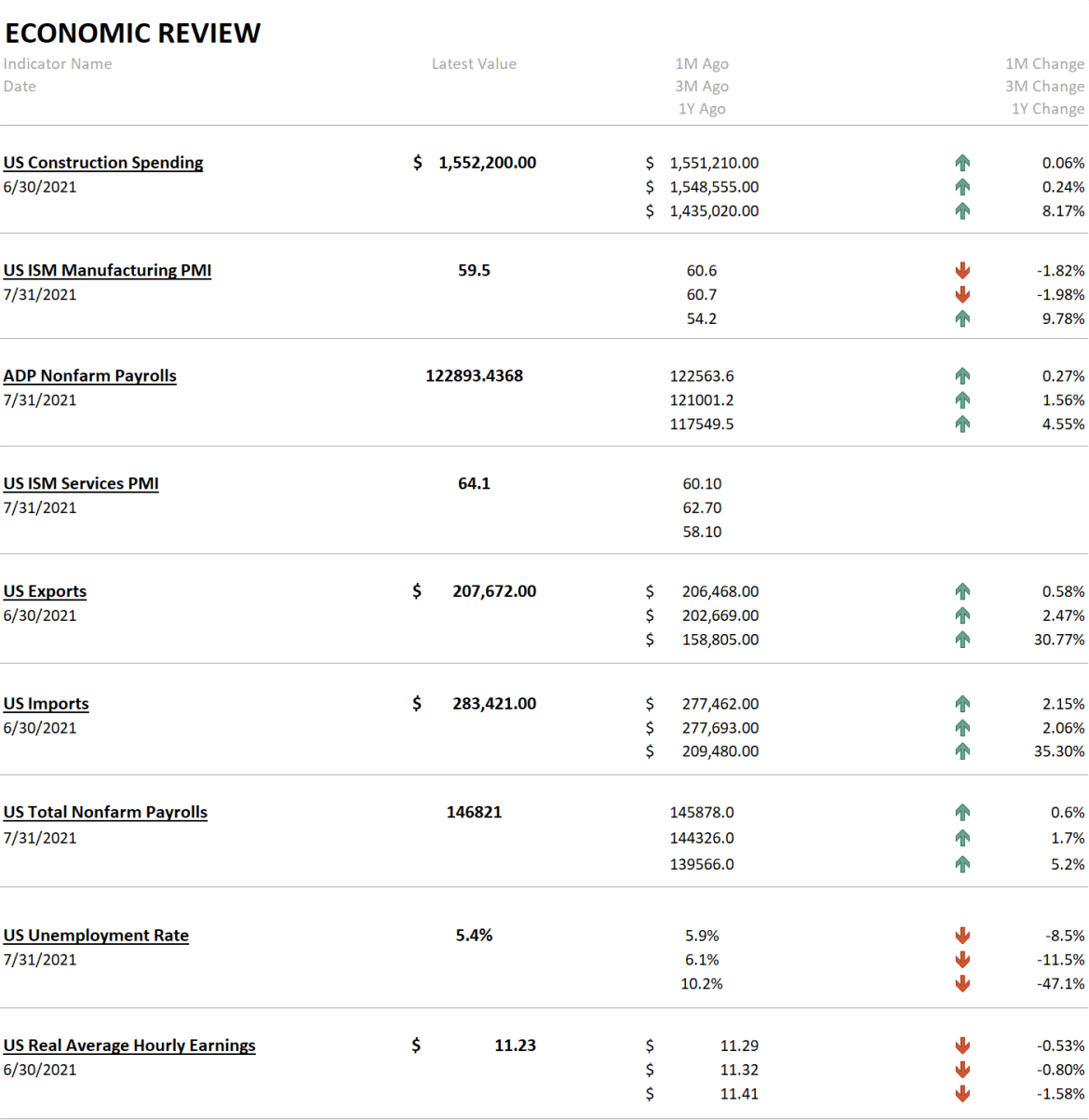

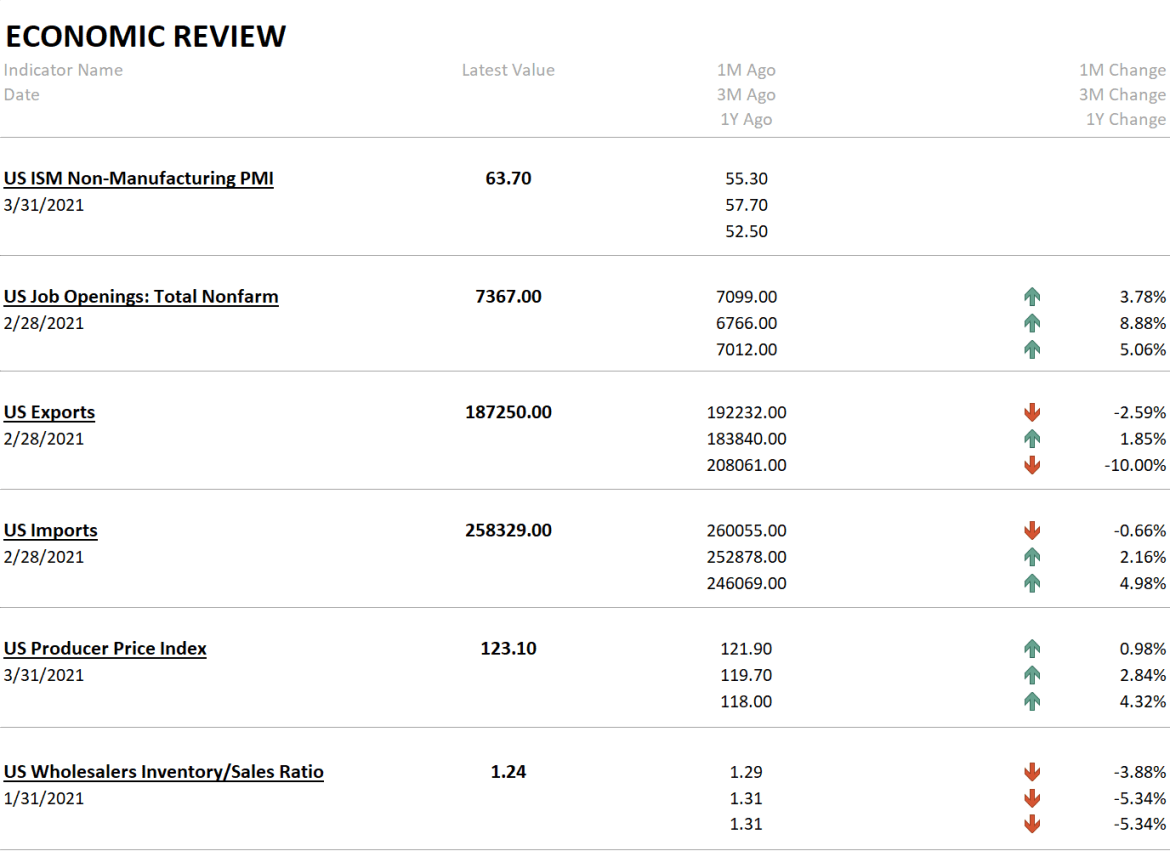

We are about to run a real world economic experiment in the US labor market. Expanded unemployment benefits have now expired and we are about to find out what impact that has on the jobs market. Certainly there are plenty of jobs available if the JOLTS report is anywhere close to accurate. You don’t need a BLS report to confirm that; just talk to any business owner or see all the help wanted signs as you drive around your city. The question is whether there really were a lot of people on the dole who would otherwise have taken those jobs. My guess is yes but we’ll find out for sure over the next few months. I’ve seen research indicating that the end of expanded benefits could mean as many as 300,000 extra jobs/month over the balance of the year. The average so far this year is about 600,000/month so if that is true we could be looking at close to a million new jobs/month for the next 4 months. The unemployment rate would likely fall to well under 5% if that happens. How do you think bonds would react to that news? How do you think Powell and company would react? Let me just suggest that they might do more than just talk about tapering.

| I don’t know if that scenario will play out but I do believe that incentives matter so it is certainly a plausible scenario. But I suppose it could be that expanded unemployment benefits had no behavioral impact on those who have been receiving it. We’ve already seen a number of research papers that purport to show that states who ended the benefits early saw no change in their employment rate. Of course, those studies were generally done by groups who wanted to see that outcome so maybe, just maybe they saw what they wanted to see. Or maybe it was just a tad premature to draw any conclusions. Or maybe they were right and those collecting benefits never had any intention of going back to work. There’s still a lot we don’t know about what has changed during the COVID era but I think it is safe to say that many people’s views about work and its place in their life have been altered by the virus. Still, as I said, I think incentives matter and monetary ones more than most. |

|

| Regardless of what happens with the economy and bonds over the rest of the year, I do think we are nearing peak exuberance in stocks. The rotation out of cash and into stocks – and bonds for that matter – is at least a little alarming. Inflows to global stocks this year are over $1 trillion and more than the last twenty years combined. What worries me about that is that fund flows are not predictive. Inflows tend to happen after stocks go up and outflows accelerate after they’ve gone down. Notice that the absence of inflows over the last twenty years didn’t prevent stocks from getting to all time highs. I can’t help but wonder if the massive size of the recent inflows will be proportional to the selloff that seems likely to follow.

I think most people fear that a slowing economy will be the trigger for a stock market selloff but I think that may be the wrong worry. Bear markets are generally associated with recession and there just isn’t any indication we are close to that kind of outcome. But corrections can be triggered by just about anything. An acceleration of the economy right now due to the end of expanded unemployment benefits would also mean an acceleration of the taper timeline and I don’t think stocks would like that, at least initially. That would be a new way for Powell to be wrong – he’s traditionally been too optimistic – but he’d be wrong just the same.

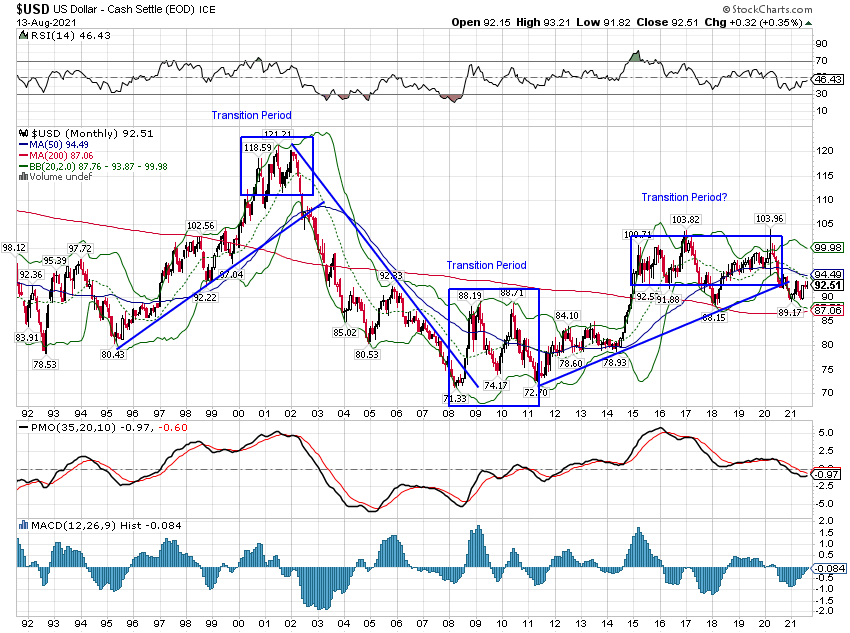

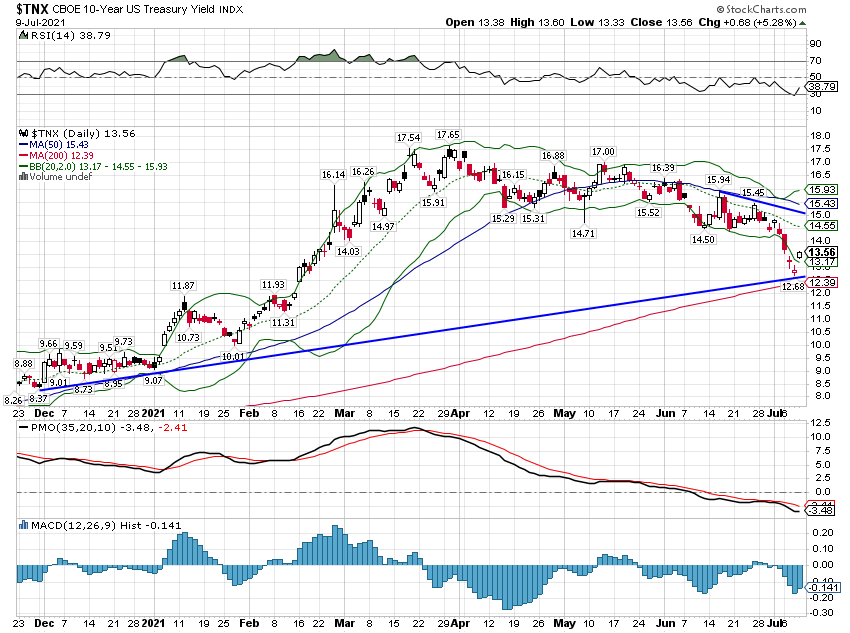

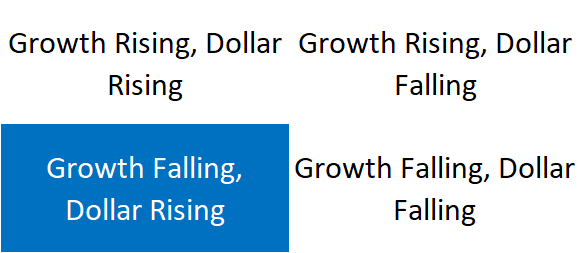

For now our environment is still one of slowing growth and a rising dollar. A shift to rising growth and rising dollar would cause us to add risk back to our portfolios and it would surely be convenient to get a correction before that happens. And yes, I am aware that the above may be nothing more than the wishful thinking of someone sitting on a lot of cash right now. We’ve reduced our risk exposure over the last few months because falling growth/rising dollar is our most difficult investing environment. It was also because stock markets are as overbought as I’ve ever seen in 30+ years of investing and momentum appears to be peaking. I fully expect stock averages to fall back to their long term trend. It may be coincidence but a pullback to the long term trend would correspond to just about a 20% correction and fit neatly into our narrative of correction but not bear market. Yeah, maybe too neatly.

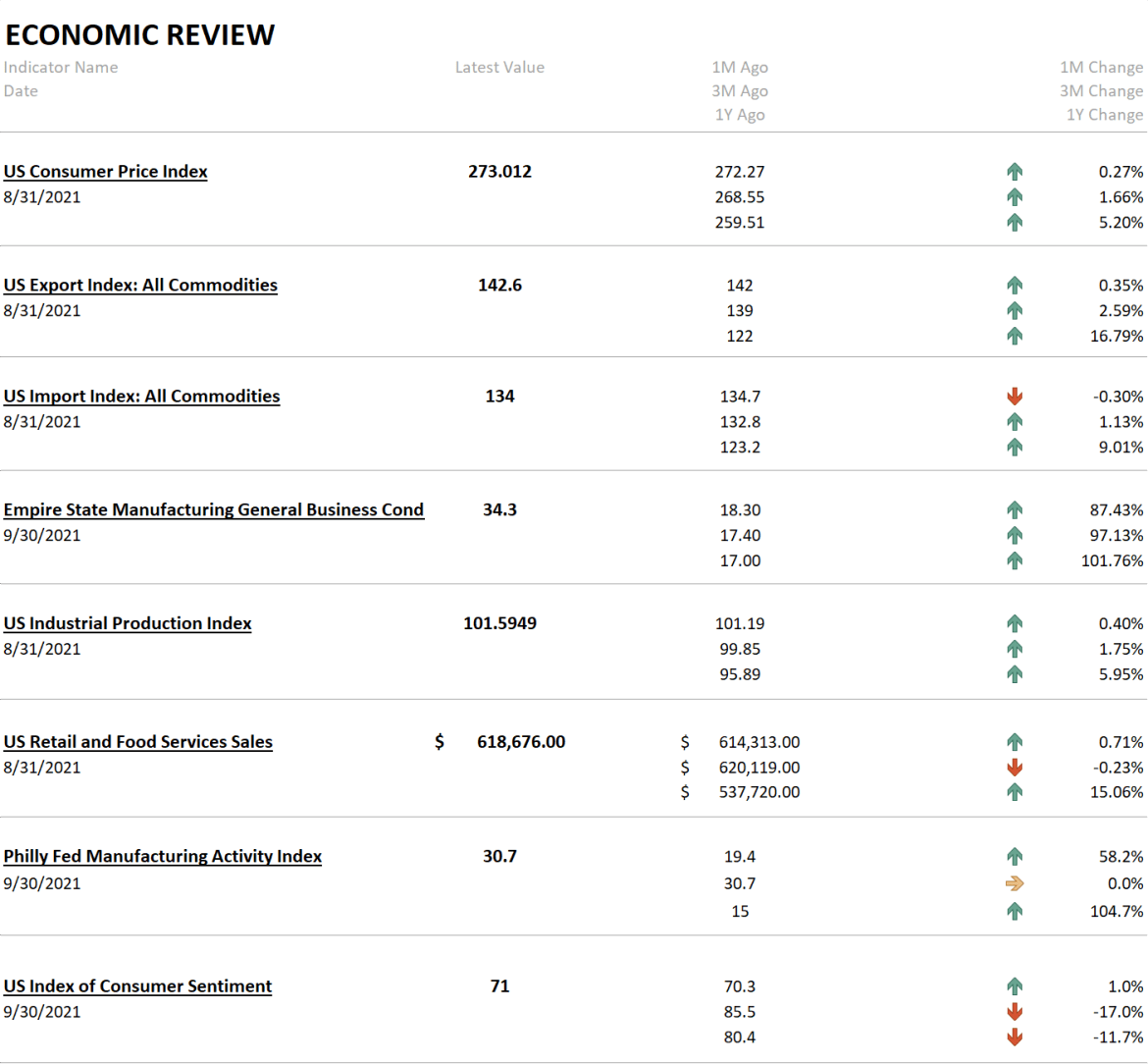

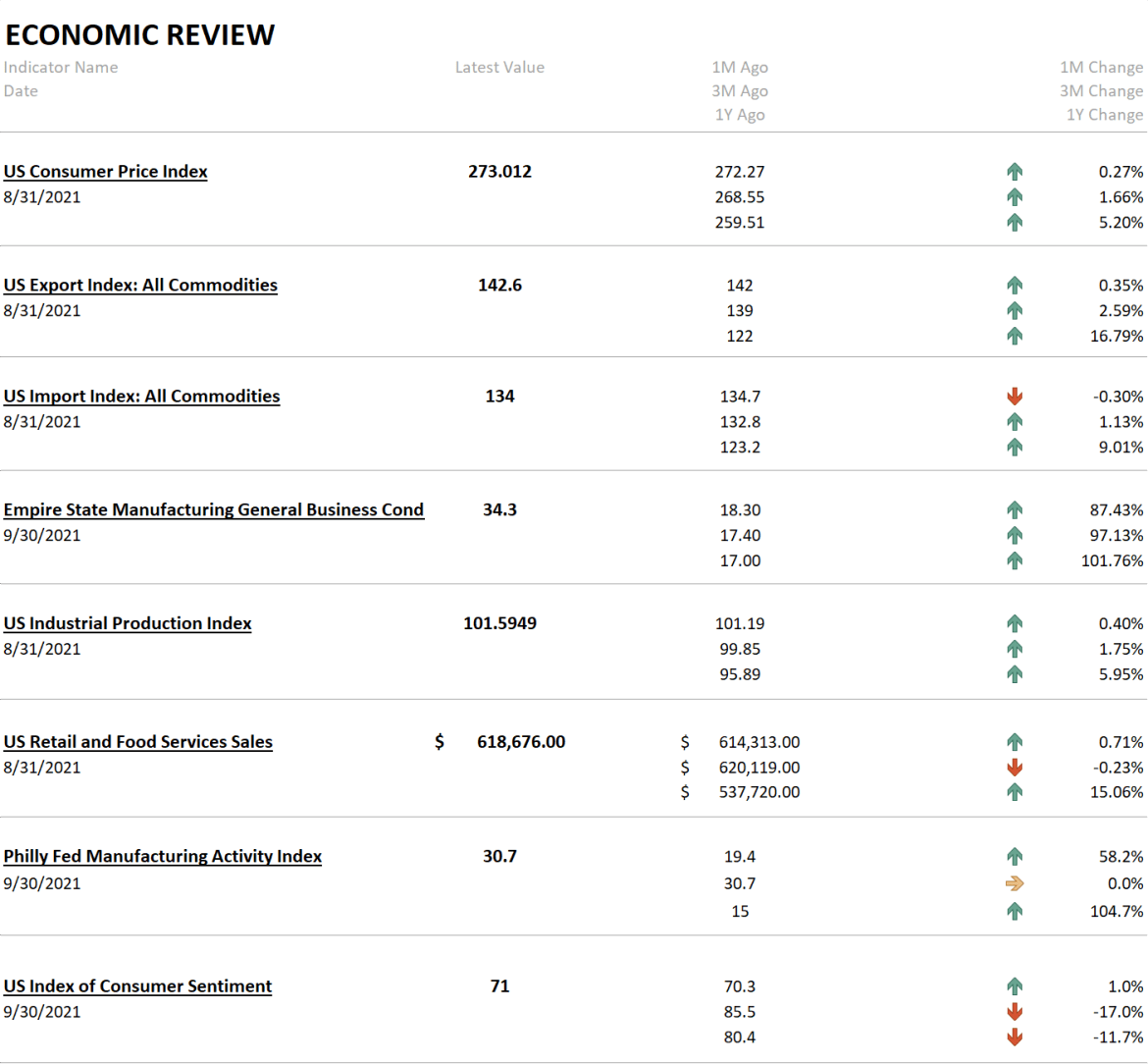

The CPI data released last week was widely interpreted as moderating but I’d be careful about that. Rents are rising faster this year than they were pre-COVID and those hikes will eventually work their way into the inflation numbers. The semiconductor shortage also isn’t getting any better and auto manufacturers are still limited in what they can produce. That one month drop in used car prices may not last. Eventually the shortages will be resolved but until then, supply is going to be issue. A lot of people want to say that this isn’t inflation but just COVID supply issues and I tend to agree. But that doesn’t mean the market or most people will. We also had a drop in import prices last month which seems like good news but might just be a matter of what was imported. |

. |

| It is the things in short supply going up in price the fastest but you can’t import what you can’t get.

The two regional Fed surveys were also very strong and better than expected last week. Retail sales were also better than expected. Estimates didn’t even get the sign right. I’ll take this one with a grain of salt just like I did the employment report for August. It is a weird month for seasonal adjustments because of school starting and it must be even weirder this year. What % of schools are actually open with normal attendance? I don’t know the exact number but it is a long way from 100. Did parents do the normal back to school shopping this year? I have no idea but if my informal poll is accurate, the answer is no. Any attempt at seasonal adjustment of these numbers is just a WAG. So, ignore it and wait for next month.

The worst report of the week was, again, consumer sentiment which continues to sag. Prices are playing a role here with most people saying it is a lousy time to buy a car or a house. No kidding, right?

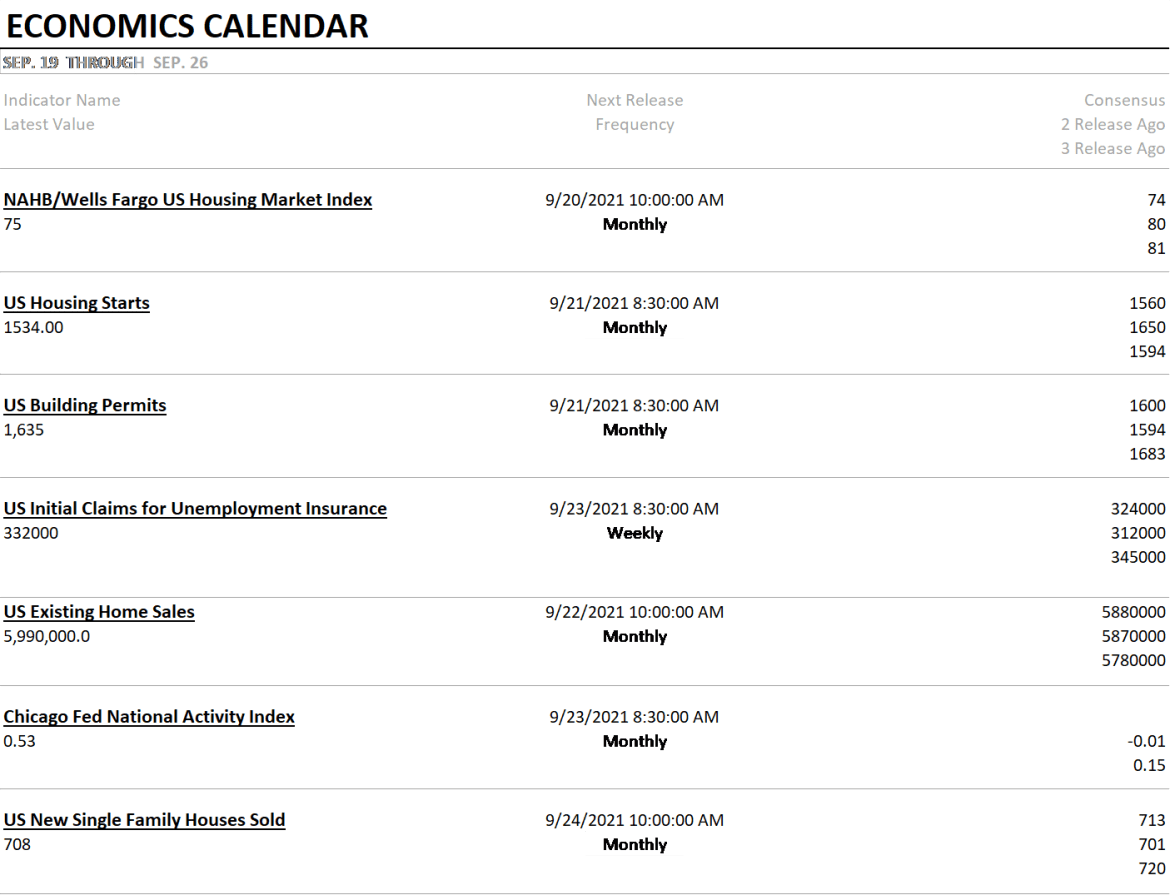

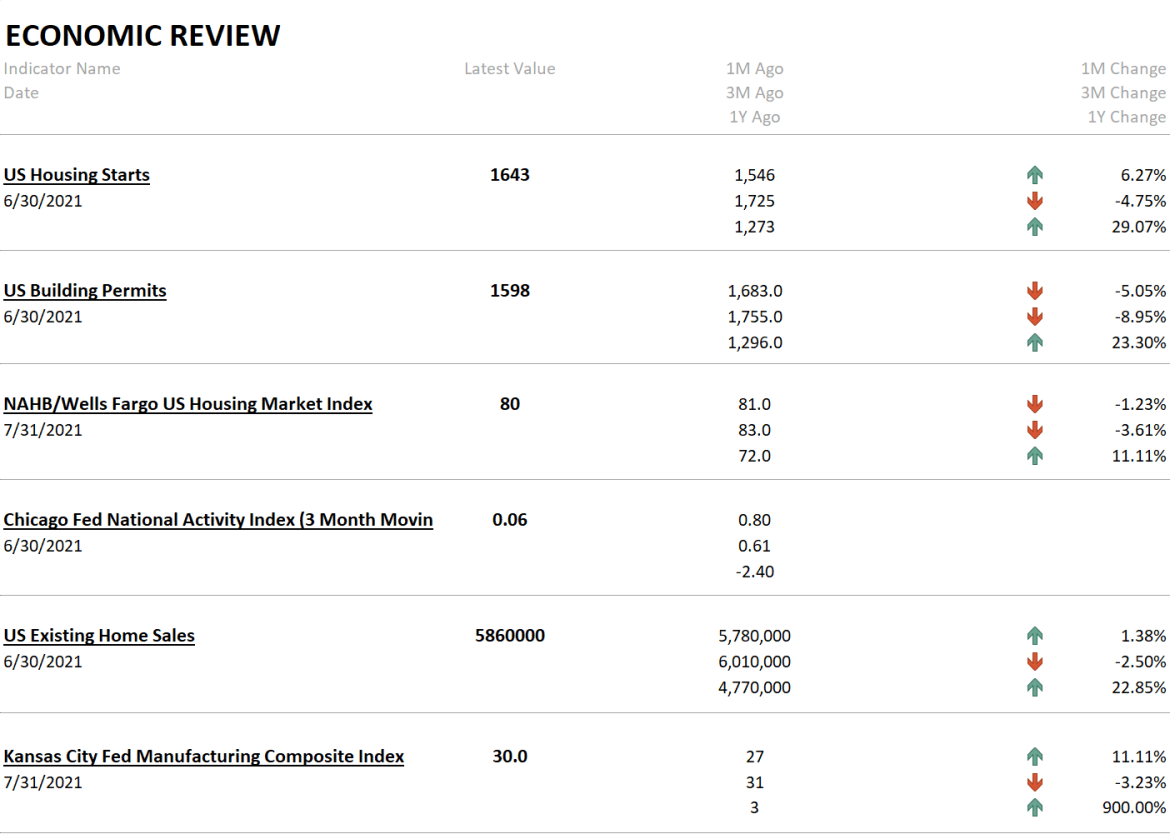

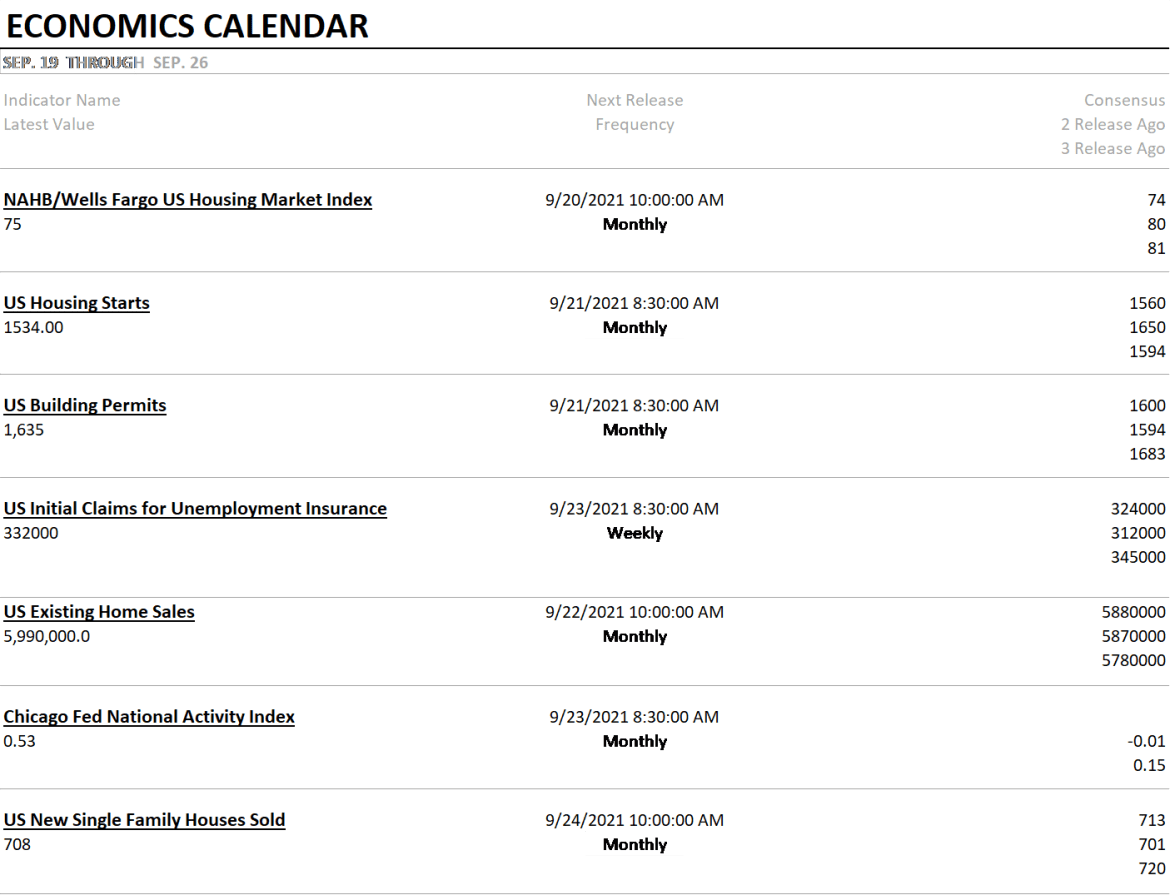

We get a comprehensive update on the housing market this week with starts, permits, new and existing home sales all reporting. Jobless claims could be interesting too after the end of expanded and extended benefits.

We also get a new reading on the Chicago Fed National Activity Index. The 3 month moving average is 0.23 well over the zero level that represents trend growth.

|

. |

|

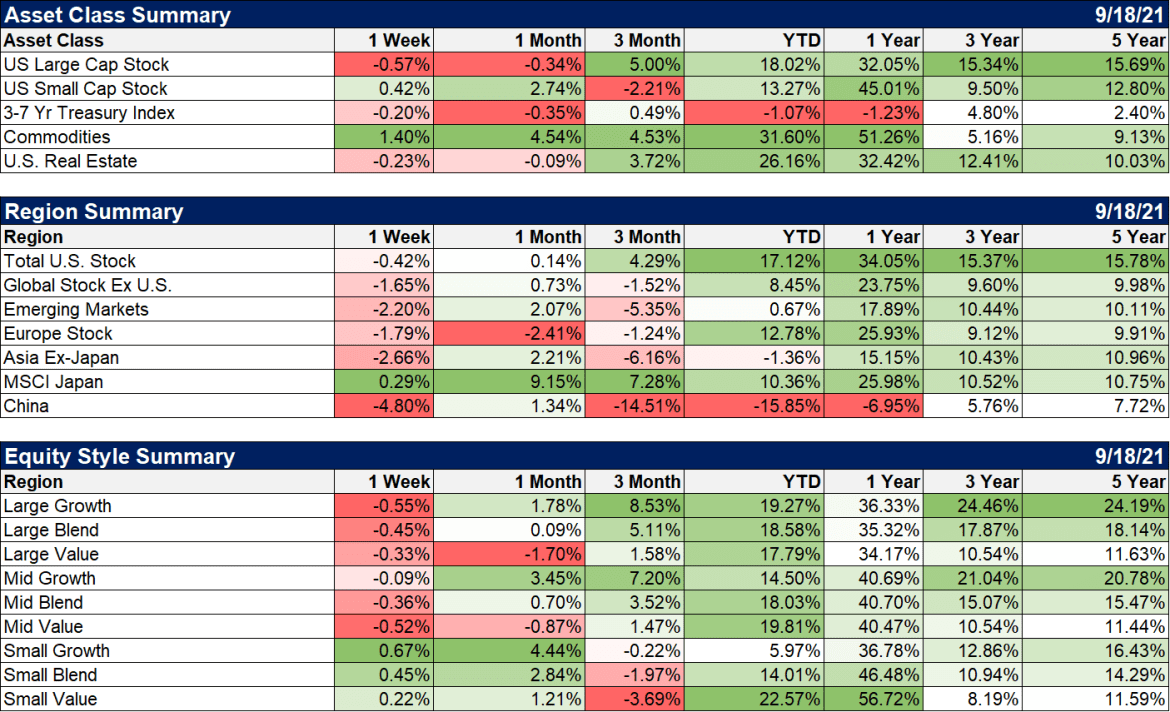

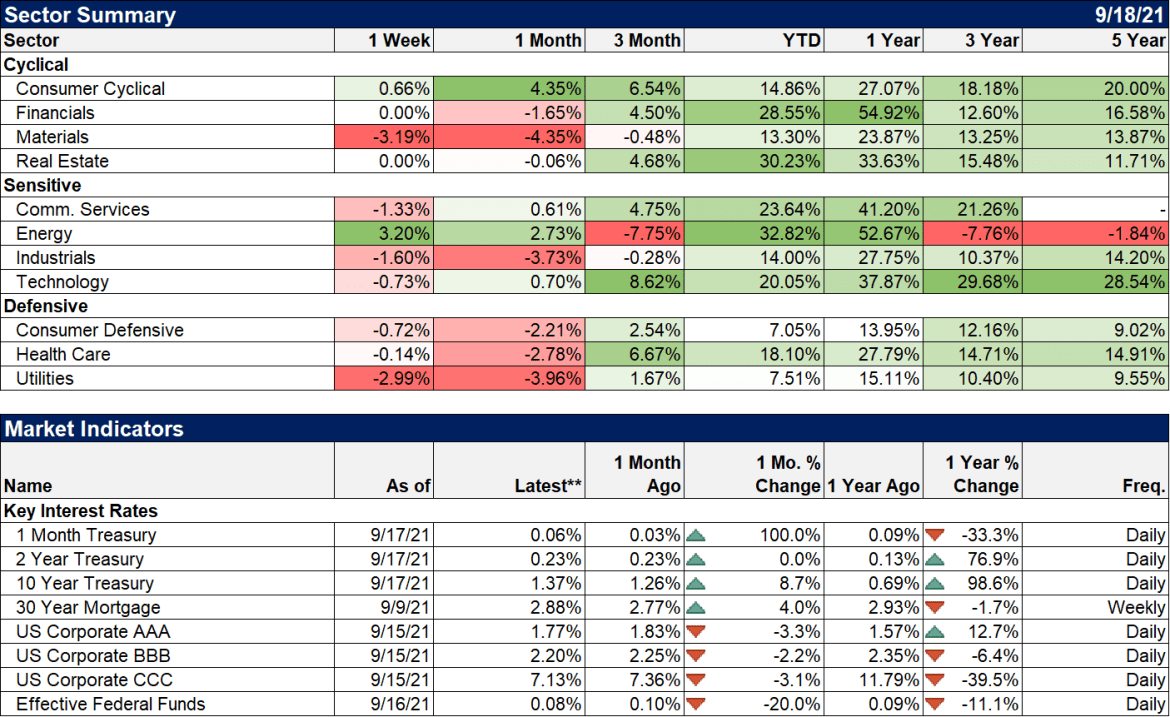

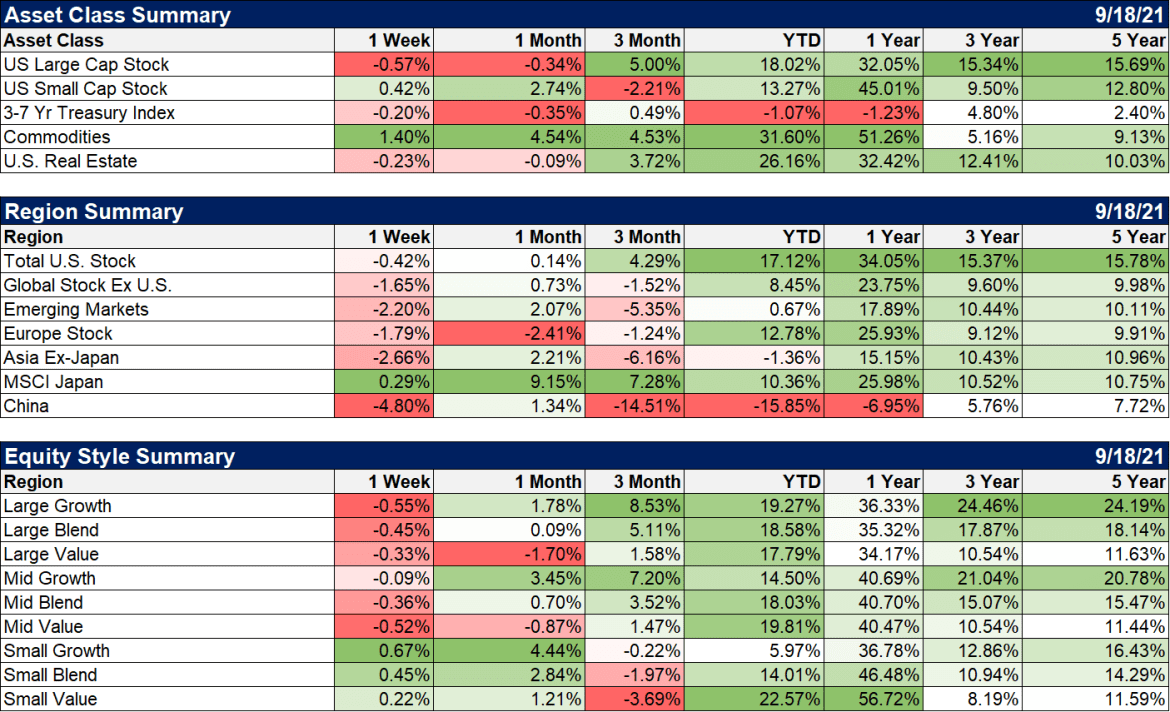

Small cap stocks outperformed last week, another indication that investors may be starting to anticipate higher rates. Small cap performance vs large caps peaked with bond yields in the spring so we’d expect them to turn higher with rates. Will it continue? Maybe…

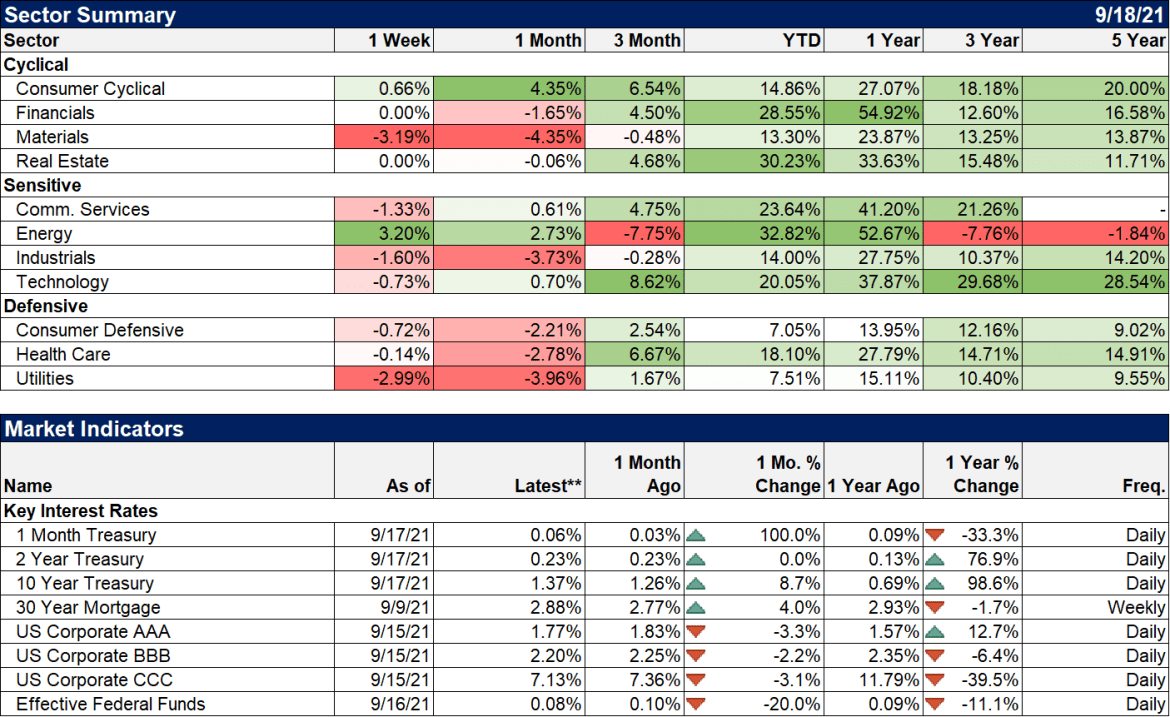

Commodity indexes also had a pretty good week but that was mostly due to energy which makes up the majority of the GSCI. Other commodities haven’t been that strong lately. Copper, platinum and palladium were all down last week while crude oil and natural gas were both up over 3%.

Japan also continued its recent outperformance and while it might pull back short term, the trend here is obvious. And Japanese stocks are still cheap to boot. |

. |

| Why were materials stocks hit so hard? That’s mostly a reaction to underlying commodity prices which is also why energy stocks did so well last week. |

. |

I tell people all the time that it isn’t my job to predict the future and that hasn’t changed. I do think we need to think about possibilities though, especially ones that aren’t in consensus. If the economy just continues to slow back to trend I don’t think anyone would be that surprised. Disappointed yes, but surprised? I don’t think so. I also don’t think anyone would be surprised to see the economy accelerate some as Delta fades (assuming it does of course). The outlier forecast is for something outside that mainstream view, a bigger slowdown or acceleration. Since recession probabilities based on our indicators is very low, the larger acceleration seems the more likely choice.

Our baseline expectation is for the economy to eventually return to the slow growth that prevailed pre-COVID. In fact, considering the debt we’ve added since March 2020, I’d say growth slightly less than pre-COVID makes sense. We don’t see anything obvious that happened during COVID that would alter the long term trend of workforce and productivity growth and therefore, overall growth. But as I’ve mentioned a number of times, there’s a lot we don’t know about how things changed over the last 18 months. So we spend a lot time thinking about how and why that baseline might be wrong. Will the end of extended and expanded unemployment benefits accelerate the employment market? Maybe. I think you have to at least consider the possibility.

Tags:

Alhambra Research,

Bonds,

cfnai,

commodities,

commodity indexes,

Consumer Sentiment,

COVID,

CPI,

currencies,

economy,

employment,

extended unemployment benefits,

Featured,

Federal Reserve/Monetary Policy,

gsci,

Housing market,

import prices,

inflation,

japanese stocks,

Markets,

newsletter,

Quantitative Easing,

Real Estate,

Retail sales,

small cap stocks,

stocks,

taper tantrum,

unemployment rate,

US dollar