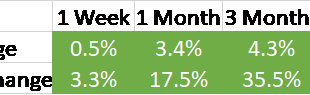

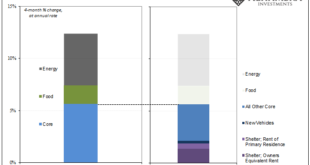

One thing I can tell you for certain about last week’s big rally on Thursday and Friday: there were a lot of people who desperately wanted a good excuse to buy stocks. And buy they did after a better-than-expected CPI report Thursday morning, pushing the S&P 500 up nearly 6% on the week with all of that coming on Thursday and Friday. The same could be said of bonds which also had a good week, with the aggregate index up 2.3%. The stock market rally probably says...

Read More »Weekly Market Pulse: Just A Little Volatility

Markets were rather volatile last week. That’s a wild understatement and what passes for sarcasm in the investment business. Stocks started the week waiting with bated (baited?) breath for the inflation reports of the week. It isn’t surprising that the market is focused firmly on the rear view mirror for clues about the future since Jerome Powell has made it plain that is his plan, goofy as it is. Stocks were down slightly Monday and Tuesday fearing the worst and...

Read More »US CPI Data Release Update

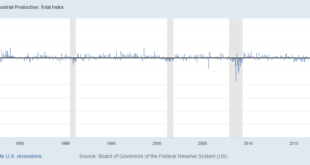

It is easy to get caught up in data releases. The media is keen to read a lot into them, hoping it will offer some sense of what is really going on, so often the news is about numbers just announced or expectations for what one economic measure will show from one month to the next. However, as we outline below, many of the numbers that are released on a frequent and regular basis (CPI and employment, for example) can be misleading. Whether it’s down to the inputs or...

Read More »Weekly Market Pulse: No News Is…

Nothing happened last week. Stocks and bonds and commodities continued to trade and move around in price but there was no news to which those movements could be attributed. The economic news was a trifle and what there was told us exactly nothing new about the economy. A report that wholesale inventories rose 0.6% cannot be turned into market moving news no matter how hard the newsletter sellers try. Jobless claims fell 8,000? Yawn. Exports rose $500 million? In a...

Read More »Is it All Really about Today’s US CPI Print?

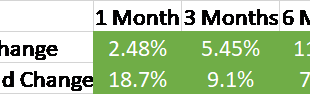

Overview: The US dollar is trading with a heavier bias ahead of the July CPI report. The intraday momentum indicators are overextended, and this could set the stage for the dollar to recover in North America. Outside of a handful of emerging market currencies, which include the Mexican peso and Hong Kong dollar, most are trading lower. Losses in US equities yesterday and poor news from another chip maker (Micron) weighed on Asia Pacific equities. Europe’s Stoxx 600...

Read More »Weekly Market Pulse: There Is No Certainty In Investing

Investors crave certainty. They want to know that there are definitive signals for them to follow as they adjust their investments to fit the current market and economy. They want to know that A leads to B leads to C. Tea leaf readers are always in high demand on Wall Street and they continue to find employment despite their almost universally dismal track record. In this case, it is demand that drives supply rather than the other way around. The constant demand for...

Read More »Eurodollar Futures Interpretation Is Everywhere

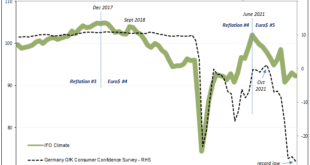

Consumer confidence in Germany never really picked up all that much last year. Conflating CPIs with economic condition, this divergence proved too big of a mystery. When the German GfK, for example, perked up only a tiny bit around September and October 2021, the color of consumer prices clouded judgement and interpretation of what had always been a damning situation. From GfK back then: The growing consumer optimism signals that consumers here consider the German...

Read More »Market Pulse: Mid-Year Update

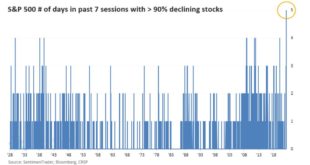

Note: This update is longer than usual but I felt a comprehensive review was necessary. The Federal Reserve panicked last week and spooked investors into the worst week for stocks since the onset of COVID in March 2020. The S&P 500 is now firmly in bear market territory but that is a fraction of the pain in stocks and other risky assets. Stocks are now down 10 of the last 11 weeks but the pain was concentrated in the last two weeks. 5 of the last 8 trading days...

Read More »Curve Inversion 101: US CPI Politics Up Front, China PPI Down(ing) The Back

While the world fixated on the US CPI, it was other “inflation” data from across the Pacific that is telling the real economic story. Having conflated the former with a red-hot economy, the fact American consumer prices aren’t tied to the actual economic situation has been lost in the shuffle of the FOMC’s hawkishness, with markets obliged to price wrong-way Jay. The short end of the yield curve (USTs and elsewhere) is plotting like FOMC dots, whenever oil and crude...

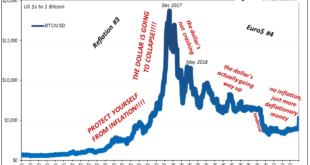

Read More »It’s Not Nothing, It’s Everything (including crypto)

Markets got aggressive long before the FOMC did. Everything, and I mean everything, has been trending the other way. Jay Powell says inflation risks are most pressing when markets have consistently priced the opposite for a whole lot longer. It’ll be revised history when ultimately the mainstream attempts to write it over the months ahead, many will try to snatch some limited victory from the jaws of defeat. Should recession happen and bring an end to the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org