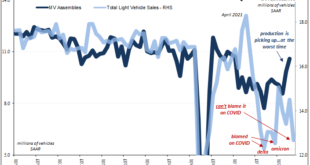

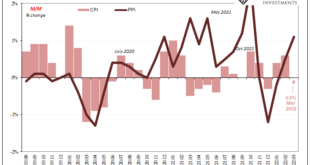

It wasn’t exactly a secret, though the raw data doesn’t ever tell you why something might’ve changed in it. According to the Bureau of Economic Analysis, confirmed by industry sources, US new car sales absolutely tanked in May 2022. At a seasonally-adjusted annual rate of 12.7 million, it was a quarter fewer than sales put down in May 2021 and 13% below the not-great level from the month prior in April 2022. Such puny results have typically been reserved for those...

Read More »Update The Conflict of Interest Rate(s)

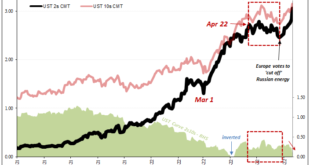

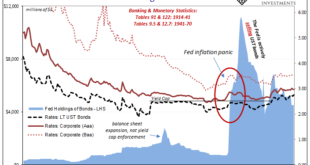

What changed? For over a month, the Treasury market had the Fed and its rate hiking figured out. Rising recession risks had been confirmed by almost every piece of incoming data, including, importantly, labor data. It is the jobs market where much of the official “inflation” jawboning is centered, all that Phillips Curve stuff. So, whatever might seriously undermine Phillips would put the end to the rate hikes in sight. Short-term Treasuries therefore ignored...

Read More »Can’t Blame COVID For This One

Late in March 2021, then-German Chancellor Angela Merkel announced a reverse. Several weeks before that time, Merkel’s federal government had reached an agreement with the various states to begin opening the country back up, easing more modest restrictions to move daily life closer to normal. But with case counts sharply rising once more, the whole thing was going to get shutdown instead. The government declared a holiday starting April 1 (no fooling) last year,...

Read More »Peak Inflation (not what you think)

For once, I find myself in agreement with a mainstream article published over at Bloomberg. Notable Fed supporters without fail, this one maybe represents a change in tone. Perhaps the cheerleaders are feeling the heat and are seeking Jay Powell’s exit for him? Whatever the case, there’s truth to what’s written if only because interest rates haven’t been rising based on rising inflation/growth expectations. Quite the contrary, actually. It’s all FOMC and the...

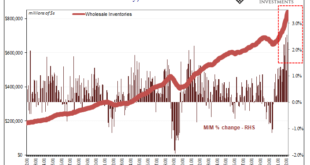

Read More »Historic Inventory Continued In March, But Is It All Price Illusion, Too?

The Census Bureau today released its advanced estimates for March trade. These include, among other accounts like imports and exports, preliminary results reported by retailers and wholesalers. That means, for our purposes, inventories. Oh my, was there ever more inventory. It was, apparently, widely expected that following an avalanche of goods building up over the previous five months the situation might calm down a touch. Analysts had figured wholesale...

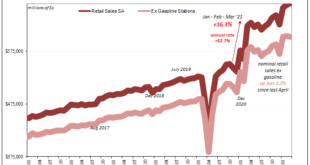

Read More »Not Good Goods

The goods economy in the United States is – maybe was – the lone economic bright spot. That in and of itself should’ve provoked more caution, instead there was the red-hot recovery to sell under the cover of supply shock pricing changes. The sheer spending on goods, and how they arrived, each unabashedly artificial from the get-go. Combine those two factors, however, the necessary supply squeeze surge in prices along with the artificiality behind it wearing off,...

Read More »China More and More Beyond ‘Inflation’

If only the rest of the world could have such problems. Chinese consumer prices were flat from February 2022 to March, even though gasoline and energy costs predictably skyrocketed. According to China’s NBS, gas was up 7.2% month-over-month while diesel costs on average gained 7.8%. Balancing those were the prices for main food staples, especially pork, the latter having declined an rather large 9.3% last month from the month before. Keeping energy but removing...

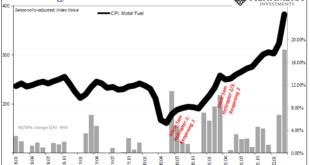

Read More »You Know What They Say About The Light At The End Of The Tunnel

In any year when gasoline prices rise 18%, that’s not going to be good for anyone except maybe oil companies who extract its key ingredient from out of the ground (or don’t, as the case can be). Yet, annual rates of increase that size do happen. After August 2017 up to and including August 2018, the BLS’s CPI registered a seasonally-adjusted 20.5% year-over-year gain in its motor fuel component. Economic pain followed thereafter, though not entirely the fault of...

Read More »US Jobs, EMU CPI, Japan’s Tankan, and China’s PMI Highlight the Week Ahead

This year was supposed to be about the easing of the pandemic and the normalization of policy. Instead, Russia's invasion of Ukraine threw a wrench in the macroeconomic forecasts as St. Peter’s victories broke the brackets of the NCAA basketball championship pools. The war has pushed up the price of energy, metals, and foodstuffs, which seemed to be advancing prior to the conflict. High-frequency economic data are important because of the insight generated about...

Read More »Consumer Prices And The Historical Pain(s)

The 1947-48 experience was truly painful, maybe even terrifying. The US and Europe had just come out of a decade when the worst deflationary consequences were so widespread that the period immediately following quickly erupted into the worst conflagration in human history. Then, suddenly, consumer prices skyrocketed and it left many Americans wondering if there would ever be an end to the massive volatility. At its peak in March 1947, the US CPI had gained 19.67%...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org