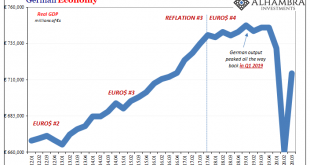

With all eyes on Washington DC, today, everyone should instead be focused on Europe. As we’ve written for nearly three years now, for nearly three years Europe has been at the unfortunate forefront of Euro$ #4. We could argue about whether coming out of GFC2 back in March pushed everything into a Reflation #4 – possible – or if this is still just one three-yearlong squeeze of a global dollar shortage. Either way, Europe gets at it first. In 2018, what had been...

Read More »FX Daily, September 30: Nervous Calm

Swiss Franc The Euro has risen by 0.05% to 1.0798 EUR/CHF and USD/CHF, September 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Quarter and month-end considerations could be overwhelming other factors today. Turnaround Tuesday saw early gains in US equities fade. Asia Pacific shares were mixed, with the Nikkei (-1.5%) and Australia (-2.3%) bear the brunt of the selling, while China, Hong Kong, Taiwan, and...

Read More »Inflation Karma

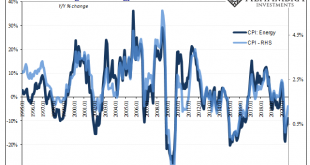

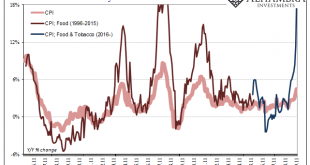

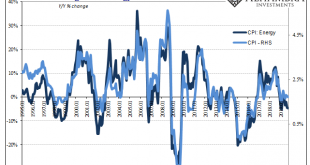

There is no oil in the CPI’s consumer basket, yet oil prices largely determine the rate by which overall consumer prices are increasing (or not). WTI sets the baseline which then becomes the price of motor fuel (gasoline) becoming the energy segment. As energy goes, so do headline CPI measurements. CPI Changes on Energy, 1995-2020 - Click to enlarge And that’s a huge problem…if you are Jay Powell. We’ve been making a big deal out of him making a huge deal out of...

Read More »A Big One For The Big “D”

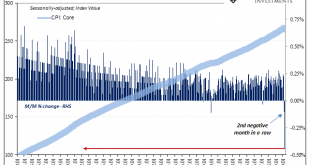

From a monetary policy perspective, smooth is what you are aiming for. What central bankers want in this age of expectations management is for a little bit of steady inflation. Why not zero? Because, they decided, policymakers need some margin of error. Since there is no money in monetary policy, it takes time for oblique “stimulus” signals to feed into the psychology of markets and the economy. Thus, a little steady inflation as insurance against the real evil....

Read More »What Happens When Central Banks Buy Stocks (ETFs)? Well, We Already Know

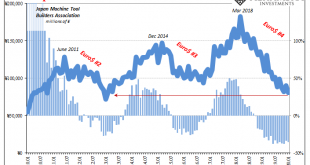

Can we please dispense with all notions that monetary policy works? Specifically balance sheet expansion via any scale asset purchase programs. Nowhere has that been more apparent than Japan. Go back and reread all the promised benefits from BoJ’s Big Bang QQE that were confidently written in 2013. The biggest bazooka ever conceived has fallen short in every conceivable way. Starting with the fact QQE remains ongoing approaching its seventh birthday. Over here in...

Read More »If Trade Wars Couldn’t, Might Pig Wars Change Xi’s Mind?

Forget about trade wars, or even the eurodollar’s ever-present squeeze on China’s monetary system. For the Communist Chinese government, its first priority has been changed by unforeseen circumstances. At the worst possible time, food prices are skyrocketing. A country’s population will sit still for a great many injustices. From economic decay to corruption and rising authoritarianism, the line between back alley grumbling and open rebellion is usually a thick...

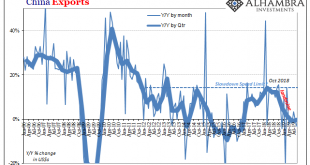

Read More »China’s Dollar Problem Puts the Sync In Globally Synchronized Downturn

Because the prevailing theory behind the global slowdown is “trade wars”, most if not all attention is focused on China. While the correct target, everyone is coming it at from the wrong direction. The world awaits a crash in Chinese exports engineered by US tariffs. It’s not happening, at least according to China’s official statistics. The reported numbers aren’t good by any stretch, but they aren’t perhaps as bad as imagined by the constant references to what we...

Read More »CPI Changes On Energy: The Inflation Check

After constantly running through what the FOMC gets (very) wrong, let’s give them some credit for what they got right. Though this will end up as a backhanded compliment, still. After having spent all of 2018 forecasting accelerating inflation indices, from around New Year’s Day forward policymakers notably changed their tune. Inflation pressures that were in December 2018 building underneath leading officials to fear a harmful breakout, by January 2019 they were...

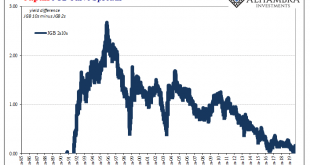

Read More »Why The Japanese Are Suddenly Messing With YCC

While the world’s attention was fixated on US$ repo for once, the Bank of Japan held a policy meeting and turned in an even more “dovish” performance. Likely the global central bank plan had been to combine the Fed’s second rate cut with what amounted to a simultaneous Japanese pledge for more “stimulus” in October. Both of those followed closely an ECB which got itself back in the QE business once more. But all that likely coordinated “accommodation” was spoiled...

Read More »Big Difference Which Kind of Hedge It Truly Is

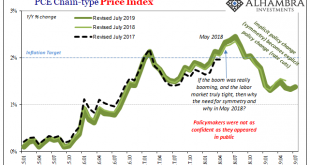

It isn’t inflation which is driving gold higher, at least not the current levels of inflation. According to the latest update from the Bureau of Economic Analysis, the Federal Reserve’s preferred inflation calculation, the PCE Deflator, continues to significantly undershoot. Monetary policy explicitly calls for that rate to be consistent around 2%, an outcome policymakers keep saying they expect but one that never happens. For the month of July 2019, the index...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org