It is costing more to live and be, so naturally people are looking for who it is they need to blame. Maybe figure out some way to stop it. You know and feel for the basics since everyone’s perceptions begin with costs of just living. This is what makes the subject of inflation so difficult, even more so in the era of QE. Money printing, duh. By clarifying the situation – demonstrating over and over how there is no money printing therefore there can’t be inflation –...

Read More »All Signs Of More Slack

The evidence continues to pile up for increasing slack in the US economy. While that doesn’t necessarily mean there is a recession looming, it sure doesn’t help in that regard. Besides, more slack after ten years of it is the real story. The Federal Reserve’s favorite inflation measure in October 2019 stood at 1.31%, matching February for the lowest in several years. Despite constantly referencing a tight labor market and its fabulous unemployment rate, broad...

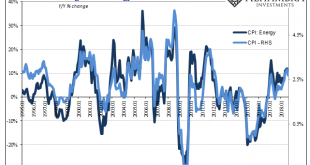

Read More »US inflation remains modest, but tariffs will soon make themselves felt

While we await the effect of import tariffs, inflation has still not taken off in the US. The Fed is unlikely to be swayed from its current rate tightening routine.Core consumer-price index (CPI) inflation rose a modest 0.12% month on month (m-o-m) in September, again undershooting market expectations, and the year-on-year (y-o-y) print stayed unchanged at 2.2% –a relatively benign outcome given the flourishing US economy and the tight labour market.Core inflation (excluding energy and food...

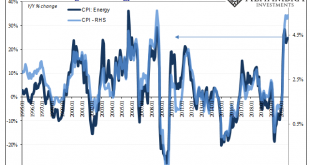

Read More »Downslope CPI

Cushing, OK, delivered what it could for the CPI. The contribution to the inflation rate from oil prices was again substantial in August 2018. The energy component of the index gained 10.3% year-over-year, compared to 11.9% in July. It was the fourth straight month of double digit gains. Yet, the CPI headline retreated a little further than expected. After reaching the highest since December 2011 the month before,...

Read More »Globally Synchronized What?

In one of those rare turns, the term “globally synchronized growth” actually means what the words do. It is economic growth that for the first time in ten years has all the major economies of the world participating in it. It’s the kind of big idea that seems like a big thing we all should pay attention to. In The New York Times this weekend, we learn: A decade after the world descended into a devastating economic...

Read More »Good or Bad, But Surely Not Transitory

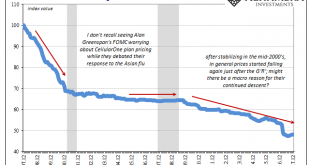

When Federal Reserve officials first started last year to mention wireless network data plans as a possible explanation for a fifth year of “transitory” factors holding back consumer price inflation, it seemed a bit transparent. One of the reasons for immediately doubting their sincerity was the history of that particular piece of the CPI (or PCE Deflator). To begin with, the unlimited data plan wars that kicked off...

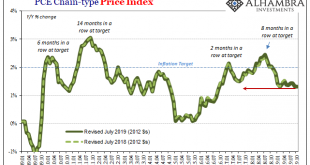

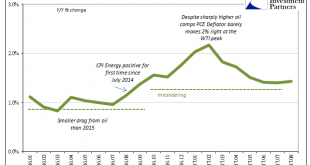

Read More »Non-Transitory Meandering

Monetary officials continue to maintain that inflation will eventually meet their 2% target on a sustained basis. They have no other choice, really, because in a monetary regime of rational expectations for it not to happen would require a radical overhaul of several core theories. Outside of just the two months earlier this year, the PCE Deflator has missed in 62 of the past 64 months. The FOMC is simply running out of...

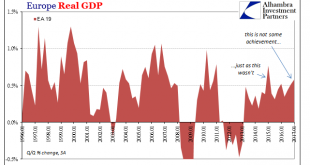

Read More »Europe’s Non-linear

Europe is as we all are. Ben Bernanke wrote a few years ago that his tenure at the Fed must have been a success in his view because the US economy didn’t perform as badly as Europe’s. As usual, this technically true comparison is for any meaningful purpose irrelevant. For one, the European economy underperformed before 2008, too. Second, after 2008, really August 9, 2007, there isn’t nearly as much difference as...

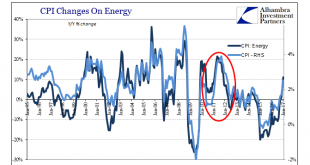

Read More »U.S. CPI after the energy push

The Consumer Price Index for January 2017 rose 2.5%, pulled upward by its energy component which thanks to oil prices now being comparing to the absolutely lows last year saw that part of the index rise 11.1% year-over-year. Given that oil prices bottomed out on February 11, 2016, this is the last month where oil prices and thus energy inflation will be at its most extreme (except, of course, should WTI actually rise...

Read More »Core euro area inflation surprises on the upside

Headline inflation was negative for the second consecutive month in March, but core inflation rose above consensus. We expect underlying inflation dynamics will remain subdued this year and it will take time to judge the effectiveness of the ECB's latest easing measures. According to Eurostat’s preliminary estimate, the euro area harmonised index of consumer prices (HICP) inflation rose to -0.08% y-o-y in March from -0.15% y-o-y in February, in line with consensus expectations. The March...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org