When Federal Reserve officials first started last year to mention wireless network data plans as a possible explanation for a fifth year of “transitory” factors holding back consumer price inflation, it seemed a bit transparent. One of the reasons for immediately doubting their sincerity was the history of that particular piece of the CPI (or PCE Deflator). To begin with, the unlimited data plan wars that kicked off with Verizon’s entry into them wasn’t all that much of a change for the industry. It seemed a little weird to be suggesting falling wireless telephone prices (the category of the CPI carrying the carriers’ various products and services) were a “transitory” factor when wireless telephone prices have been

Topics:

Jeffrey P. Snider considers the following as important: at&t, AT&T, core inflation, CPI, currencies, economy, Featured, Federal Reserve/Monetary Policy, FOMC, inflation, Janet Yellen, Markets, newslettersent, sprint, t-mobile, The United States, they really don't know what they are doing, U.S. Consumer Price index, U.S. Treasuries, Verizon, wireless telephone services

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

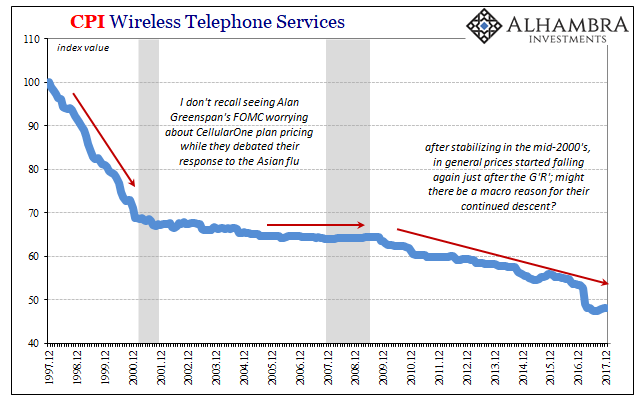

When Federal Reserve officials first started last year to mention wireless network data plans as a possible explanation for a fifth year of “transitory” factors holding back consumer price inflation, it seemed a bit transparent. One of the reasons for immediately doubting their sincerity was the history of that particular piece of the CPI (or PCE Deflator). To begin with, the unlimited data plan wars that kicked off with Verizon’s entry into them wasn’t all that much of a change for the industry.

It seemed a little weird to be suggesting falling wireless telephone prices (the category of the CPI carrying the carriers’ various products and services) were a “transitory” factor when wireless telephone prices have been falling since they were first added to the index twenty years ago. It’s kind of what they do. They may drop at times at varying rates, but by and large their direction is consistently downward, almost always a drag on the overall headline inflation rate.

Whenever analyzing monetary factors through inflation, we begin with a basic problem. Economists of generations following the Great Depression have an intense fear of deflation that didn’t uniformly exist before it. The Great Collapse starting in 1929 was a shock, to be sure, but not all deflation is monetary in origin.

In fact, the successful practice of capitalism should always lead in the direction of lower consumer prices. That’s the beauty of it, where via the right combination (the invisible hand) of labor and capital (machines or intellectual property, not cash) we consumers are able to buy more for less. It’s exactly why the CPI sub-index for Wireless Telephone Services debuted for December 1997 at 100 and is now about 48 – approximately twice as much service for the same price.

But, as noted a few days ago, it’s not always that easy to distinguish. There are other forms of deflation that aren’t so pleasant though they may seem that way on the surface. Monetary deflation is the worst, the insipid version that devastated the global economy in the early thirties and then wouldn’t really let go until Bretton Woods in 1944 (long after the world had spiraled into the true abyss of WWII). Briefly, monetary deflation is where a shortage of money is so spectacular regular folks as well as business are forced to liquidate anything and everything in order to raise cash (oftentimes so it can be further hoarded).

The prices of just about every good and commodity will plummet at that point, destroying real capital (businesses) as output prices fall below production costs, essentially shrinking the economy on the all-important supply side.

| Monetary deflation need not be so extreme, however. In what might be more fairly called macro deflation, an economic downturn might force businesses to cut prices on excess inventory, for example, or what becomes surplus production those businesses didn’t anticipate before the cycle turned. And it can be all relative, too. A firm that plans for 10% growth because it expects 5% GDP growth will find itself in a similar bind should 2% GDP leave it with but 4% revenue.

For wireless telephone services, the trend in prices does seem more than a little like what I just described above. After steadily declining in the late nineties in what was surely capitalist deflation (the introduction phase leading to widespread adoption), wireless plan prices stabilized throughout the growth period in the middle 2000’s. It wasn’t until the second half of 2009, just after the Great “Recession” was at its worst, prices began falling all over again. |

US Consumer Price Index, Dec 1997 - 2017(see more posts on U.S. Consumer Price Index, ) |

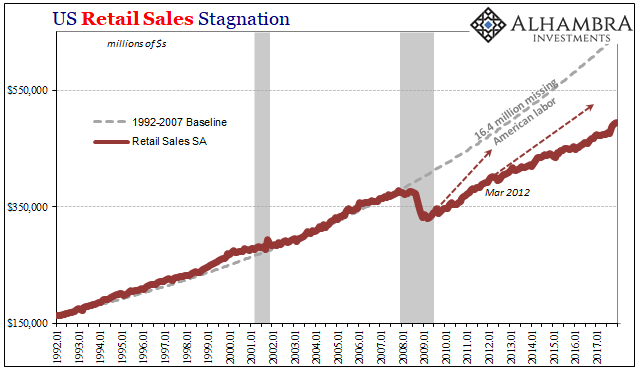

| After all, what has been the dominant feature of the post-crisis “recovery” period? The last eight years have been a perverse trend where the lack of income growth and jobs is really all that has mattered (which is why Economists try so very hard to come up with reasons why they don’t; see: unemployment rate). You look at something like retail sales and the difference is immediately obvious: |

US Retail Sales, Jan 1992 - 2018(see more posts on U.S. Retail Sales, ) |

| It sure looks a lot like the economy at least on the consumer side shrunk. What might happen to, say, wireless data providers trying to operate profitably during this shrunken portion? It stands to reason that competition in that space would be even more dramatic than at any other point, which would lead them toward outsized price sensitivity (driven largely by those macro constraints on their customers and prospective customers). |

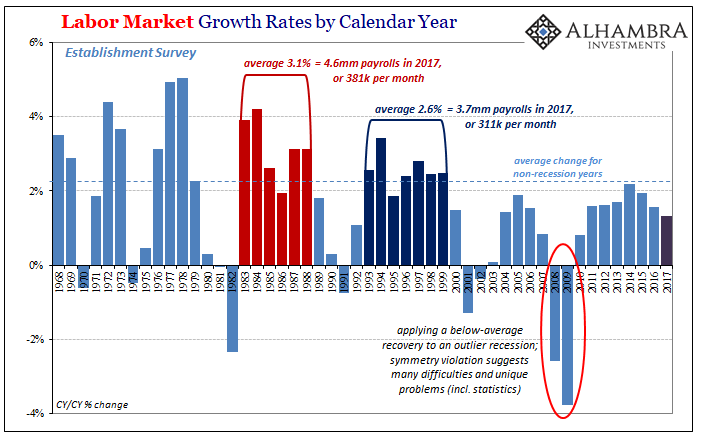

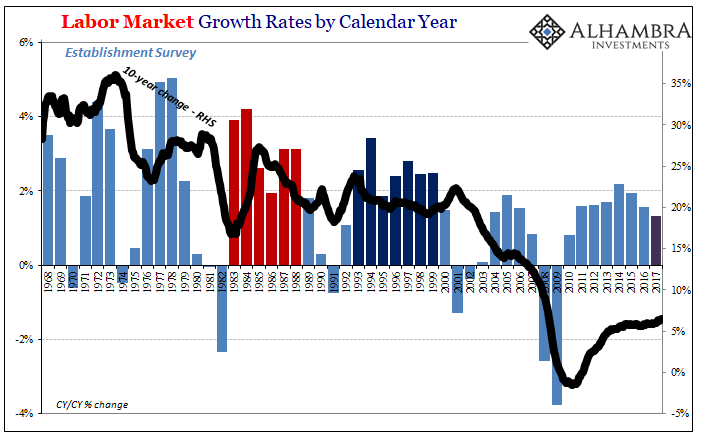

Labor Market Growth, 1968 - 2018(see more posts on Labor Market, ) |

| AT&T, Sprint, T-Mobile, and Verizon may not be trying to literally liquidate inventory, but in one meaningful sense it does appear that that’s just what they have been doing. Furthermore, if we see the 2017 bigger drop in wireless prices in this context, what might that confirm about our sense these same macro factors, especially those of the labor market beyond the unemployment rate? |

Labor Market Growth Rates, 1968 - 2018(see more posts on Labor Market, ) |

| Payroll growth has been awful for ten years, but even within that decade last year stood out as being particularly awful. There is much more than a trivial chance that explains Verizon than it does add up to some “transitory” factor time easily displaces for Janet Yellen (now Jerome Powell). |

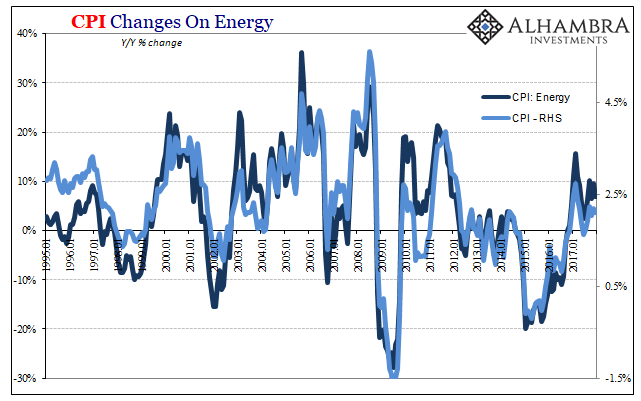

US Consumer Price Index, Jan 1995 - 2018(see more posts on U.S. Consumer Price Index, ) |

| The CPI for December 2017 rose by just 2.11% year-over-year, a little more than two-thirds of what it is supposed to be (remember, the PCE Deflator is targeted for 2%, and CPI methodology is different where it has a higher overall beta). And the only part really keeping it near 2% is the energy sector and the boost from marginally higher WTI. |

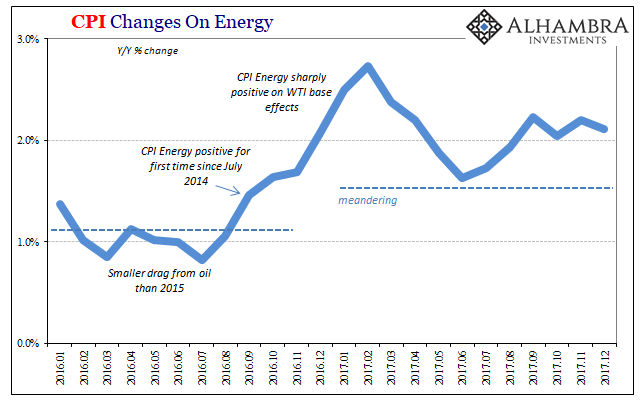

US Consumer Price Index, Jan 2016 - 2018(see more posts on U.S. Consumer Price Index, ) |

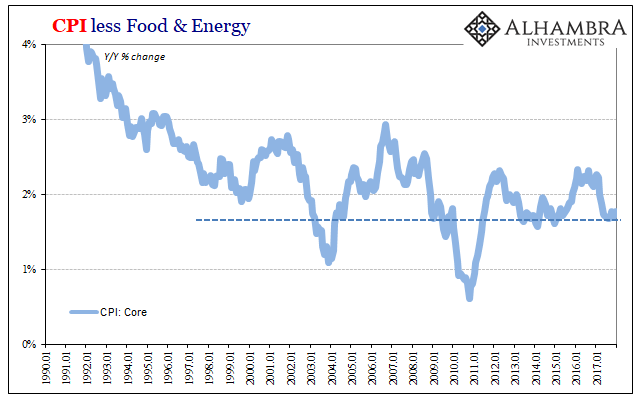

| Despite all of 2017 now being put down in stone (the unadjusted CPI cannot be revised by law, only the seasonal adjustments change), the various “core” readings uniformly describe an economy being held back rather than one likely to accelerate. |

US Consumer Price Index, Jan 1990 - 2018(see more posts on U.S. Consumer Price Index, ) |

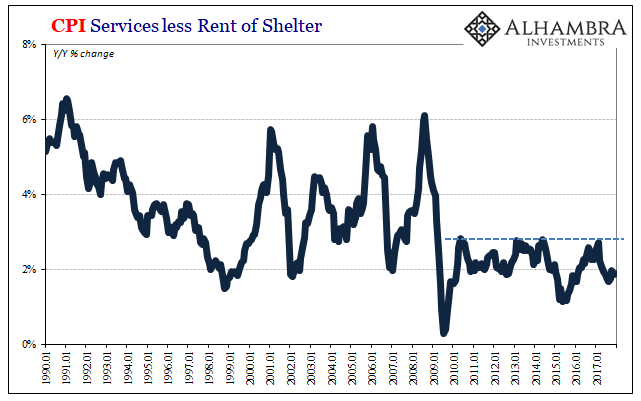

| None of this is to say there is no “good” capitalist deflation within the CPI or any of its components, including wireless telephone services, 2009 and after. There almost certainly is, but at the same time there are serious indications that too much of the “bad” kind of deflation remains a problem (worldwide). Verizon’s action may have been the anomaly FOMC officials hope that it was, or it may have been what the labor statistics (and retail sales) keep showing. |

US Consumer Price Index, Jan 1990 - 2018 |

| Yellen’s little committee, I think, made a big mistake in choosing to highlight mobile telecom prices. There is more of a case to be made for that particular part of the inflation universe being all-too-consistent than there is for them being a benign and “transitory” reason for starting a sixth year significantly beneath the FOMC explicit target mandate. All that despite four QE’s, years of ZIRP, and now ridiculous internecine debates about why inflation targets might need to be raised. It all tallies instead on the side of the ledger where they really don’t know what they are doing. |

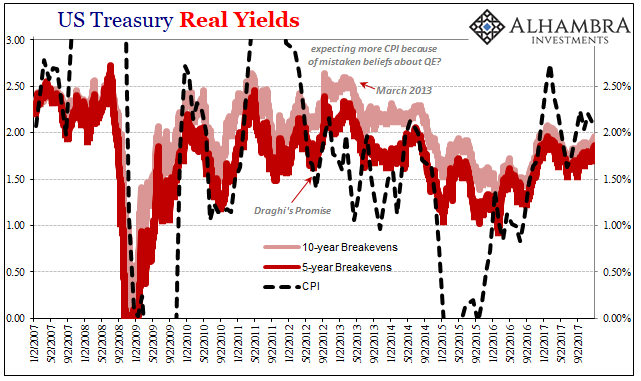

US Treasury Yields, Feb 2007 - Jan 2018(see more posts on U.S. Treasuries, ) |

Tags: at&t,Core Inflation,CPI,currencies,economy,Featured,Federal Reserve/Monetary Policy,FOMC,inflation,Janet Yellen,Markets,newslettersent,sprint,t-mobile,they really don't know what they are doing,U.S. Consumer Price Index,U.S. Treasuries,Verizon,wireless telephone services