Headline inflation was negative for the second consecutive month in March, but core inflation rose above consensus. We expect underlying inflation dynamics will remain subdued this year and it will take time to judge the effectiveness of the ECB's latest easing measures. According to Eurostat’s preliminary estimate, the euro area harmonised index of consumer prices (HICP) inflation rose to -0.08% y-o-y in March from -0.15% y-o-y in February, in line with consensus expectations. The March reading was the second negative print in a row. A positive surprise came from estimated core inflation (excluding energy, food, alcohol and tobacco), which rose from 0.83% y-o-y in February to 1.03% y-o-y in March, above consensus expectations (0.9%) and completely reversing its previous monthly decline. Strong rebound in services prices Looking at the available HICP breakdown, March’s increase was mainly driven by the rebound in services prices (+0.4% m-o-m). This followed a fall in services prices in February, mainly due to erratic factors such as package holidays. In March, services inflation rebounded strongly from 0.94% y-o-y to 1.34% y-o-y, a five-month high. Nevertheless, part of the rise might also reflect the increase in some leisure sectors due to an early Easter. Meanwhile, non-energy industrial goods inflation fell, from 0.70% y-o-y in February to 0.

Topics:

Nadia Gharbi considers the following as important: core inflation, Deflation, eurozone inflation, Macroview

This could be interesting, too:

Stephen Flood writes Rick Rule – Gold Helps Me Sleep at Night

Jeffrey P. Snider writes A Volcker Pan Recession

Jeffrey P. Snider writes Hong Kong Stocks Pivot Euro$ #5

Jeffrey P. Snider writes The Fed Inadvertently Adds To Our Ironclad Collateral Case Which Does Seem To Have Already Included A ‘Collateral Day’ (or days)

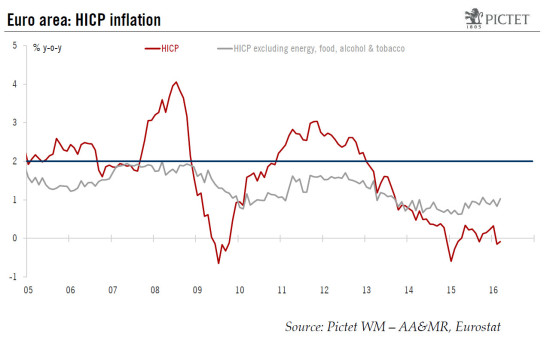

Headline inflation was negative for the second consecutive month in March, but core inflation rose above consensus. We expect underlying inflation dynamics will remain subdued this year and it will take time to judge the effectiveness of the ECB's latest easing measures.

According to Eurostat’s preliminary estimate, the euro area harmonised index of consumer prices (HICP) inflation rose to -0.08% y-o-y in March from -0.15% y-o-y in February, in line with consensus expectations. The March reading was the second negative print in a row. A positive surprise came from estimated core inflation (excluding energy, food, alcohol and tobacco), which rose from 0.83% y-o-y in February to 1.03% y-o-y in March, above consensus expectations (0.9%) and completely reversing its previous monthly decline.

Strong rebound in services prices

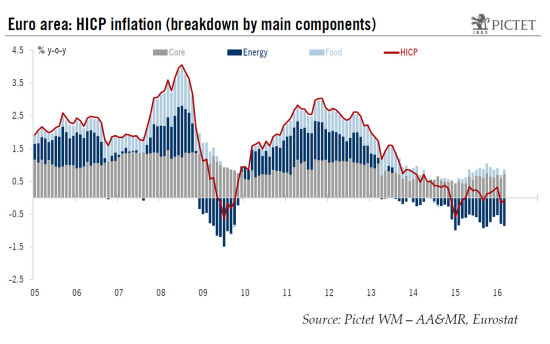

Looking at the available HICP breakdown, March’s increase was mainly driven by the rebound in services prices (+0.4% m-o-m). This followed a fall in services prices in February, mainly due to erratic factors such as package holidays. In March, services inflation rebounded strongly from 0.94% y-o-y to 1.34% y-o-y, a five-month high. Nevertheless, part of the rise might also reflect the increase in some leisure sectors due to an early Easter.

Meanwhile, non-energy industrial goods inflation fell, from 0.70% y-o-y in February to 0.51% y-o-y in March, possibly reflecting the delayed impact of a stronger EUR in effective terms on imported inflation.

Energy inflation (-8.70% y-o-y in March) has been negative for 21 months, and base effects are expected to further depress HICP in the near-future, given the modest recovery in oil prices so far this year.

Germany drove the HICP up

At a country level, the increase in the HICP was mainly driven by Germany, where inflation rose from -0.2% y-o-y in February to +0.1% y-o-y in March. In contrast, inflation softened in Italy from -0.2% y-o-y to -0.3% y-o-y, and was stable in France at -0.1% y-o-y and in Spain at -1.0% y-o-y.

Normalisation in inflation will be slow

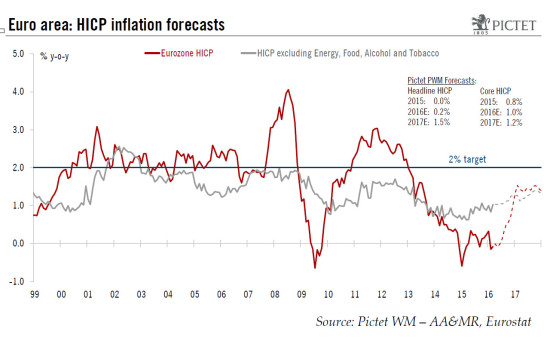

We expect euro area headline inflation to marginally increase from 0.0% in 2015 to 0.2% in 2016 and 1.5% in 2017, assuming a gradual rise of oil prices to $50 by end-2017 and a EUR/USD exchange rate at 1.14. More importantly, the underlying inflation dynamic is likely to remain subdued. We expect core inflation to rise only gradually, averaging 1.0% in 2016 and 1.2% in 2017.

As in March, the composition of any rise in core inflation is likely to shift from currency-driven core goods inflation to domestically-driven services inflation. The main reason is that the ECB’s latest actions are more tilted towards resuming the recovery by improving the bank credit channel than by driving down the euro. Moreover, the impact of past euro weakness on core inflation seems to be fading, as suggested by non-energy industrial goods inflation recent dynamics.

On the other hand, second-round effects of low oil prices on core inflation will need to be monitored closely as well. However, we currently see little evidence of large second-round effects of low oil prices on wage growth.

Overall, inflation is likely to remain below the ECB’s target. It will take time to assess the effectiveness on inflation of the comprehensive package announced by the ECB on March 10. As a result, it is too early to say that additional actions are needed. ECB’s inflation forecast for 2018 will be key for its future policy. In March, ECB staff projected just 1.6% for inflation in 2018, but this does not include the additional measures announced on 10 March. Thus, the next forecast update on 2 June will be important for more guidance on how the ECB views medium-term inflation prospects.