While we await the effect of import tariffs, inflation has still not taken off in the US. The Fed is unlikely to be swayed from its current rate tightening routine.Core consumer-price index (CPI) inflation rose a modest 0.12% month on month (m-o-m) in September, again undershooting market expectations, and the year-on-year (y-o-y) print stayed unchanged at 2.2% –a relatively benign outcome given the flourishing US economy and the tight labour market.Core inflation (excluding energy and food prices) was abnormally buffeted by a sharp drop in prices for used cars) and hotels in September, so the latest reading possibly under-estimates ‘true’ underlying inflation. Core inflation is also being influenced by structural factors, such as the ongoing moderation in healthcare costs that make it

Topics:

Thomas Costerg considers the following as important: core inflation, core price index, Macroview, US inflation

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

While we await the effect of import tariffs, inflation has still not taken off in the US. The Fed is unlikely to be swayed from its current rate tightening routine.

Core consumer-price index (CPI) inflation rose a modest 0.12% month on month (m-o-m) in September, again undershooting market expectations, and the year-on-year (y-o-y) print stayed unchanged at 2.2% –a relatively benign outcome given the flourishing US economy and the tight labour market.

Core inflation (excluding energy and food prices) was abnormally buffeted by a sharp drop in prices for used cars) and hotels in September, so the latest reading possibly under-estimates ‘true’ underlying inflation. Core inflation is also being influenced by structural factors, such as the ongoing moderation in healthcare costs that make it hard to determine the exact cyclical price pressures on the US economy.

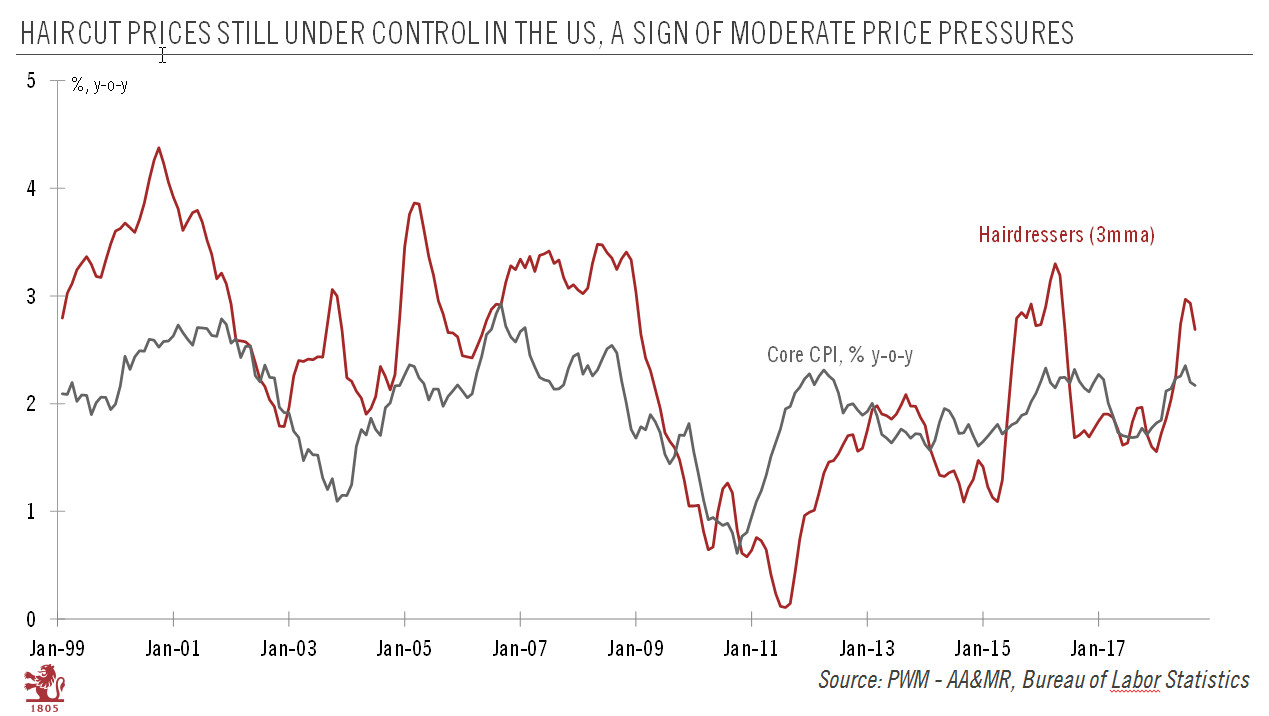

We always like to refer to the ‘hairdresser’ price sub-index (basically, the price of a haircut) for an idea of where ‘true’ core inflation may be (see chart). The reading for September was 2.7% y-o-y (on a three-month moving average basis), consistent with the idea that core inflation pressures are building a bit more than suggested by the official core CPI. However, overall, there is still no sign of a breakout in inflation numbers.

Core inflation is likely to pick up in coming months as the Trump Administration’s tariffs on Chinse goods (mostly consumer goods) may lead to price hikes. It is uncertain whether some firms feel tempted to use tariffs to pass on long sought-after increases in input prices.

The Federal Reserve (Fed) is likely to set aside the relatively modest September CPI print. It remains on course to hike rates in December, continuing its routine of one quarter-point increase per quarter, buoyed by the strong economy and the ongoing improvement in the labour market. We still expect four further rate increases (at the Fed’s December, March, June and September meetings) followed by a long pause.