Hurricane Ida swept up the Gulf of Mexico and slammed into the Louisiana coastline on August 29. The storm would continue to wreak havoc even as it weakened the further inland it traversed. By September 1 and 2, the system was still causing damage and disruption into the Northeast of the United States. While absolutely tragic for those who suffered its blow, in economic terms this means that any weakness exhibited by whichever economic account during both August and...

Read More »Weekly Market Pulse: Perception vs Reality

It was the best of times, it was the worst of times… Charles Dickens, A Tale of Two Cities Some see the cup as half empty. Some see the cup as half full. I see the cup as too large. George Carlin The quote from Dickens above is one that just about everyone knows even if they don’t know where it comes from or haven’t read the book. But, as the ellipsis at the end indicates, there is quite a bit more to the line than the part everyone remembers. It was the best of...

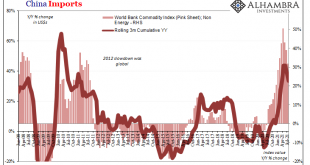

Read More »Inflating Chinese Trade

There was never really any answer given by the Chinese Communists for why their own export data diverged so much from other import estimates gathered by its largest trading partners. Ostensibly different sides of the same thing, it’s not like anyone asked Xi Jinping to weigh in; they report what numbers they have and consider them authoritative. However, the United States’ Census Bureau’s tallies of China-made goods entering this country used to track very closely...

Read More »Weekly Market Pulse: Inflation Scare?

Bonds sold off again last week with the yield on the 10 year Treasury closing over 1.6% for the first time since early June. The yield is now down just 16 basis points from the high of 1.76% set on March 30. But this rise in rates is at least a little different than the fall that preceded it. When nominal rates fell from April through July, real rates fell right along with them. The nominal bond yield fell by 63 basis points and the 10 year TIPS yield fell by 57....

Read More »What’s The Real Downside To Some of These Key Commodities?

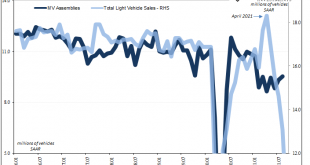

Last night, Autodata reported its first estimates for September auto sales in the US. According to its own as well as those compiled by the Bureau of Economic Analysis (the same government outfit which keeps track of GDP), vehicle sales have been sliding overall ever since April. For a couple months in the middle of Uncle Sam’s helicopter-fed frenzy, the number of vehicle units had surged to a high of more than 18 million (seasonally-adjusted annual rate) in both...

Read More »Weekly Market Pulse: Zooming Out

How often do you check your brokerage account? There is a famous economics paper from 1997, written by some of the giants in behavioral finance (Thaler, Kahnemann, Tversky & Schwartz), that tested what is known as myopic loss aversion. What they found was that investors who check their performance less frequently are more willing to take risk and experience higher returns. Investors who check their results frequently take less risk and perform worse. And that...

Read More »Weekly Market Pulse: Time For A Taper Tantrum?

The Fed meets this week and is widely expected to say that it is talking about maybe reducing bond purchases sometime later this year or maybe next year or at least, someday. Jerome Powell will hold a press conference at which he’ll tell us that markets have nothing to worry about because even if they taper QE, interest rates aren’t going up for a long, long time. That statement might have more credibility if the Fed had been right about just about anything over the...

Read More »Weekly Market Pulse: Time For A Taper Tantrum?

The Fed meets this week and is widely expected to say that it is talking about maybe reducing bond purchases sometime later this year or maybe next year or at least, someday. Jerome Powell will hold a press conference at which he’ll tell us that markets have nothing to worry about because even if they taper QE, interest rates aren’t going up for a long, long time. That statement might have more credibility if the Fed had been right about just about anything over the...

Read More »What’s Real Behind Commodities

Inflation is sustained monetary debasement – money printing, if you prefer – that wrecks consumer prices. It is the other of the evil monetary diseases, the one which is far more visible therefore visceral to the consumers pounded by spiraling costs of bare living. Yet, it is the lesser evil by comparison to deflation which insidiously destroys the labor market from the inside out. You see inflation around you; anyone can only tell deflation by hopefully noticing and...

Read More »Weekly Market Pulse: Happy Anniversary!

Today is the 50th anniversary of the “Nixon shock”, the day President Richard Nixon closed the gold window and ended the post-WWII Bretton Woods currency agreement. That agreement, largely a product of John Maynard Keynes, pegged the dollar to gold and most other currencies to the dollar. It wasn’t a true gold standard as only other countries that were party to the agreement could demand gold in exchange for their dollars, but it was at least a standard of some...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org