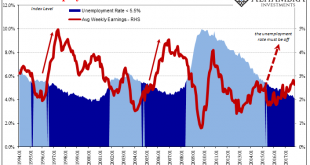

Swiss Franc The Euro has risen by 0.18% to 1.1673 CHF. EUR/CHF and USD/CHF, December 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates US interest rates have recovered the drop seen after the FOMC yesterday, but the dollar at best has been able to consolidate its losses and at worst, seen its losses extended. The Fed boosted its growth forecasts and lower unemployment...

Read More »What Central Banks Have Done Is What They’re Actually Good At

As a natural progression from the analysis of one historical bond “bubble” to the latest, it’s statements like the one below that ironically help it continue. One primary manifestation of low Treasury rates is the deepening mistrust constantly fomented in markets by the media equivalent of the boy who cries recovery. That narrative “has ruffled a few feathers,” BMO Capital Markets strategists Ian Lyngen and Aaron Kohli...

Read More »Globally Synchronized Downside Risks

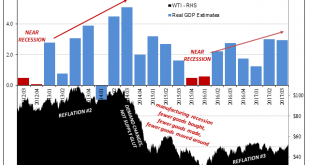

Oil prices were riding high after several weeks of steady, significant gains. It’s never really clear what it is that might actually move markets in the short run, whether for crude it was Saudi Arabia’s escalating activities or other geopolitical concerns. Behind those, the idea of “globally synchronized growth” that is supposedly occurring for the first time since before the Great “Recession” while it may not have...

Read More »FX Daily, November 14: Euro Rides High After German GDP

Swiss Franc The Euro has risen by 0.22% to 1.1646 CHF. EUR/CHF and USD/CHF, November 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Sterling is trading in the lower end of yesterday’s range and has been confined to about a quarter a cent on either side of $1.31. On the other hand, the euro has pushed a bit through GBP0.8950 to reach its best level since October 26....

Read More »An Unexpected (And Rotten) Branch of the Maestro’s Legacy

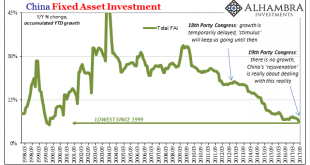

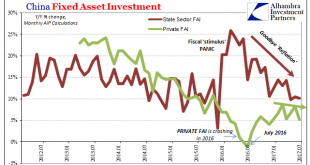

The most significant part of China’s 19th Party Congress ended in the usual anticlimactic fashion. These events are for show, not debate. Like any good trial lawyer will tell you, you never ask a question in court that you don’t already know the answer to. For China’s Communists, that meant nominating Xi Jinping’s name to be written into the Communist constitution with the votes already tallied. Without any objection,...

Read More »FX Daily, October 19: Kiwi Drop and Sterling Losses Punctuate Subdued FX Market

Swiss Franc The Euro has fallen by 0.25% to 1.1539 CHF. EUR/CHF and USD/CHF, October 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The 30th anniversary of the 1987 equity market crash the major US benchmarks at record highs. The drop in the market was at least partly a function of the lack of capacity, sufficient instruments, and regulatory regime. Each of these...

Read More »Swimming The ‘Dollar’ Current (And Getting Nowhere)

The People’s Bank of China reported this week that its holdings of foreign assets fell slightly again in August 2017. Down about RMB 21 billion, almost identical to the RMB 22 billion decline in July, the pace of forex withdrawals is clearly much preferable to what China’s central bank experienced (intentionally or not) late last year at ten and even twenty times the rate of July and August. The US Treasury Department...

Read More »FX Daily, September 14: New Trump Tactics Help Greenback and Rates

In the face of much cynicism and pessimism about the outlook for the Trump Administration’s agenda, we have repeatedly pointed out the resilience of the system of checks and balances. Many of the more extreme positions have been tempered, either on their own accord, such as naming China a currency manipulator or pulling out of NAFTA or KORUS, or the judiciary branch, such as on immigration curbs, or the legislative...

Read More »Losing Economic ‘Reflation’

The backbone of China’s internal economy has been its ghost cities, but not as they may be ghost towns now, rather in how little time they might take to fill up. If the lag was relatively small because of restored growth, more would be needed and the Chinese building economy rolling ever onward. “Reflationary” prices were often Chinese prices of just that perceived process. The perceptions of a possible “hard landing”...

Read More »China: Losing Economic ‘Reflation’

The backbone of China’s internal economy has been its ghost cities, but not as they may be ghost towns now, rather in how little time they might take to fill up. If the lag was relatively small because of restored growth, more would be needed and the Chinese building economy rolling ever onward. “Reflationary” prices were often Chinese prices of just that perceived process. The perceptions of a possible “hard landing”...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org