Swiss Franc The Euro has fallen by 0.44% to 1.1877 CHF. EUR/CHF and USD/CHF, May 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates US 10-year rates are again probing the air above 3%, and this is encouraging a push back toward JPY110, with the euro slipping toward $1.19. Asian equities fell, with the MSCI Asia Pacific shedding 0.8%, the most in nearly a month, snapping a...

Read More »FX Daily, April 17: Dollar Recovers from Further Selling as Turnaround Tuesday Unfolds

Swiss Franc The Euro has risen by 0.29% to 1.1914 CHF. EUR/CHF and USD/CHF, April 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After the retreating in the North American session yesterday, despite a rebound in retail sales after three-months of declines, the greenback has been sold further in Europe and Asia. The euro edged through last week’s high near $1.24, and...

Read More »China’s Questionable Start to 2018

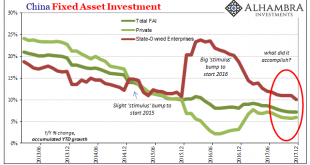

The Chinese government reported estimates for Industrial Production, Retail Sales, and Fixed Asset Investment (FAI) for both January and February 2018. The National Bureau of Statistics prepares and calculates China’s major economic statistics in this manner at the beginning of each year due to the difficulties created by calendar effects (New Year Golden Week). Despite this attempt to offset them, there remains...

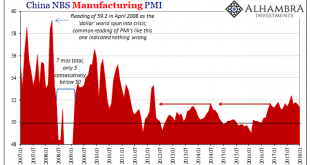

Read More »How Global And Synchronized Is A Boom Without China?

According to China’s official PMI’s, those looking for a boom to begin worldwide in 2018 after it failed to materialize in 2017 are still to be disappointed. If there is going to be globally synchronized growth, it will have to happen without China’s participation in it. Of course, things could change next month or the month after, but this idea has been around for a year and a half already. Without China, growth won’t...

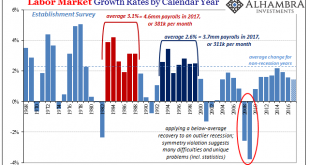

Read More »The Blatant Dishonesty of the ‘Boom’

Why do humans tend to behave in herds? It’s a fundamental question that only recently have researchers been able to better understand. On the one hand, it doesn’t take an advanced degree in some neurological science to see the basis behind it; survival for our ancestors often meant getting along with the crowd. There are times when that very trait applies still. In 2009, neurologists in the UK conducted function...

Read More »Is Un-Humming A Word? It Might Need To Become One

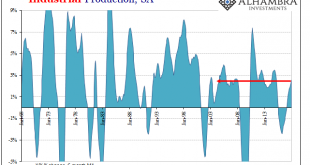

Industrial Production in the US was up 3.6% year-over-year in December 2017. That’s the best for American industry since November 2014 when annual IP growth was 3.7%. That’s ultimately the problem, though, given all that has happened this year. In other words, despite a clear boost the past few months from storm effects, as well as huge contributions from the mining (crude oil) sector, American production at its best...

Read More »FX Daily, January 18: Currencies Consolidate After Chop Fest

Swiss Franc The Euro has fallen by 0.20% to 1.174 CHF. EUR/CHF and USD/CHF, January 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar rallied in the North American afternoon yesterday and the timing coincided with the release of the Fed’s Beige Book that saw several districts report wage and price pressures. The US 10-year yield moved toward toward 2.60%,...

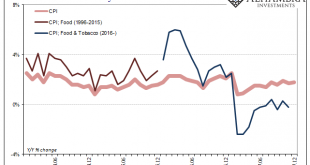

Read More »Inflation Correlations and China’s Brief, Disappointing Porcine Nightmare

Two years ago, China was gripped by what was described as an epic pig problem. For most Chinese people, pork is a main staple so rapidly rising pig prices could have presented a serious challenge to an economy already at that time besieged by massive negative forces. It was another headache officials in that country really didn’t need. For economists and the media, however, China’s possible porcine nightmare was...

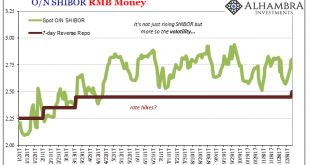

Read More »Chinese Are Not Tightening, Though They Would Be Thrilled If You Thought That

The PBOC has two seemingly competing objectives that in reality are one and the same. Overnight, China’s central bank raised two of its money rates. The rate it charges mostly the biggest banks for access to the Medium-term Lending Facility (MLF) was increased by 5 bps to 3.25%. In addition, its reverse repo interest settings were also moved up by 5 bps each at the various tenors (to 2.50% for the 7-day, 2.80% for the...

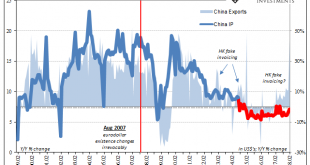

Read More »China Exports and Industrial Production: Revisiting Once More The True Worst Case

As weird as it may seem at first, the primary economic problem right now is that the global economy looks like it is growing again. There is no doubt that it continues on an upturn, but the mere fact that whatever economic statistic has a positive sign in front of it ends up being classified as some variant of strong. That’s how this works in mainstream analysis, this absence of any sort of gradation where if it’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org