In the face of much cynicism and pessimism about the outlook for the Trump Administration’s agenda, we have repeatedly pointed out the resilience of the system of checks and balances. Many of the more extreme positions have been tempered, either on their own accord, such as naming China a currency manipulator or pulling out of NAFTA or KORUS, or the judiciary branch, such as on immigration curbs, or the legislative branch itself, as in limiting the President’s ability to rollback new sanctions on Russia (and Iran and North Korea). The most important shift since last November’s election has taken place recently. After increasing frustrations with Republican legislators, who despite their majority, have ideological

Topics:

Marc Chandler considers the following as important: $CNY, AUD, China Fixed Asset Investment, China Industrial Production, China Retail Sales, EUR/CHF, Featured, France Consumer Price Index, FX Trends, GBP, Italy Consumer Price Index, Japan Industrial Production, JPY, newsletter, U.S. Consumer Price index, U.S. Core Consumer Price Index, U.S. Initial Jobless Claims, USD, USD/CHF

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

In the face of much cynicism and pessimism about the outlook for the Trump Administration’s agenda, we have repeatedly pointed out the resilience of the system of checks and balances. Many of the more extreme positions have been tempered, either on their own accord, such as naming China a currency manipulator or pulling out of NAFTA or KORUS, or the judiciary branch, such as on immigration curbs, or the legislative branch itself, as in limiting the President’s ability to rollback new sanctions on Russia (and Iran and North Korea).

The most important shift since last November’s election has taken place recently. After increasing frustrations with Republican legislators, who despite their majority, have ideological differences, that have stymied the Administration’s agenda, Trump has switched gears. He is seeking, at least in some areas, to work with a Democrats, with the hope of peeling off enough Republicans to forge a majority. This worked to buy more time, insofar as the debt limit and spending authorization were extended until mid-December to ensure smooth emergency aid funding after the recent weather calamities.

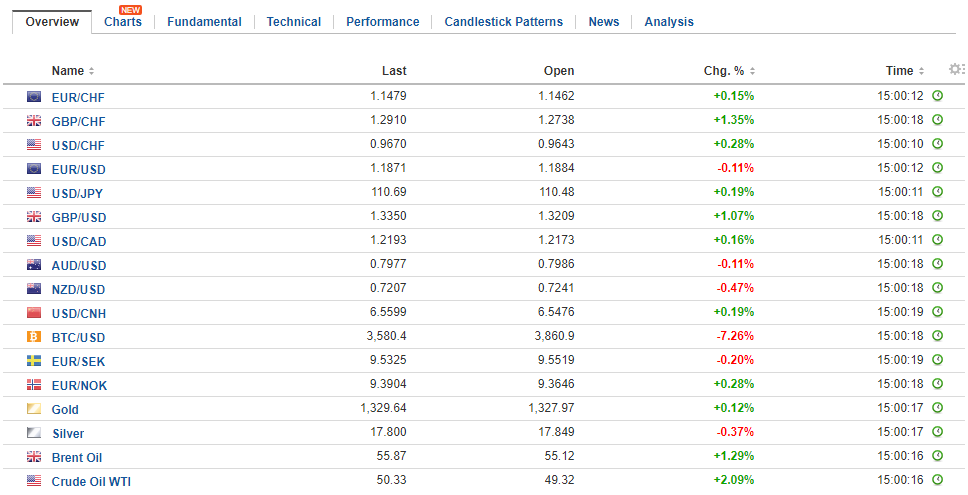

Swiss FrancThe Euro has risen by 0.17% to 1.1477 CHF. |

EUR/CHF and USD/CHF, September 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

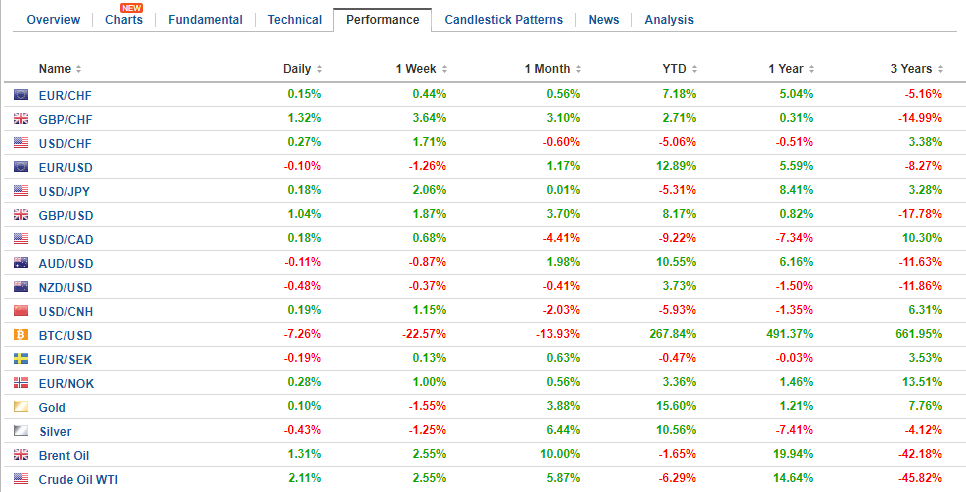

FX RatesIt looks like this new course can be extended in a few issue-specific areas, including DACA, and possibly health care and tax reform. It may be premature to reach any hard and fast conclusions, but the point is that the dance between the fractious and small Republican legislative majority, a maverick President, and strident Democrat minority has changed tunes, and many investors do not appear prepared for this. Given prices, market positioning, and sense of market psychology, we think the market is ill-prepared for any one of these scenarios: tax reform, the continuation of the Fed’s gradual removal of accommodation through increasing the Fed funds target range, and Yellen being reappointed. We suspect the first is two are more dollar bullish than the third, but the reappointment of Yellen, assuming she would accept, would provide continuity at an important time for the administration. Many in the media have emphasized the importance of loyalty for the White House, but in the Fed’s case, dependability may be almost as good. She is a known quantity, there is a nearly 40-year old tradition of two term for the Fed chair, and her views on regulation are very much what one would expect from one of the most important regulators. |

FX Daily Rates, September 14 |

| Tax reform is of keen interest, and the squabbling between the Freedom Caucus and the Tuesday Group warned that what happened to health care reform was going to sabotage tax reform. A new bipartisan group has emerged (Problem Solvers) that may break the logjam. Although details are not clear, a new time frame has been offered. In about two weeks (~September 25), a broad framework will be announced and this will be followed up by release of core elements that will operationalize the framework by mid-October by House Ways and Means Committee.

This would leave only 28 legislative days for the remainder of the 2017 session. The debt ceiling can be maneuvered around for a few months, but the spending authorization needs to be renewed/extended from early December, or face the risk of a shutdown of parts of the government. Sequentially, the FY2018 budget needs to be in place to allow the parliamentary ploy that allows tax reform to pass with a simple majority. There is a bit a chicken-egg story, as some legislators (Freedom Caucus) are reluctant approve spending authorization without a better understanding of the tax changes. |

FX Performance, September 14 |

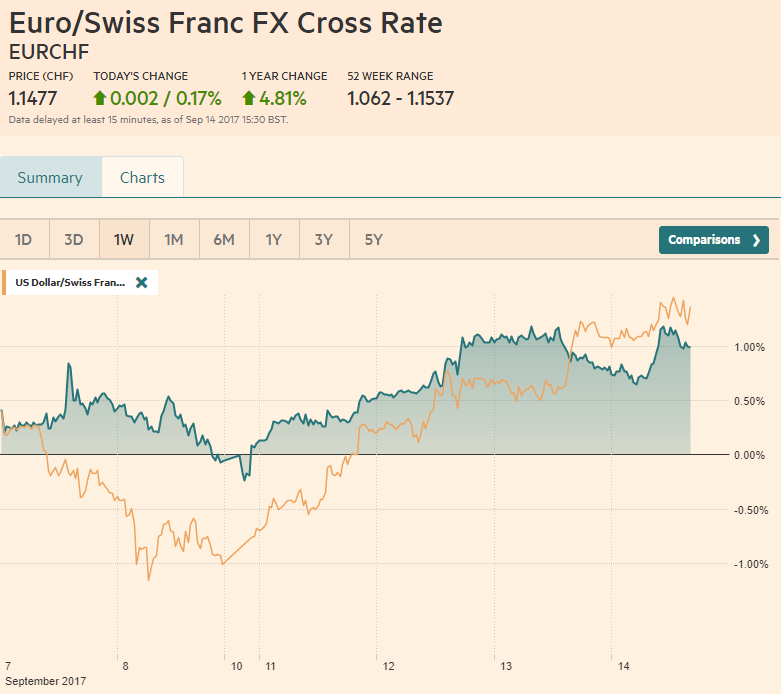

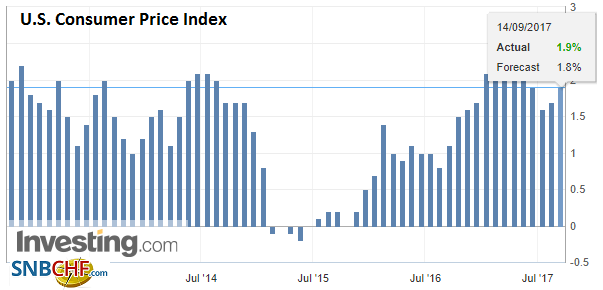

United StatesThe US August CPI is key economic report left today after the strong Australian jobs report and the disappointing Chinese data. The story is well known. Price pressures have softened this year in the US at both the headline and core levels. This has become a concern for several Fed officials, though most (according to recent FOMC minutes) still think it is a result of temporary factors, but seem increasingly open the possibility of a structure shift. |

U.S. Consumer Price Index (CPI) YoY, Aug 2017(see more posts on U.S. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| Headline consumer prices in the US have averaged a monthly increase of 0.1% this year after 0.2% last year. The headline has not increased by 0.2% since April. The median estimate in the Bloomberg survey is for a 0.3% rise in August. After what seemed like a soft PPI report yesterday, some fear a disappointing report. While that is possible, the finished consumer goods component of the PPI rose 0.6%, which augers against a downside surprise today.

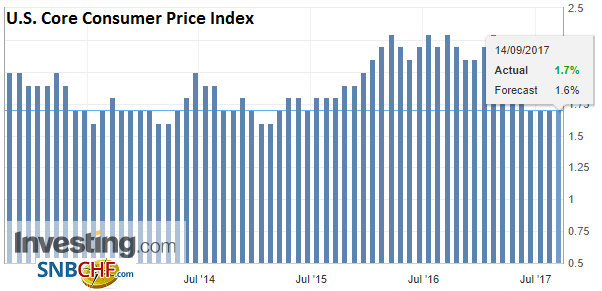

The core rate has not risen by more than 0.1% since February. The median estimate looks for a 0.2% increase in August. However, due to the base effect (last August core CPI rose 0.3%), the year-over-year rate could tick down to 1.6% from 1.7%. That might give the bond market a pause with the 10-year yield near 2.2% after slipping to almost 2.0% on September 8. |

U.S. Core Consumer Price Index (CPI) YoY, Aug 2017(see more posts on U.S. Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

|

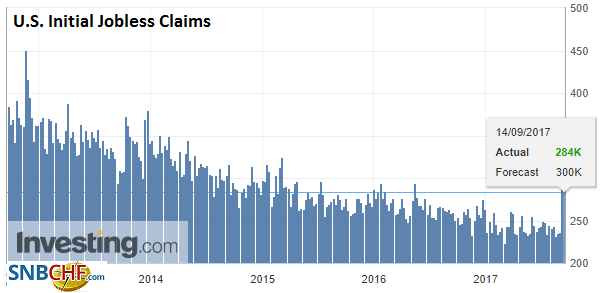

Tomorrow the US reports retail sales. Redbook weekly report of chain store sales may help to offset some of the drag of weaker auto sales. US consumption remains firm after a soft Q1, underpinned by job creation, small but positive real wage growth, and the increased use of credit. Perceptions of the risk of a December rate hike have risen in recent days. Bloomberg’s calculation has increased the odds from almost 27% at the end of last week to almost 39% chance now. By the CME’s interpolation the odds have risen from 31% to 46%. |

U.S. Initial Jobless Claims, 14 September 2017(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

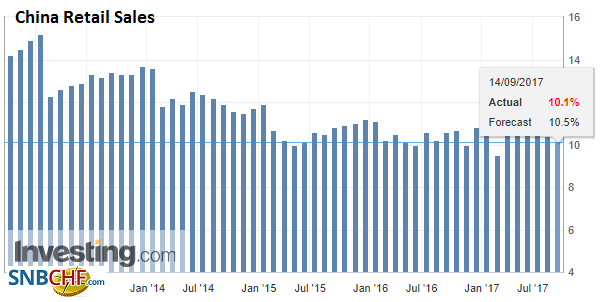

ChinaChina reported a series of August data that disappointing data that strengthens the idea that the world’s second largest economy may have seen in its mini-growth spurt lose momentum in H2. Retail sales slowed to 10.1% from 10.4%. |

China Retail Sales YoY, Aug 2017(see more posts on China Retail Sales, ) Source: Investing.com - Click to enlarge |

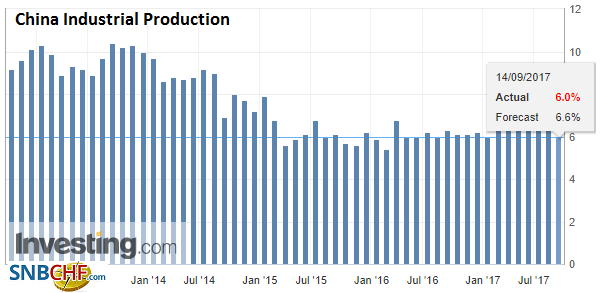

| The median guesstimate had been for an increase. Industrial output slowed to 6.0% from 6.4%. Here too the median forecast had expected an acceleration. |

China Industrial Production YoY, Aug 2017(see more posts on China Industrial Production, ) Source: Investing.com - Click to enlarge |

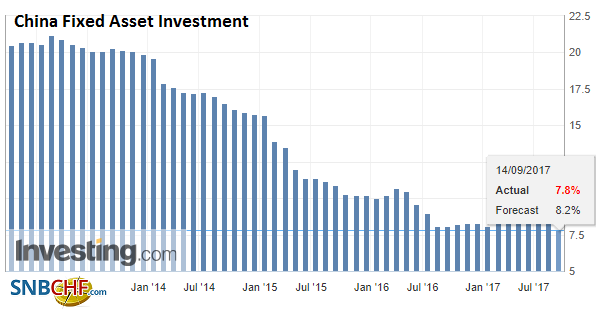

| Fixed investment slows more than expected to 7.8% from 8.3%. This (non-rural) investment figure is the lowest since before China joined the WTO in 2001. |

China Fixed Asset Investment YoY, Aug 2017(see more posts on China Fixed Asset Investment, ) Source: Investing.com - Click to enlarge |

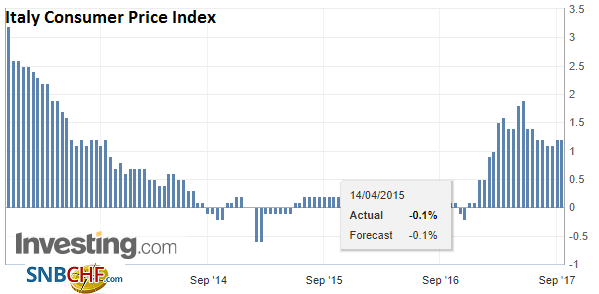

Italy |

Italy Consumer Price Index (CPI) YoY, Sep 2017(see more posts on Italy Consumer Price Index, ) Source: Investing.com - Click to enlarge |

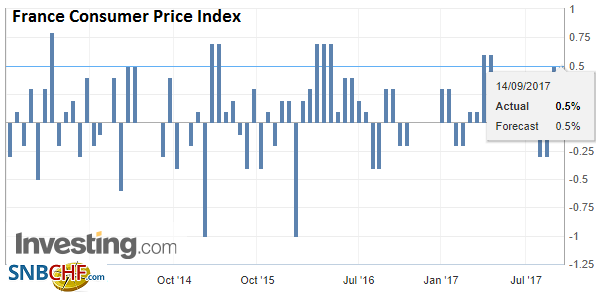

France |

France Consumer Price Index (CPI), Aug 2017(see more posts on France Consumer Price Index, ) Source: Investing.com - Click to enlarge |

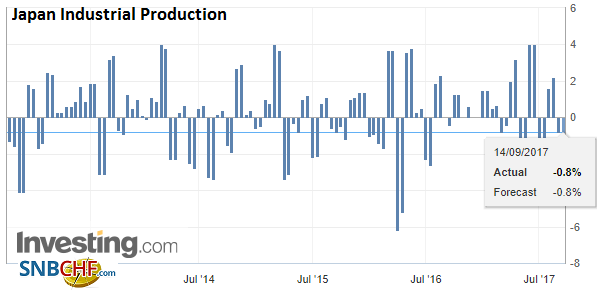

Japan |

Japan Industrial Production, Aug 2017(see more posts on Japan Industrial Production, ) Source: Investing.com - Click to enlarge |

The most impressive thing about Australia’s jobs report is not that it created more than 40k full-time positions. It is a volatile number and follows a loss of nearly 20k full-time positions in July. More striking was the fact that the participation rate rose to 65.3% from 65.1%, while the unemployment rate was unchanged at 5.6%. This may have helped the Australian dollar shrug off the weaker growth impulses from China.

The Bank of England meets today, but we do not see this as a major driver. No one expects a change in policy, even after the firmer than expected CPI reading earlier this week. The scope for surprise seems limited, but it could appear in the vote. Most expected a 7-2 vote, so a 6-3 vote would likely spur a quick pop higher in sterling. Sterling is the only major currency that is currently higher against the dollar this week (@ $1.3220).

There are some chunky options that expire later today that could impact the price action. There are options with a notional value of 1.1 bln euros that are struck at $1.19 that expire today. In the yen, options struck at JPY110.50 ($840 men) and JPY111.00 ($894) will be cut today. There are about A$1.8 bln options struck at $0.8010 that roll-off later today.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CNY,$JPY,China Fixed Asset Investment,China Industrial Production,China Retail Sales,EUR/CHF,Featured,France Consumer Price Index,Italy Consumer Price Index,Japan Industrial Production,newsletter,U.S. Consumer Price Index,U.S. Core Consumer Price Index,U.S. Initial Jobless Claims,USD/CHF