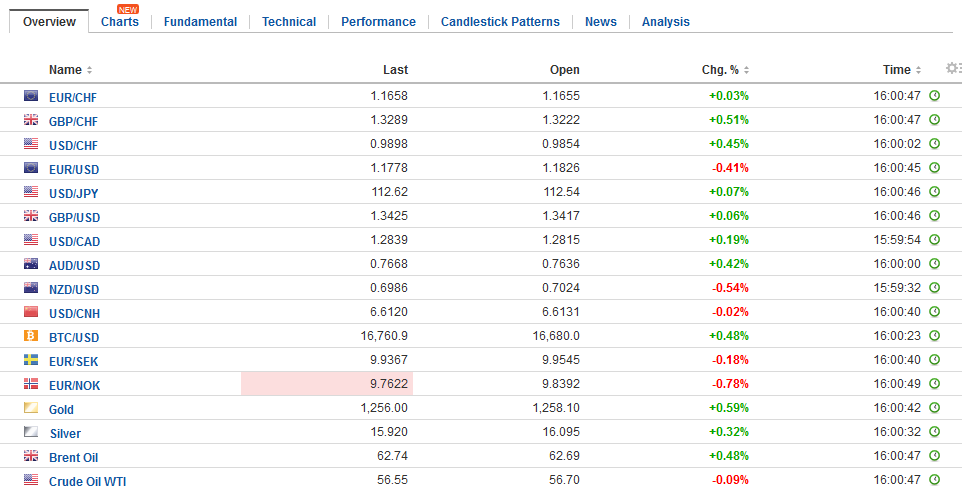

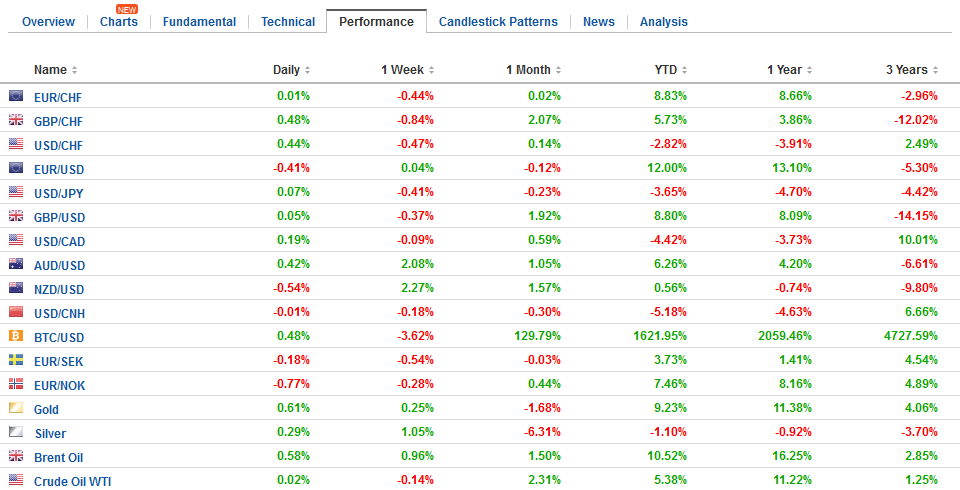

Swiss Franc The Euro has risen by 0.18% to 1.1673 CHF. EUR/CHF and USD/CHF, December 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates US interest rates have recovered the drop seen after the FOMC yesterday, but the dollar at best has been able to consolidate its losses and at worst, seen its losses extended. The Fed boosted its growth forecasts and lower unemployment forecasts. Yet its interest rate trajectory and inflation forecasts were largely unchanged. Yellen, as her recent predecessors have done, played down the implications of the flattening of the yield curve. The 2-10-year curve has flattened from about 135 bp at the start of the year to 57 bp currently.

Topics:

Marc Chandler considers the following as important: $CNY, China Fixed Asset Investment, China Industrial Production, China Retail Sales, EUR, EUR/CHF, Eurozone Manufacturing PMI, Eurozone Markit Composite PMI, Eurozone Services PMI, Featured, France Consumer Price Index, France Manufacturing PMI, France Services PMI, FX Trends, GBP, Germany Composite PMI, Germany Manufacturing PMI, Germany Services PMI, Japan Industrial Production, Japan Manufacturing PMI, newsletter, Spain Consumer Price Index, TLT, U.K. Retail Sales, U.S. Initial Jobless Claims, U.S. Manufacturing PMI, U.S. Retail Sales, U.S. Services PMI, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.18% to 1.1673 CHF. |

EUR/CHF and USD/CHF, December 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

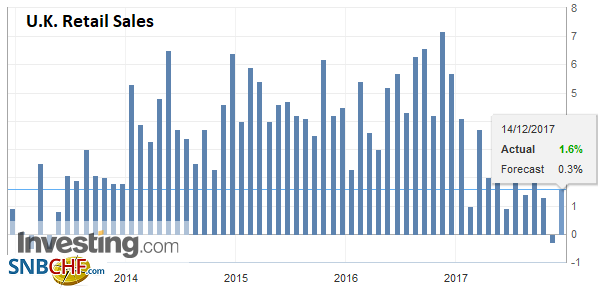

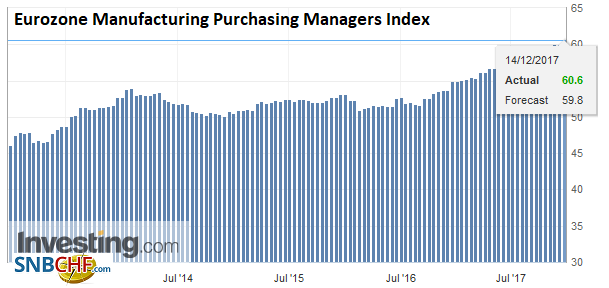

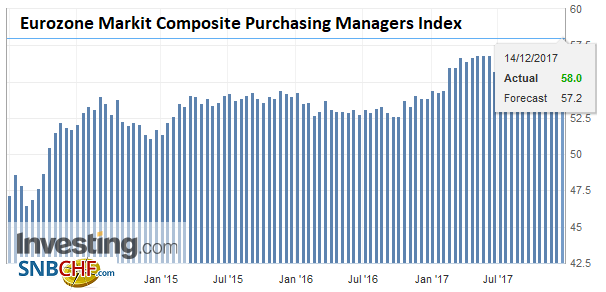

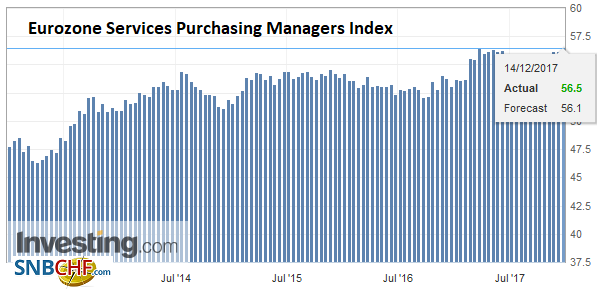

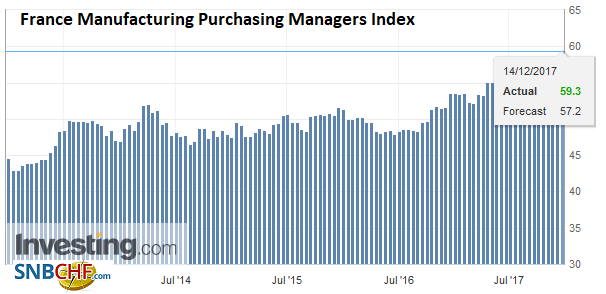

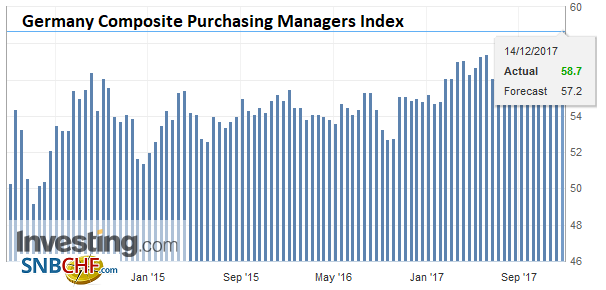

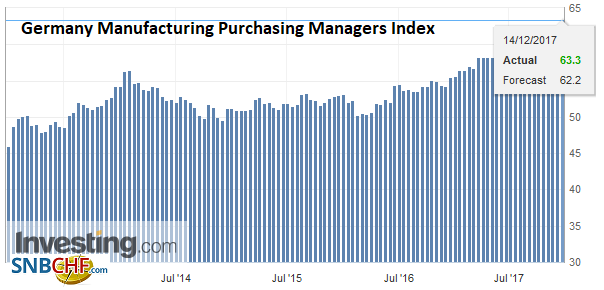

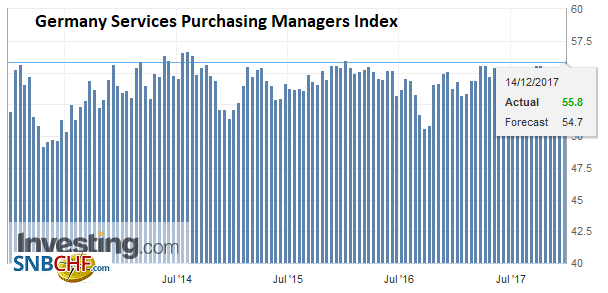

FX RatesUS interest rates have recovered the drop seen after the FOMC yesterday, but the dollar at best has been able to consolidate its losses and at worst, seen its losses extended. The Fed boosted its growth forecasts and lower unemployment forecasts. Yet its interest rate trajectory and inflation forecasts were largely unchanged. Yellen, as her recent predecessors have done, played down the implications of the flattening of the yield curve. The 2-10-year curve has flattened from about 135 bp at the start of the year to 57 bp currently. The flattening was a primarily the result of the two-year yield rising, driven in greater measure by Fed tightening, and a 10-year yield that is little changed. Also, importantly, while the Fed acknowledged that the fiscal stimulus may boost growth in the short-run, it does not appear to be the “economic miracle” that will boost growth potential, or trend growth. The focus is primarily on the ECB meeting today. Ahead of the meeting, the flash PMI for December showed that growth momentum is continuing, and will likely carry over into next year. The composite rose to 58.0 from 57.5, while the median in the Bloomberg survey expected a softer report. New orders were strong and the backlog increased. Employment gains were also reported. France reported a jump in manufacturing. It accelerated to 59.3. It was after 53.5 last December. German manufacturing rose (63.3 vs. 62.5), but it was the service sector that was most impressive, jumping to 58.7 from 57.3. |

FX Daily Rates, December 14 |

| Investors will likely focus on two elements of the ECB meeting. First, the ECB staff, whose forecasts often are more cautious than the EC and other bodies in which governments are represented, will likely revise up its growth forecasts and it may edge its inflation forecast higher. Faster growth means absorbing the economic slack sooner.

Second, while the ECB has signaled it will slow its asset purchases starting next month, it has not provided any insight into the composition. Will it simply cut all its purchases in half so the total falls to 30 bln euros a month from 60 bln? The corporate bond purchases program has come under scrutiny after one of the previously triple-A issues may fail. If the euro holds above the $1.1800 area, short-term participants will see it as a sign of an upside breakout and signaling another run to $1.20. A move above $1.1860 would bolster such views. Meanwhile, note that there are large option expires today. At $1.18 there is a billion-euro option struck and another 828 mln struck at $1.1820. Another option for 728 mln is struck at $1.1860. Two other central banks have already met today: the Swiss National Bank and Norway’s Norges Bank. The SNB left rates on hold, as universally anticipated, but also revised up growth and inflation forecasts. Ideas that the SNB will be a laggard in the normalization of monetary policy, and that Swiss franc will underperform the euro, some dollar bulls prefer to express their view against the franc rather than the euro. |

FX Performance, December 14 |

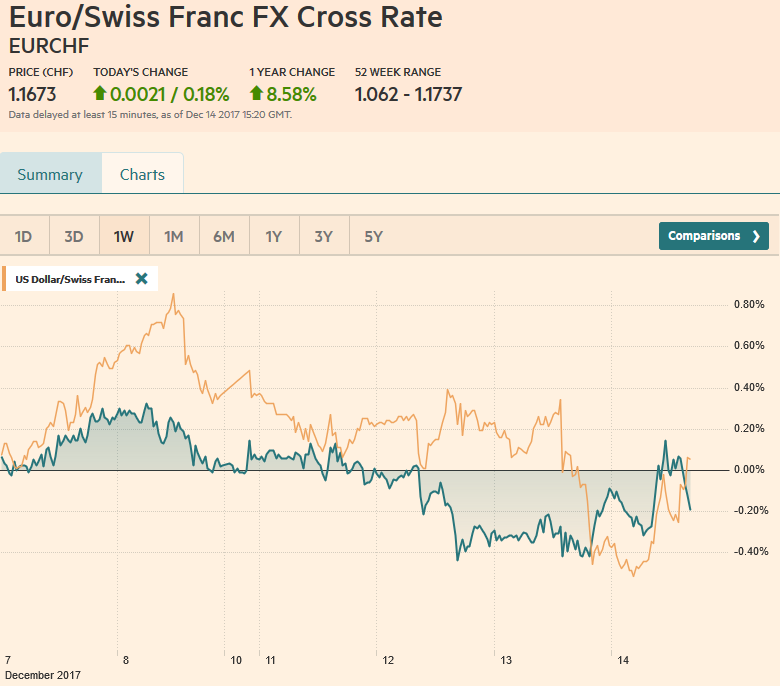

United KingdomThe Bank of England meets today. After raising rates last month, it is now on hold. A unanimous vote to this effect would not be surprising. This week’s economic news has been mixed. Inflation was a bit firmer in the headline measure but others were flat. While there were fewer people working, earnings growth ticked up. Today’s news showed that UK consumers are more resilient than expected. Retail sales jumped 1.1% and 1.2% excluding auto fuel. The median forecast was for a 0.4% increase, and to top it off, the October series was revised higher. Sterling closed above $1.3400 yesterday and has record the week’s high near $1.3465 today. Initial support is pegged in the $1.3380-$1.3400 area. The euro has been largely confined to a GBP0.8780-GBP0.8850 trading range this week. Sterling has held up well in the aftermath of the UK government’s defeat in Parliament yesterday. By a narrow majority, made possible by Troy members themselves wrested the final word on Brexit from the government. A vote on the final Brexit deal must be held before it is final. The government faces a similar defeat next week if it does not withdraw a clause in Brexit bill that specifies the exit date of the end March 2019. |

U.K. Retail Sales YoY, Nov 2017(see more posts on U.K. Retail Sales, ) Source: Investing.com - Click to enlarge |

EurozoneThe EU heads of state summit begins today. Some argue that yesterday’s vote leaves May at a negotiating disadvantage, but the parliaments in some other countries also must be consulted, and approve of agreements. |

Eurozone Manufacturing Purchasing Managers Index (PMI), Dec 2017(see more posts on Eurozone Manufacturing Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

| Recall what the Canadian trade agreement was almost scuppered because of one parliament. We have argued that the UK government seemed to be in denial about the EU’s position on Brexit, and it seems to be in denial of the fact that it lost its majority. |

Eurozone Markit Composite Purchasing Managers Index (PMI), Dec 2017(see more posts on Eurozone Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

| Rather than heel the fissures in the Tory Party over Europe, it has exposed and widened them, and now scar tissue of mistrust and recriminations is growing. |

Eurozone Services Purchasing Managers Index (PMI), Dec 2017(see more posts on Eurozone Services PMI, ) Source: Investing.com - Click to enlarge |

ChinaWe note that China’s central bank appears to have snugged policy. By that we mean edged rates slightly higher, but not an actual rate hike. |

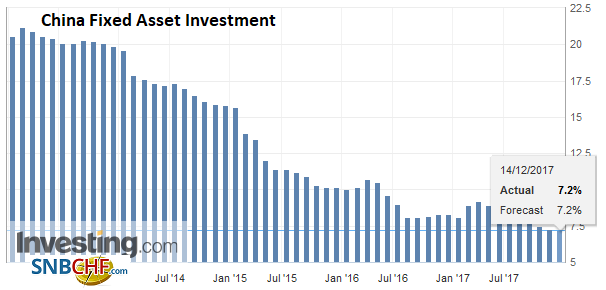

China Fixed Asset Investment YoY, Nov 2017(see more posts on China Fixed Asset Investment, ) Source: Investing.com - Click to enlarge |

| The PBOC increased the rate of its open-market operations and in its medium-term lending facility. The move appeared small-around five basis points. |

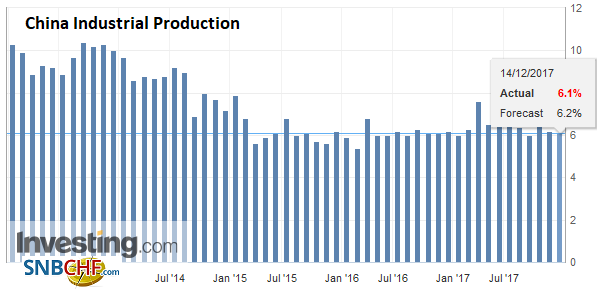

China Industrial Production YoY, Nov 2017(see more posts on China Industrial Production, ) Source: Investing.com - Click to enlarge |

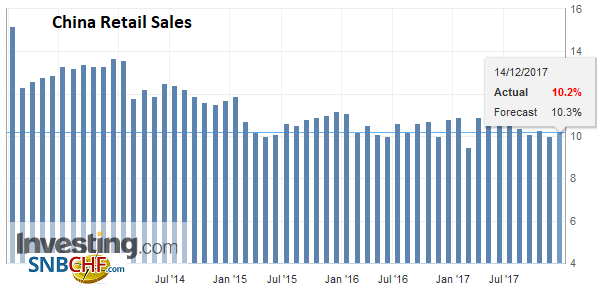

| The announcement on its website suggested the adjustment would help investors “form reasonable expectations for interest rates,” and discourage “excessive leverage.” Separately, China reported slightly slower industrial output and fixed asset investment, while retail sales rose (10.2% year-over-year from 10.0%). |

China Retail Sales YoY, Nov 2017(see more posts on China Retail Sales, ) Source: Investing.com - Click to enlarge |

Japan |

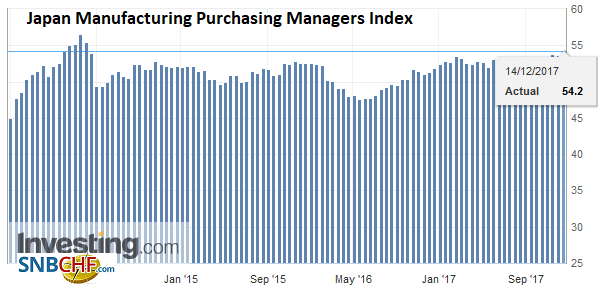

Japan Manufacturing Purchasing Managers Index (PMI), Dec 2017(see more posts on Japan Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

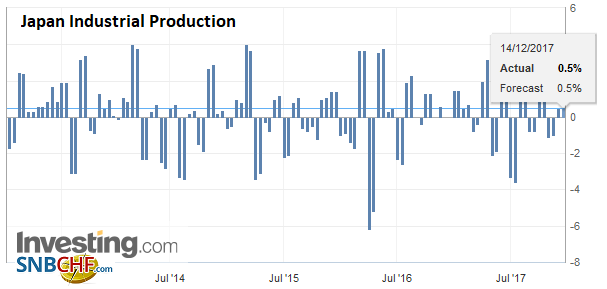

Japan Industrial Production, Nov 2017(see more posts on Japan Industrial Production, ) Source: Investing.com - Click to enlarge |

|

France |

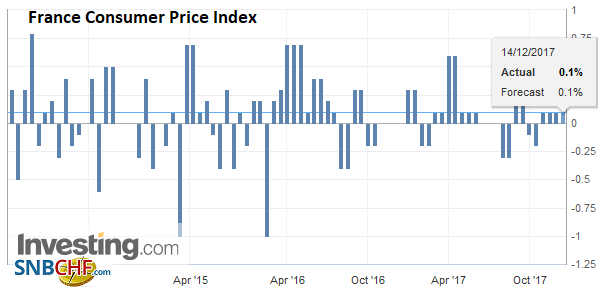

France Consumer Price Index (CPI), Nov 2017(see more posts on France Consumer Price Index, ) Source: Investing.com - Click to enlarge |

France Manufacturing Purchasing Managers Index (PMI), Dec 2017(see more posts on France Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

|

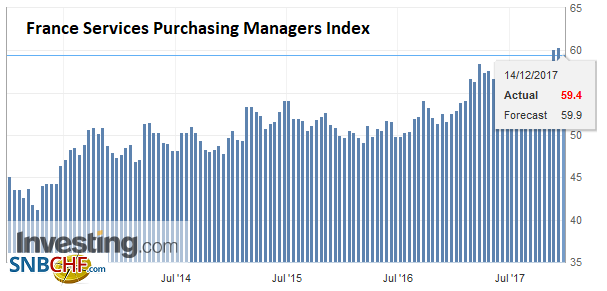

France Services Purchasing Managers Index (PMI), Dec 2017(see more posts on France Services PMI, ) Source: Investing.com - Click to enlarge |

|

Spain |

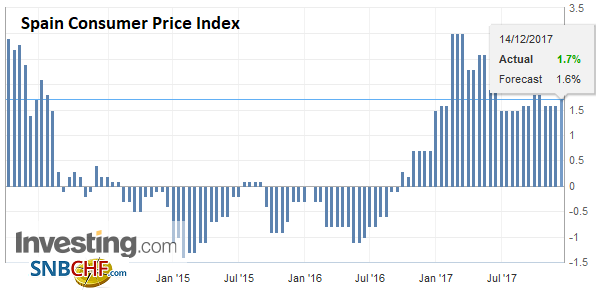

Spain Consumer Price Index (CPI) YoY, Nov 2017(see more posts on Spain Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Germany |

Germany Composite Purchasing Managers Index (PMI), Dec 2017(see more posts on Germany Composite PMI, ) Source: Investing.com - Click to enlarge |

Germany Manufacturing Purchasing Managers Index (PMI), Dec 2017(see more posts on Germany Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

|

Germany Services Purchasing Managers Index (PMI), Dec 2017(see more posts on Germany Services PMI, ) Source: Investing.com - Click to enlarge |

|

United States |

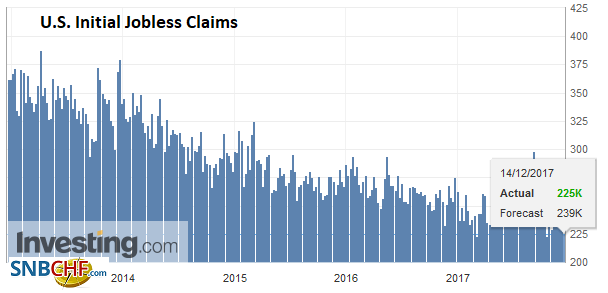

U.S. Initial Jobless Claims, 14 December(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

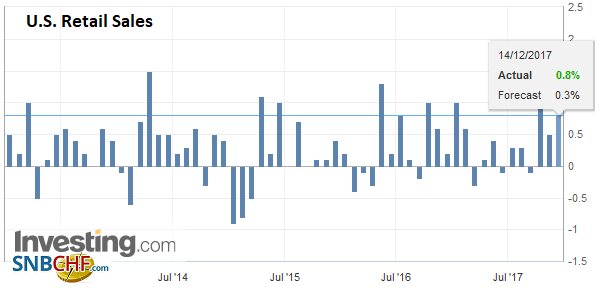

U.S. Retail Sales , Nov 2017(see more posts on U.S. Retail Sales, ) Source: Investing.com - Click to enlarge |

|

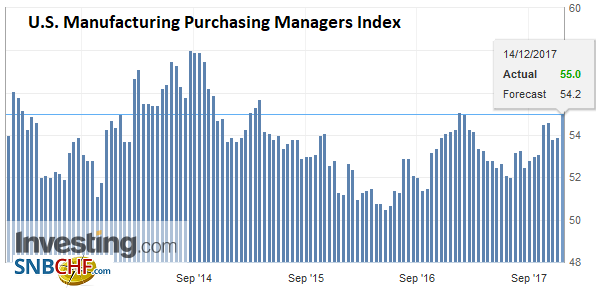

U.S. Manufacturing Purchasing Managers Index (PMI), Dec 2017(see more posts on U.S. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

|

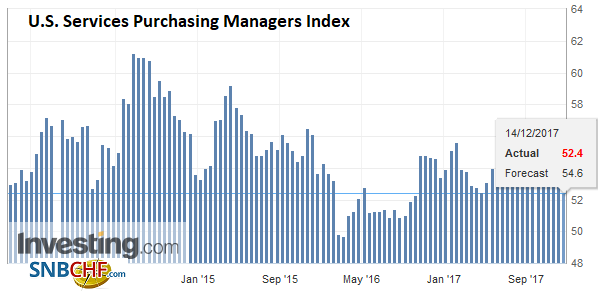

U.S. Services Purchasing Managers Index (PMI), Dec 2017(see more posts on U.S. Services PMI, ) Source: Investing.com - Click to enlarge |

The Norges Bank also left rates on hold, but it was a hawkish hold and the krone is the best performing major currency, up around 1% against the dollar and euro. The central bank suggested an early hike than anticipated in September may be needed on idea that growth is stronger and the output gap is smaller, while the krone is weaker. Those conditions, they expect, will lead to higher inflation and stronger wage growth.

Australia reported strong employment data. The 61.6k jobs created were three-times for than expected. It grew nearly 42k full -time positions in November after a revised 31k in October (from 24.3k). The participation rate jumped to 65.5%, but the unemployment rate was unchanged at 5.4%. Australian interest rates jumped on the news. Although Aussie two-year rates had dipped below similar US rates, that is not the case. A 9-10 bp premium is back in place. The Australian dollar’s advancing streak is extending for a fourth session. The next target is the $0.7700-$0.7740.

Among emerging market currencies, Asian currencies are mostly firmer. The South African rand and Mexican peso are nursing losses, while the Turkish lira has dropped 1.7%. Turkey’s central bank was expected to raise the late liquidity lending by 100 bp but only delivered a 50 bp hike. Asian equities edged higher. The MSCI Asia Pacific Index has advanced for the fifth time in six sessions. Europe equities, in contrast, are down for the third time this week. Benchmark 10-year yields are mostly higher. Italy has stabilized after yesterday jump in yields due to early election reports.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$CNY,$EUR,$TLT,China Fixed Asset Investment,China Industrial Production,China Retail Sales,EUR/CHF,Eurozone Manufacturing PMI,Eurozone Markit Composite PMI,Eurozone Services PMI,Featured,France Consumer Price Index,France Manufacturing PMI,France Services PMI,Germany Composite PMI,Germany Manufacturing PMI,Germany Services PMI,Japan Industrial Production,Japan Manufacturing PMI,newsletter,Spain Consumer Price Index,U.K. Retail Sales,U.S. Initial Jobless Claims,U.S. Manufacturing PMI,U.S. Retail Sales,U.S. Services PMI,USD/CHF