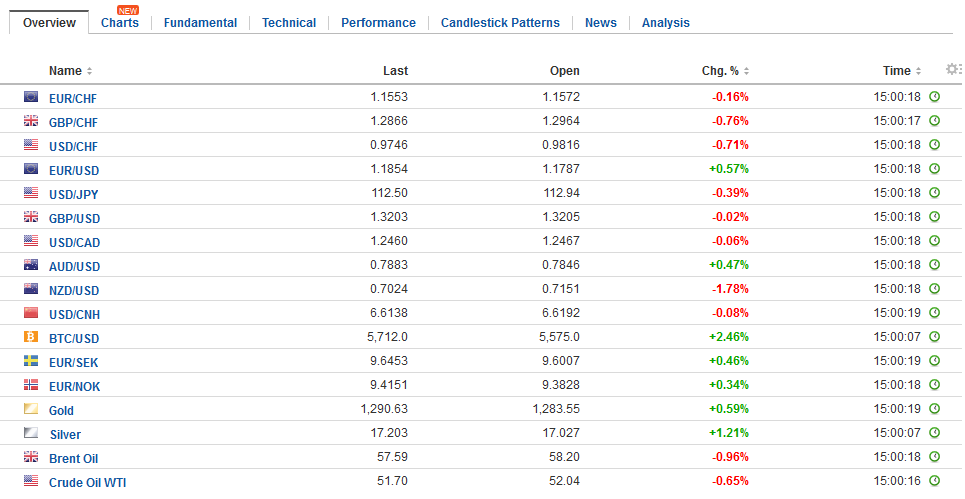

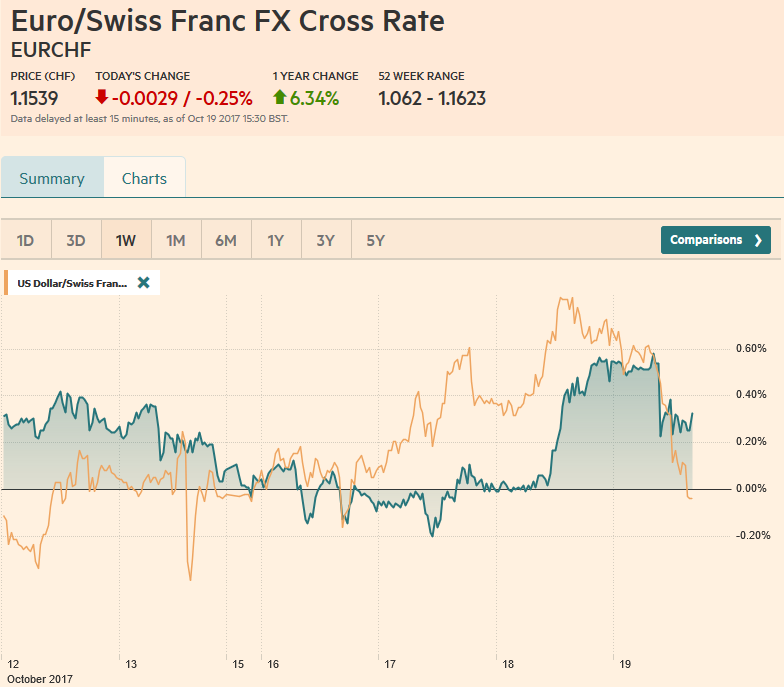

Swiss Franc The Euro has fallen by 0.25% to 1.1539 CHF. EUR/CHF and USD/CHF, October 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The 30th anniversary of the 1987 equity market crash the major US benchmarks at record highs. The drop in the market was at least partly a function of the lack of capacity, sufficient instruments, and regulatory regime. Each of these factors has been addressed to some extent. Circuit breakers have been introduced, and have evolved. The financial capacity has grown immensely. Sophisticated portfolio insurance, better hedging techniques, and tools are available. This most assuredly does not mean that equities cannot crash. Surely they

Topics:

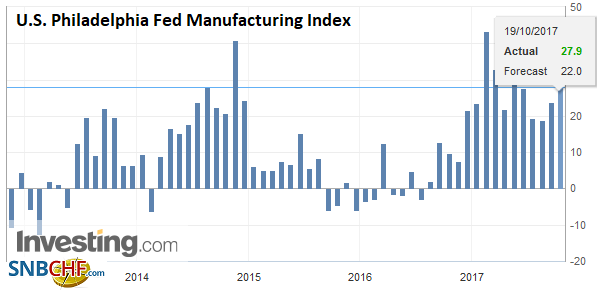

Marc Chandler considers the following as important: $CNY, China Fixed Asset Investment, China Gross Domestic Product, China Industrial Production, China Retail Sales, EUR, EUR/CHF, Featured, FX Trends, GBP, Japan Exports, Japan Imports, Japan Trade Balance, JPY, newslettersent, NZD, TLT, U.K. Retail Sales, U.S. Initial Jobless Claims, U.S. Philadelphia Fed Manufacturing Index, USD/CHF, Yuan

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has fallen by 0.25% to 1.1539 CHF. |

EUR/CHF and USD/CHF, October 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe 30th anniversary of the 1987 equity market crash the major US benchmarks at record highs. The drop in the market was at least partly a function of the lack of capacity, sufficient instruments, and regulatory regime. Each of these factors has been addressed to some extent. Circuit breakers have been introduced, and have evolved. The financial capacity has grown immensely. Sophisticated portfolio insurance, better hedging techniques, and tools are available. This most assuredly does not mean that equities cannot crash. Surely they can. How it does it, though can change. Meanwhile what concerns many investors now is not the market structure as much as valuation. In 1987, the bull market was five years old. The current bull market is eight years old and counting. Many investment managers have expressed concern about the stretched valuations, though the year-over-year growth in earnings is roughly matching the S&P 500 advance this year. At the same time, with the ECB and the BOJ buying up practically all new net issuance of sovereign bonds, and yields remaining low (with an estimated $3 trillion in negative yielding bonds), many investors see little alternative to risk assets, including stocks. |

FX Daily Rates, October 19 |

| Equities are trading heavier today. The MSCI Asia Pacific Index is off slightly but lowers for the third session, after the snapping an advancing streak that saw one down day from September 29-October 16. Japanese stocks advanced ahead of the weekend election in which the Abe’s Liberal Democrat Party may secure a larger majority than it has today. MOF data showed that foreign investors bought Japanese shares last week for the third consecutive week. Over the three weeks, foreigners purchased nearly JPY1.55 trillion of Japanese shares, the most in any three week period in two years, which itself was the most since at least 2001.

The euro is building on yesterday’s recovery. It traded a little above $1.1820 late Asian turnover. It initially fell on the Spanish news, spiking to $1.1770 before quickly rebounding. Today’s highs represent a 61.8% retracement of the loss from last week’s high. A push higher now targets those highs near $1.1880. |

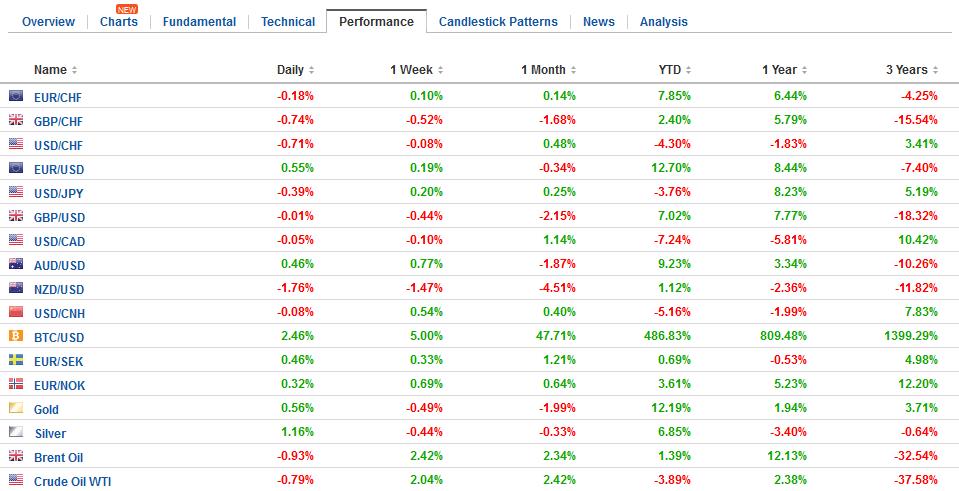

FX Performance, October 19 |

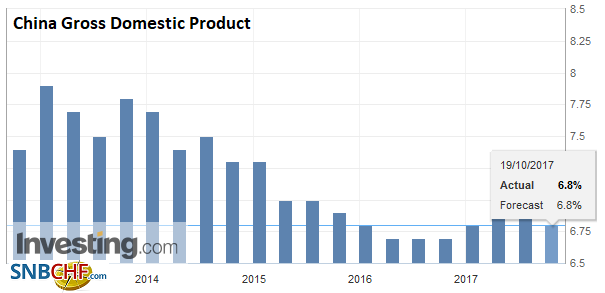

ChinaChinese shares fell, with the Shanghai Composite off 0.35%. Chinese data failed to impress. Q3 GDP expanded by 6.8% year-over-year, in line with expectations. That is a 1.7% quarterly advance. |

China Gross Domestic Product (GDP) YoY, Q3 2017(see more posts on China Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

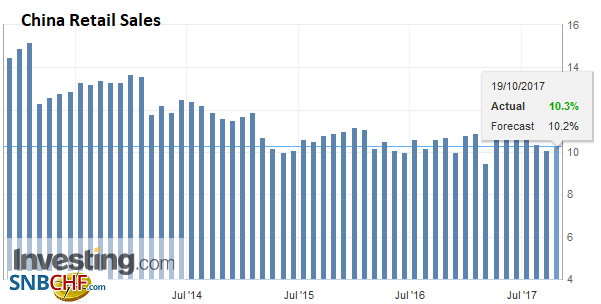

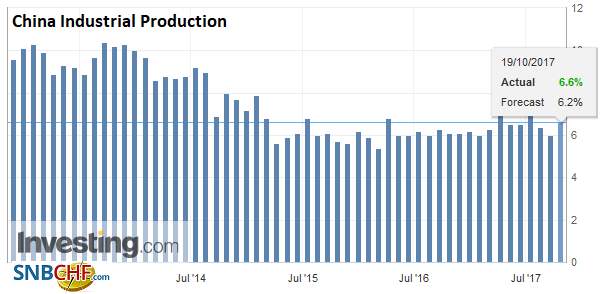

| It was supported by somewhat stronger retail sales (10.3% year-over-year) and industrial output (6.6% year-over-year). |

China Retail Sales YoY, Sep 2017(see more posts on China Retail Sales, ) Source: Investing.com - Click to enlarge |

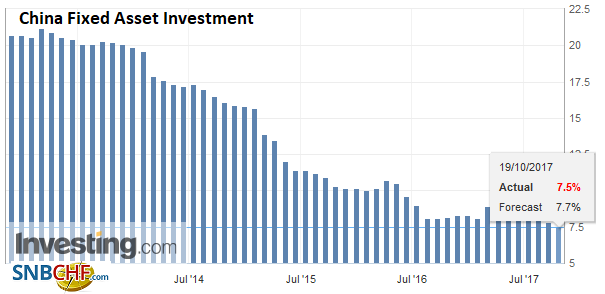

| Fixed investments slowed (7.5% vs. 7.8%). China reportedly created 10.97 mln jobs in the first three quarters, well on its way of meeting its 11 mln target. Consumption, which includes some government spending is estimated to 64.5% of China’s GDP. |

China Fixed Asset Investment YoY, Sep 2017(see more posts on China Fixed Asset Investment, ) Source: Investing.com - Click to enlarge |

| There were also some financial data reported. First, SWIFT reports the yuan shares of global payments stood at 1.85% in September down from 1.,94% in August. The share peaked in August 2015 near 2.80%. It has not been above 2% in a year or below 1.6%. Separately, fx settlements with the PBOC suggest China is experiencing capital inflows again. The CNY21.8 bln reported was the first positive reading since June 2015. |

China Industrial Production YoY, Sep 2017(see more posts on China Industrial Production, ) Source: Investing.com - Click to enlarge |

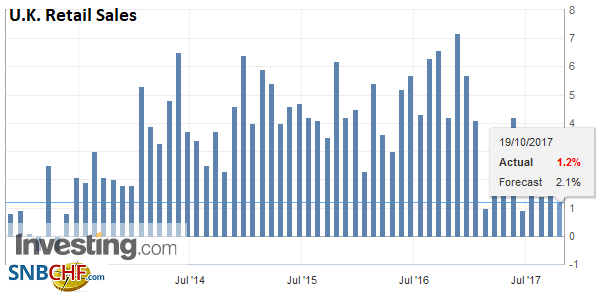

United KingdomDisappointing UK retail sales and more trouble for Prime Minister May is taking a toll on sterling. It has traded on both sides of yesterday’s range, but chart support near $1.3120 is holding, at least for the moment. A close below yesterday’s low (~$1.3140) would not look good. Retail sales fell 0.7% excluding auto fuel and 0.8% including it. The Bloomberg median forecast was for a 0.%-0.2% decline. Adding insult to injury, the August series was shaved in revision. Interest rate expectations have not changed. The December short-sterling futures contract is little changed and the OIS suggest more than an 80% chance of a November hike has been discounted. Separately, domestically May rejected a push by MPS in her own party to delay the rollout of the government’s welfare reform initiative. Instead, the help calls to the centers will be free (vs. estimated 55p per minute), and the process to receive an advance payment will be explained. The challenge is not a mortal blow to the Prime Minister, but it shows she is struggling since the June election. She is going to the EU Summit, but her plea to accelerate talks is unlikely to yield much in the way of results. The EU’s strategy may, in fact, be hammered out after May leaves the summit. |

U.K. Retail Sales YoY, Sep 2017(see more posts on U.K. Retail Sales, ) Source: Investing.com - Click to enlarge |

Japan |

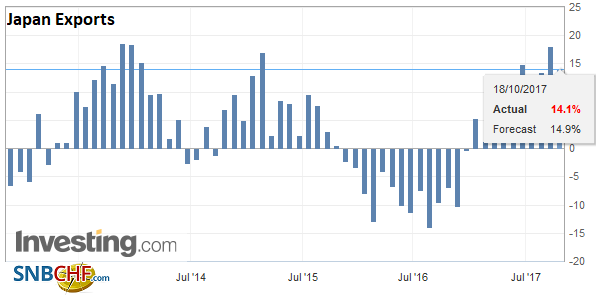

Japan Exports YoY, Sep 2017(see more posts on Japan Exports, ) Source: Investing.com - Click to enlarge |

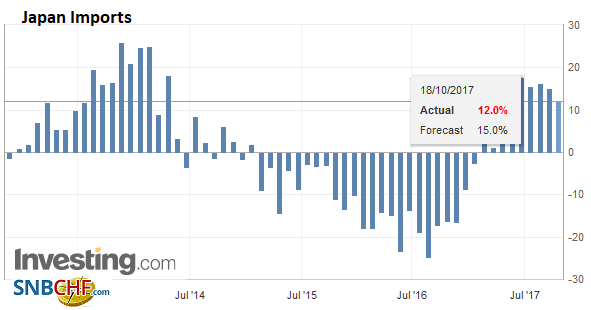

Japan Imports YoY, Sep 2017(see more posts on Japan Imports, ) Source: Investing.com - Click to enlarge |

|

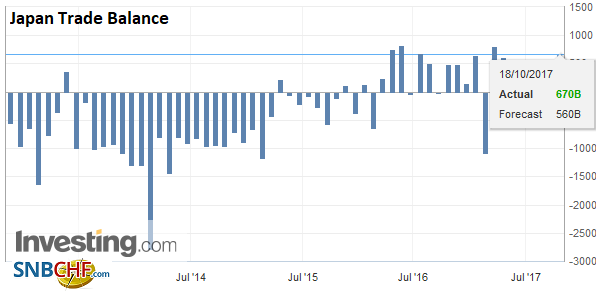

Japan Trade Balance, Sep 2017(see more posts on Japan Trade Balance, ) Source: Investing.com - Click to enlarge |

|

United States |

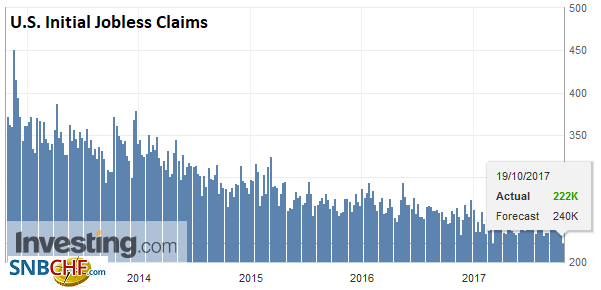

U.S. Initial Jobless Claims, Sep 2017(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

U.S. Philadelphia Fed Manufacturing Index, Oct 2017(see more posts on U.S. Philadelphia Fed Manufacturing Index, ) Source: Investing.com - Click to enlarge |

The New Zealand stocks market rose slightly. It gained for the 13th consecutive session. However, the currency is off 1.7% and has yet to stabilize following news that the nationalist New Zealand First party will form a coalition with Labour. The Kiwi is approaching the $0.7000 area, last seen in late-May. Today’s drop is the largest in a year. It peaked in late July near $0.7560. We want to give it a bit of time to see how policy shakes out, but we suspect the market will overshoot, creating an attractive opportunity to buy New Zealand dollars, backed by generally favorable fundamentals.

Separately, Australia reported employment data that was largely in line with market expectations. Australia created nearly 20k jobs, and the unemployment rate slipped to 5.5% from 5.6%. The Australian dollar is slightly firmer against the US dollar, but it is at new highs for the year against the Kiwi. It is approached NZD1.12 after reaching NZD1.09 a couple of days ago.

In Spain, Puigdemont has not backed down sufficiently for Madrid, and Prime Minister Rajoy is going forward to suspend Catalonia’s autonomy. The market has taken the move in stride. Spain’s 10-year yield is under a little pressure. The two basis point increase compares to one in Italy. Germany’s 10-year yield is flat at 39 bp. Spanish equities are lower (~-0.8%) but on par with Italy. This month Spanish shares are off almost 2%, while Italy is off 2.4%. Spain sold a little less than one bln euros of its 10-year bond. The bid to cover was 1.48 compared with 2.21 at the May auction, though the average yield was 1.124% compared with 0.777% in May.

Lastly, we note that Korea’s central bank kept rates on hold as widely expected. However, the general thrust was that the central bank was more hawkish than expected. One board member dissented. The central bank increased the forecast for growth this year to 3% (previously 2.8%). Exports are strong, and consumer prices are above the central bank’s 2% target for three months running. The Korean won weakened by 0.2%, reversing yesterday’s gain.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,$CNY,$EUR,$JPY,$TLT,China Fixed Asset Investment,China Gross Domestic Product,China Industrial Production,China Retail Sales,EUR/CHF,Featured,Japan Exports,Japan Imports,Japan Trade Balance,newslettersent,NZD,U.K. Retail Sales,U.S. Initial Jobless Claims,U.S. Philadelphia Fed Manufacturing Index,USD/CHF,yuan