There is quite an unusual price context for new week’s economic events, which include June US CPI, retail sales, and industrial production, along with China’s Q2 GDP, and the meetings for the Reserve Bank of New Zealand, the Bank of Canada, and the Bank of Japan. In addition, the US Treasury will sell $120 bln in coupons while the US earned income tax credit and the child tax credit is rolled out. The dollar surged even while interest rates fell. The US 10-year yield...

Read More »FX Daily, June 18: Markets Quiet Ahead of Triple Witching

Swiss Franc The Euro has risen by 0.14% to 1.0936 EUR/CHF and USD/CHF, June 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After some dramatic moves over in the immediate post-Fed period, the markets have quieted. The kind of volatility that is sometimes associated with triple witching expirations in the US may have already taken place. Asia Pacific equities were mixed, but the MSCI benchmark finished with...

Read More »FX Daily, April 27: Markets Mark Time Ahead of Fed

Swiss Franc The Euro is stable at 0.00% to 1.1041 EUR/CHF and USD/CHF, April 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Short-covering ahead of the FOMC’s outcome tomorrow appears to be lending the US dollar support today. It has extended yesterday’s gains against the euro, sterling, and yen. Among emerging market currencies, the Turkish lira, along with the South Korean won and Taiwanese dollar, lead...

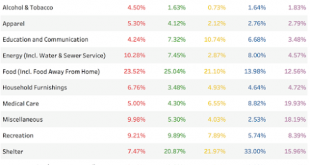

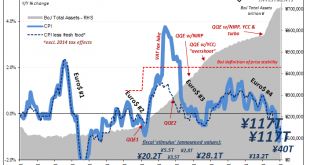

Read More »Nine Percent of GDP Fiscal, Ha! Try Forty

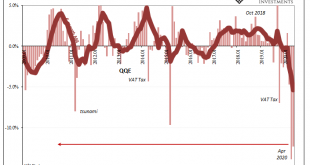

Fear of the ultra-inflationary aspects of fiscal overdrive. This is the current message, but according to what basis? Bigger is better, therefore if the last one didn’t work then the much larger next one absolutely will. So long as you forget there was a last one and when that prior version had been announced it was also given the same benefit of the doubt. Most people don’t like looking to Japan mainly because it is too depressing; unless one is an Economist who...

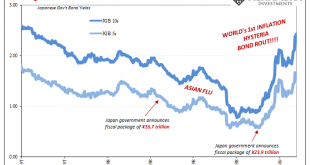

Read More »They’ve Gone Too Far (or have they?)

Between November 1998 and February 1999, Japan’s government bond (JGB) market was utterly decimated. You want to find an historical example of a real bond rout (no caps nor exclamations necessary), take a look at what happened during those three exhilarating (if you were a government official) months. The JGB 10-year yield had dropped to a low of just 77.2 bps during the depths of 1998’s Asian Financial Crisis (or “flu”, so noted for its regional contagious dollar...

Read More »FX Daily. October 29: Markets Continue to Struggle

Swiss Franc The Euro has fallen by 0.11% to 1.0681 EUR/CHF and USD/CHF, October 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The spreading virus that is shutting down large parts of Europe, while the US is reluctant to return to lockdowns and refuses to have a nationwide requirement for masks in public hit risk assets yesterday. The S&P posted its largest decline in four-months yesterday (~3.5%), and...

Read More »FX Daily, October 20: Narrowly Mixed Markets as Clearer Direction Sought

Swiss Franc The Euro has risen by 0.11% to 1.0721 EUR/CHF and USD/CHF, October 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets lack a clear direction today. This is reflected in narrowly mixed equities, bonds, and currencies. The spreading contagion is giving rise to new economic concerns, among other things, and the UK-EU talks are struggling to resume, while Pelosi-Mnuchin talks in the...

Read More »Reopening Inertia, Asian Dollar Style (Still Waiting On The Crash)

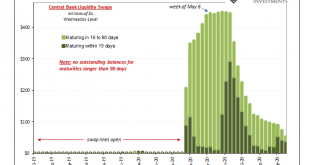

Why are there still outstanding dollar swap balances? It is the middle of September, for cryin’ out loud, and the Federal Reserve reports $52.3 billion remains on its books as of yesterday. Six months after Jay Powell conducted what he called a “flood”, with every financial media outlet reporting as fact this stream of digital dollars into every corner of the world, how can there be anything greater than zero in overseas liquidity swaps? Six months is an eternity....

Read More »FX Daily, September 17: Powell Lets Steam Out of Equities and Spurs Dollar Short-Covering

Swiss Franc The Euro has risen by 0.02% to 1.0743 EUR/CHF and USD/CHF, September 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Profit-taking after the FOMC meeting saw US equities and gold sell-off. The high degree of uncertainty without fresh stimulus did not win investors’ confidence. The Fed signaled rates would likely not be hiked for the next three years, and without additional measures, that appears...

Read More »Looking Ahead Through Japan

After the Diamond Princess cruise ship docked in Tokyo with tales seemingly spun from some sci-fi disaster movie, all eyes turned to Japan. Cruisers had boarded the vacation vessel in Yokohama on January 20 already knowing that there was something bad going on in China’s Wuhan. The big ship would head out anyway for a fourteen-day tour of Vietnam, Taiwan, and, yes, China. Three days in, news reached the Diamond that the Communists had closed down the affected region....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org