Overview: Most equity markets in the Asia Pacific region lost ground today. China’s Shenzhen, Hong Kong, and India were notable exceptions. The MSCI Asia Pacific Index is at its lowest level since June 2020. Europe’s Stoxx 600 is forging a base ahead of 4000 and is trading quietly with a small upside bias. The French stock market lagging after Macron lost his parliamentary majority, is raising questions about his reform agenda. US equity futures are firm, but the...

Read More »Prospects of Aggressive Tightening Sends Shock Waves through the Capital Markets

Overview: The markets' evolving expectations of a more aggressive monetary policy is not limited to the Federal Reserve, where the terminal rate is now straddling the 4% area, around 100 bp above late May levels. Consider that on May 31, the swaps market saw the key rate in the eurozone finishing the year at 60 bp. It has risen by more than 40 bp in the past four sessions. The UK expectedly reported the second consecutive monthly contraction in GDP, and still there...

Read More »Dollar Jumps, Stocks and Bonds Slide

Overview: The prospect of a more aggressive Federal Reserve policy has spurred a sharp sell-off in global equities and bonds and sent the dollar sharply higher. The large Asia Pacific bourses were off mostly 2%-4%. Europe’s Stoxx 600 is off 2.2%, its fifth consecutive losing session. US futures are off also. The NASDAQ was down 3.5% before the weekend and the S&P 500 fell 2.9%. The dollar rocks. The Scandis and Antipodean currencies are bearing the brunt and are...

Read More »Fed 50, BOE 25, and the BOJ to Stand Pat: Week Ahead

Three G7 central banks meet in the coming days, and they dominate the macro stage. The Federal Reserve's meeting concludes on Wednesday, the Bank of England on Thursday, and the Bank of Japan on Friday. The market recognizes a strong consensus has emerged at the FOMC for 50 bp hikes in June, but the unexpectedly strong CPI report before the weekend saw the market price in about a 50% chance of a 75 bp hike in July. Some Fed officials have been understandably...

Read More »No Pandemic. Not Rate Hikes. Doesn’t Matter Interest Rates. Just Globally Synchronized.

The fact that German retail sales crashed so much in April 2022 is significant for a couple reasons. First, it more than suggests something is wrong with Germany, and not just some run-of-the-mill hiccup. Second, because it was this April rather than last April or last summer, you can’t blame COVID this time. Something else is going on. . In America, the Fed Cult is out to take credit for this brewing downturn (Jay Powell seeking his place alongside Volcker, which...

Read More »US Jobs, EMU CPI, Japan’s Tankan, and China’s PMI Highlight the Week Ahead

This year was supposed to be about the easing of the pandemic and the normalization of policy. Instead, Russia's invasion of Ukraine threw a wrench in the macroeconomic forecasts as St. Peter’s victories broke the brackets of the NCAA basketball championship pools. The war has pushed up the price of energy, metals, and foodstuffs, which seemed to be advancing prior to the conflict. High-frequency economic data are important because of the insight generated about...

Read More »The Week Winds Down with Equities under Pressure and the Dollar Mostly Firmer

Overview: The combination of the volatility and a large number of central bank meetings have exhausted market participants, and the holiday phase appears to have begun. Equities are under pressure following the sell-off yesterday in the US. Japan, China, and Hong Kong suffered more than 1.2% losses, while Australia, South Korea, and Taiwan posted minor gains. It was the fifth loss in the past six sessions for the MSCI Asia Pacific Index. Europe's Stoxx 600 is off...

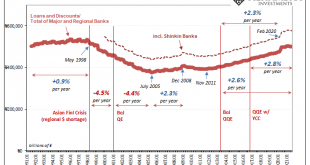

Read More »You Don’t Have To Take My Word For It About Eliminating QE

You don’t have to take my word for it. QE doesn’t work and it never has. That’s not just my assessment, pull out any chart of interest rates for wherever gets the misfortune of having been wasted with one of these LSAP’s. If none handy, then just read what officials and central bankers write about their own programs (or those of their close and affectionate counterparts). After nearly a decade of Abenomics in Japan, the latest Japanese Prime Minister Fumio Kishida...

Read More »What to Expect When You are Expecting

Overview: The markets have stabilized since Monday's panic attack but have not made much headway. China and Taiwan returned from the extended holiday weekend. Mainland shares were mixed. Shanghai rose by about 0.4%, while Shenzhen fell by around 0.25%. Taiwan got tagged for 2%, and Japan's Topix was off 1%. Hong Kong and South Korean markets were closed. Europe's Dow Jones Stoxx 600 is firmer for the second day but is still lower for the week. US indices...

Read More »FX Daily, July 16: BOJ Tweaks Forecasts

Swiss Franc The Euro has risen by 0.10% to 1.085 EUR/CHF and USD/CHF, July 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The markets head into the weekend with little fanfare. Most large equity markets in the Asia Pacific region slipped earlier today. Hong Kong, which will be exempt from the need to secure mainland’s cybersecurity approval for foreign IPOs, and Australia were notable exceptions. European...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org