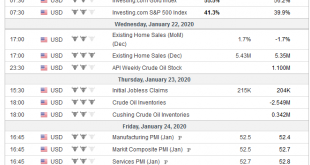

The US dominated the news stream at the start of 2020. The spasm in the US-Iran confrontation has quickly subsided. The much-heralded US-China Phase 1 trade deal has been signed. The US has completed the ratification process of the US Mexico Canada Free-Trade Agreement. The early signs from the economic entrails suggest the world’s largest economy continue to enjoy a record-long, even if not robust, expansion. The focus shifts elsewhere in the week ahead,...

Read More »FX Daily, December 19: Whiff of Inflation in the Air

Swiss Franc The Euro has risen by 0.01% to 1.0893 EUR/CHF and USD/CHF, December 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It is risky to read too much into the price action in holiday-thin markets, but inflation fears are beginning to surface. The price of January WTI is around $61, having tested $50 a barrel in Q3. The CRB Index made new highs for the year yesterday and is up almost 9% for the year....

Read More »FX Weekly Preview: Central Bank Meetings and Flash PMI Reports, but its Over except for the Shouting

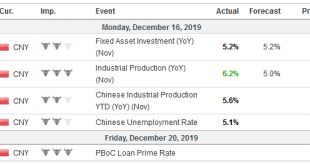

After last week’s flurry of events, market activity is set to slow over the next three weeks. But what a flurry of events it was. A new NAFTA apparently has been agreed, and it is set to be approved by the US House of Representatives next week and the Senate early next year. The US and China struck an agreement that will get rid of the immediate tariff threat and unwind half of the punitive tariffs in exchange for a commitment to buy twice the amount of agriculture...

Read More »FX Daily, October 31: No Good Deed Goes Unpunished

Swiss Franc The Euro has fallen by 0.32% to 1.0993 EUR/CHF and USD/CHF, October 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The equity and bond rally in North America yesterday carried over into today’s session. With some notable exceptions, like China, Taiwan, Australia, and Indonesia, most bourses in Asia Pacific and Europe traded higher. US shares are little changed in early Europe after the S&P...

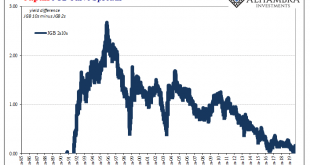

Read More »Why The Japanese Are Suddenly Messing With YCC

While the world’s attention was fixated on US$ repo for once, the Bank of Japan held a policy meeting and turned in an even more “dovish” performance. Likely the global central bank plan had been to combine the Fed’s second rate cut with what amounted to a simultaneous Japanese pledge for more “stimulus” in October. Both of those followed closely an ECB which got itself back in the QE business once more. But all that likely coordinated “accommodation” was spoiled...

Read More »ISM Spoils The Bond Rout!!!

With China closed for its National Day Golden Week holiday, the stage was set for Japan to steal the market spotlight. If only briefly. The Bank of Japan announced last night that it had had enough of the JGB curve. The 2s10s very nearly inverted last month and BoJ officials released preliminary plans to steepen it back out. Japan’s central bank says that it might refrain from buying JGB’s at the long end. This is upside down from when YCC was first attached to QQE...

Read More »FX Weekly Preview: Six Things to Watch in the Week Ahead

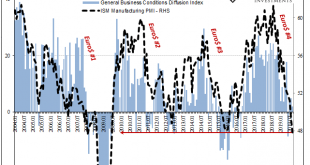

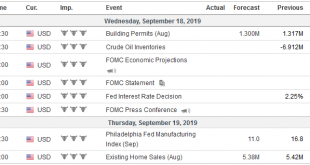

The prospect of a third trade truce between the US and China helped underpin the optimism that extended the rally in equities. Bond yields continued to back-up after dropping precipitously in August, led by a more than 30 bp increase in the US yield benchmark. The Dollar Index fell for the second consecutive week, something it had not done this quarter. United States The Federal Reserve’s meeting on September 18 is the most important calendar event in the week...

Read More »BoJ stays put amid economic headwinds

Japan’s central bank has little room for further easing despite a downbeat outlook. At its monetary policy meeting on 30 July, the Bank of Japan (BoJ) decided to keep its monetary policy unchanged, as expected. The decision came as the Japanese economy faces strong external headwinds and a downbeat outlook for domestic demand. However, we do not expect the BoJ to make any changes to its current monetary easing...

Read More »BoJ stays put amid economic headwinds

Japan's central bank has little room for further easing despite a downbeat outlook.At its monetary policy meeting on 30 July, the Bank of Japan (BoJ) decided to keep its monetary policy unchanged, as expected. The decision came as the Japanese economy faces strong external headwinds and a downbeat outlook for domestic demand.However, we do not expect the BoJ to make any changes to its current monetary easing framework until H1 2020 as it has probably reached the limit of its easing capacity....

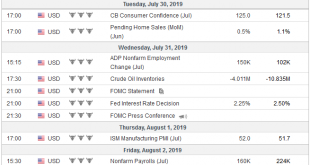

Read More »FX Weekly Preview: The FOMC and US Jobs Headline the Week Ahead

There is little doubt that the Federal Reserve will ease monetary policy at the conclusion of the FOMC meeting on July 31. We never thought the chances of a 50 bp move were anything but negligible, though even at this late stage, the market appears to be pricing in about a one-in-five chance. Although a minority, and maybe worth a dissent or two (Rosengren? George?), we are sympathetic to those Fed officials that do not...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org