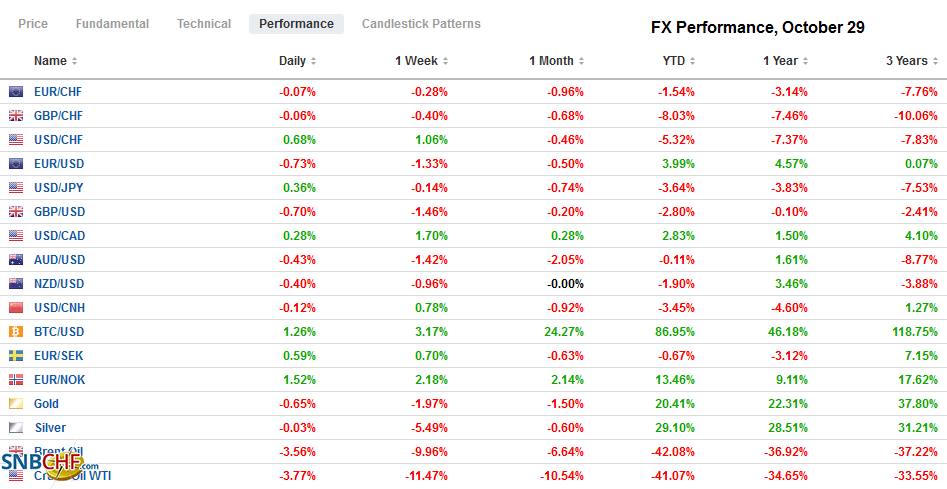

Swiss Franc The Euro has fallen by 0.11% to 1.0681 EUR/CHF and USD/CHF, October 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The spreading virus that is shutting down large parts of Europe, while the US is reluctant to return to lockdowns and refuses to have a nationwide requirement for masks in public hit risk assets yesterday. The S&P posted its largest decline in four-months yesterday (~3.5%), and the selling carried into the Asia Pacific region. Most bourses fell, led by the 1.6% slide in Australia and Taiwan’s 1% fall. Chinese markets were more resilient and posted modest gains. Around 970 Chinese companies reported earnings today, and most appear to be reporting sequential improvement. The Dow

Topics:

Marc Chandler considers the following as important: $CNY, 4.) Marc to Market, 4) FX Trends, Bank of Canada, Bank of Japan, Currency Movement, ECB, Featured, Japan, newsletter, Oil, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.11% to 1.0681 |

EUR/CHF and USD/CHF, October 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The spreading virus that is shutting down large parts of Europe, while the US is reluctant to return to lockdowns and refuses to have a nationwide requirement for masks in public hit risk assets yesterday. The S&P posted its largest decline in four-months yesterday (~3.5%), and the selling carried into the Asia Pacific region. Most bourses fell, led by the 1.6% slide in Australia and Taiwan’s 1% fall. Chinese markets were more resilient and posted modest gains. Around 970 Chinese companies reported earnings today, and most appear to be reporting sequential improvement. The Dow Jones Stoxx 600 dropped almost 3% yesterday, but today is trying to snap a three-day 5.7% slide that brought it to five-month lows. It rose by about 0.5% in early dealing. The S&P 500 gapped lower yesterday and settled on its lows. US shares are trading firmer, and yesterday’s gap (~3342.5-33888.7) is important from a technical perspective. Bond yields are slightly lower in Europe today. Italy sold a 10-year bond at a record low rate today (~0.23% and oversubscribed). The US 10-year Treasury yield is about 0.78%, having settled last week near 0.84%. The greenback is mostly firmer, though the yen and British pound are firm. Most European currencies are softer, ahead of the ECB meeting outcome. Emerging market currencies are heavier, and the Turkish lira remains offered near the record lows seen yesterday. The JP Morgan Emerging Market Currency Index struggles to sustain even modest upticks after falling in the first three sessions this week. Gold became nearly $31 an ounce less precious yesterday as it fell to new lows for the month (~$1869.5) and has steadied today, but uninspiringly so and has struggled to rise above $1885. December WTI fell within a few cents of its month low, a little below $37 a barrel yesterday, and is pushing near $36 now, a new four-month low. Rising US inventories and amid demand worries spurred by the virus are weighing on prices, and the next target is near $35. |

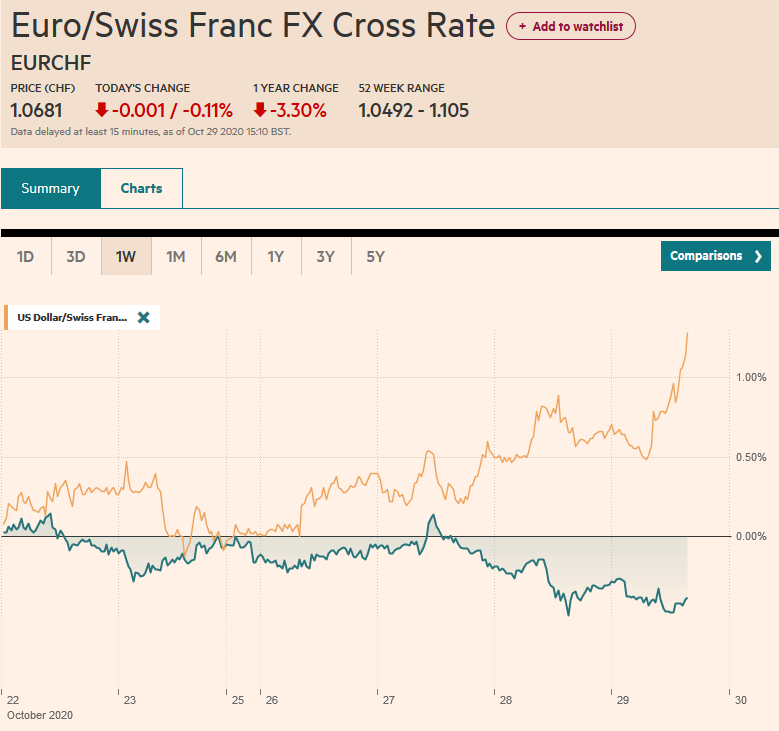

FX Performance, October 29 |

Asia PacificJapan is in the spotlight today. First, the BOJ meeting concluded, and as widely expected, there was no change in rates or asset purchases. It did tweak its economic forecasts. Growth in the current fiscal year was downgraded to -5.5% from -4.7%, which is closer to the market and the IMF’s new projections. However, growth in the next fiscal year was adjusted to 3.6% from 3.3%. According to the Bloomberg survey, that still is a bit optimistic, which sees a 2.5% expansion and the IMF at 2.3%. The BOJ shaved its core CPI forecast to -0.6% from -0.5% this fiscal year and shifted it into the next fiscal year (0.4% vs0.3%). |

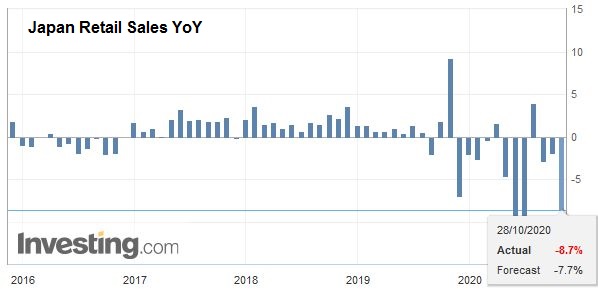

Japan Retail Sales YoY, September 2020(see more posts on Japan Retail Sales, ) Source: investing.com - Click to enlarge |

The surprise from Japan today was not the BOJ, but the September retail sales report. Although retail sales jumped 4.6% in August, economists had forecast a 1% gain in September (median forecast in the Bloomberg survey). Instead, they unexpectedly slipped by 0.1%. Adversely impacted by last October’s sales tax increase, retail sales had been weak prior to the pandemic. The government’s cash payments and pent-up consumer demand appeared to have been exhausted. Rather than fresh monetary moves to support the economy, the onus is on the Suga government, and a third supplemental budget is expected to be announced next month. Prime Minister Suga is opposed to unwinding the controversial sales tax increase.

Market participants are still digesting the implication of the PBOC’s decision to drop the counter-cyclical component of the reference rate. The other two components are the official close of the onshore market and the other major currencies’ subsequent price action. The counter-cyclical component was a proverbial black-box, but the net impact was to smooth out the yuan’s movement. With it gone, there is a risk that the currency becomes more volatile, which may a policy objective as a way to encourage Chinese businesses to develop, in many cases, more sophisticated hedging capabilities. It may alter the calculus in choosing to hedge either in forward or the options market. Three-month implied volatility rose above 6.5% for the first time this year today. It began the year a little below 4.5%.

The dollar’s bounces after testing support near JPY104 have become smaller and less impressive. After reaching about JPY104.10 yesterday, the greenback’s upticks stalled at JPY104.50. There are large options at JPY104, with $1.8 bln expiring today and $1.3 bln tomorrow. On the upside, a $385 mln option at JPY104.50 expires today, and $2.4 bln in options expire there tomorrow. The Australian dollar’s upticks in the Asia Pacific time zone that carried it to $0.7075 were reversed in early European turnover. The Aussie returned toward yesterday’s low (~$0.7040). A break sets up a test on the $0.7000, which has not been violated in three months. The PBOJ set the dollar’s reference rate at CNY6.7260, which was stronger than yesterday’s fix (CNY6.7195) and slightly higher than the bank models projected (~CNY6.7235). In trading, the dollar surrendered most of yesterday’s gains against the yuan and is back below CNY6.71.

EuropeThe ECB meets today. The virus is surging, and new restrictions for at least a month have been announced in many, including Germany, France, Italy, Spain, and Ireland. As a rough rule of thumb, a month may shave around half a percentage point off quarterly growth. Lagarde is expected to respond with assurances that the ECB can and will do more. There has been some late talk that the ECB could move today, but this does not appear to be particularly likely. It can still step up its bond purchases, and the main hurdle is not interest rates or financial conditions. A surprise move today on rates or extending asset purchases could spur a test on the $1.16 area, the lower end of the euro’s three-month range. |

Germany Consumer Price Index (CPI) YoY, October 2020(see more posts on Germany Consumer Price Index, ) Source: investing.com - Click to enlarge |

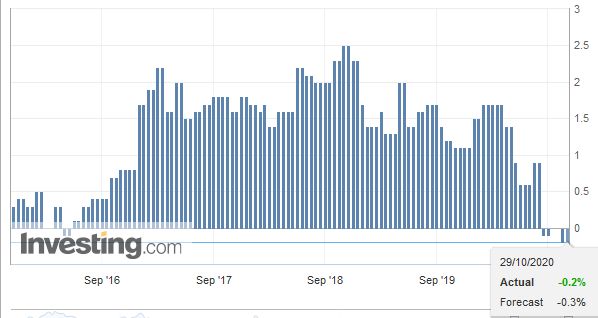

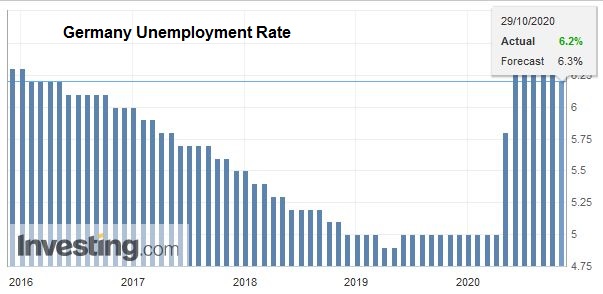

| The pandemic and policy response means that much of the high-frequency data may be dated. For example, Germany reported that its unemployment rate unexpectedly slipped to 6.2% from 6.3% in September. The states have been reporting October CPI, and the national figure will be released later today. A flat showing on the month would keep the year-over-year pace around September’s -0.4%. Spain’s deflation deepened in October as the EU-harmonized measure rose by 0.3% on the month, but fell 1.0% from a year ago, which was more than expected (~-0.7%) and the most in four years. Tomorrow the first estimate of Q3 GDP for the eurozone is due. The Bloomberg survey’s median forecast sees a 9.6% quarterly expansion after an 11.8% contraction in Q2. The eurozone also publishes September unemployment and October CPI. Unemployment may tick up from 8.1% in August, while headline and core CPI are expected to be little changed from -0.3% and 02%, respectively. |

Germany Unemployment Rate, October 2020(see more posts on Germany Unemployment Rate, ) Source: investing.com - Click to enlarge |

The euro recovered yesterday from a test on $1.1720 in the US morning to about $1.1760. It remains stuck in that range now ahead of the ECB meeting. There is an option for about 785 mln euros at $1.1700 and another for around 720 mln euros at $1.1720. The $1.1750 area is more interesting. It holds options for roughly 870 mln euros expiring today and 1.1 bln euros expiring tomorrow. This month’s low was set on October 15, near $1.1690. A break could spur a test on $1.1600. For its part, sterling has been mostly confined to about a 20-tick range on both sides of $1.30 as it trades comfortably within yesterday’s range (~$1.2920-$1.3065). Meanwhile, the optimists are hoping for a breakthrough in the UK-EU trade talks next week. The euro made a marginal new low for the month against sterling today as it edges closer to GBP0.9100. It has not traded below there since early September.

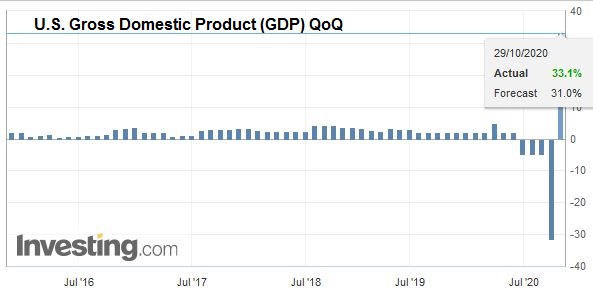

AmericaThere is little doubt that the US economy recovered smartly in Q3. The median expectation in the Bloomberg survey is for around a 32% annualized surge, and that follows a contraction of nearly the same magnitude in Q2 (-31.4%). The range of forecasts is quite dramatic. The range in the Bloomberg survey (20.0% to 37.1%) may understate the uncertainty. Consider that while the Atlanta Fed’s tracker is 37%, the other two regional Fed’s with a similar model are below the lower end of the Bloomberg survey. The St. Loius Fed’s Newscast is at 19.45%, and the New York Fed’s tracker is at 13.7%. The top forecasters in the Blomberg survey forecasts of 30% or higher. The volatile components for which all the data have not yet been reported are inventories and imports. We argue that the issue is not so much about Q3 as it is about Q4, and the outlook was already dimming before the new outbreaks. Economists seem to be revising downward Q4 estimates, and a sub-3% pace is beginning to look more likely. While the GDP report has been anxiously awaited, it will have to share the attention with the ECB, where the clocks have moved back an hour before the US adjusts to daylight savings time. Also, the US reports weekly jobless claims. A modest decline (~20k) is expected after last week’s 55k decline, which included California’s updated figures for the first time in a few weeks. Note too that in terms of earnings, many high-flying and popular tech companies report today. |

U.S. Gross Domestic Product (GDP) QoQ, Q3 2020(see more posts on U.S. Gross Domestic Product, ) Source: investing.com - Click to enlarge |

The Bank of Canada left interest rates alone, with a 25 bp overnight target rate. It did tweak policy, though, in two ways. First, it indicated that it would recalibrate its bond-buying and shift toward long-term bonds. Second, it announced it would gradually slow its purchases to C$4 bln a week from C$5 bln. In broad contours, the central bank suggested while growth had been a bit stronger than previously anticipated, the slowing in the “recuperation phase” is more abrupt than anticipated. It expects that the economic slack will not be absorbed until 2023. It is interesting to note that the central bank’s economic forecast assumes that a vaccine and effective treatment will be available from around the middle of next year.

The US dollar remains firm against the Canadian dollar. It reached almost CAD1.3335 yesterday, its highest level in three weeks. As is typically the case, it is sensitive to the broader risk environment (S&P 500 proxy). A move above CAD1.3350 targets the CAD1.3440 area, the highs from late September. The greenback is extending its gains against the Mexican peso. It had begun the week with a four-day slide in tow, and with today’s gains, a four-day rally is underway. The next immediate target is the MXN21.48-MXN21.53 band.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Bank of Canada,Bank of Japan,Currency Movement,ECB,Featured,Japan,newsletter,OIL