So Far a Normal Correction In last week’s update on the gold sector, we mentioned that there was a lot of negative sentiment detectable on an anecdotal basis. From a positioning perspective only the commitments of traders still appeared a bit stretched though, while from a technical perspective we felt that a pullback to the 200-day moving average in both gold and gold stocks shouldn’t be regarded as anything but a...

Read More »FX Daily, October 03: May’s Confirmation Sends Sterling Lower

Swiss Franc After the sudden jump with SNB’s Q3 window dressing, the EUR/CHF is trending lower again. . - Click to enlarge FX Rates Sterling has a bad case of the Monday blues. Even the moon looks distraught. Prime Minister May has confirmed earlier suggestions that she will trigger Article 50 to formally begin its divorce proceedings from the EU at the end of Q1 17. Several officials have already hinted this time...

Read More »FX Daily, September 30: SNB Intervenes to Polish Q3 Results

Swiss Franc During the day the EUR/CHF has fallen to a low of 1.0819. We know that the in-official new floor lies at that level. Moreover, the SNB had to polish the Q3 results. With interventions she lifted the EUR/CHF to 1.0893 and the euro continued rising thanks to speculators that jumped on the train.There was no economic data that could have justified the sudden increase. EUR/CHF, September 30. FX Rates True...

Read More »FX Daily, September 26: Dollar Mixed while Stocks Slide to Begin Last Week of Q3

Swiss Franc The Swiss Franc remained nearly unchanged against the euro. It fell to 1.0875 during the day and recovered with the good U.S. new home sales data. Click to enlarge. FX Rates The US dollar is narrowly mixed. The euro, yen and Swiss franc are higher, while the dollar-bloc and sterling are softer. The moving element here is not so much the greenback, which serving more as a fulcrum, but idiosyncratic,...

Read More »Japan’s Planners Ratchet up Monetary Experimentation

A Litany of Failures It was widely expected that the BoJ would announce something this week after it promised to perform a comprehensive review of its monetary policy. It certainly did deliver a major tweak to its inflationary program, but its implications were seemingly not entirely clear to everybody (probably not even to the BoJ). There were many reasons for the BoJ to review its policies. For one thing, they...

Read More »FX Daily, September 23: It is Friday and the Dollar is Firmer Again

Swiss Franc EUR/CHF, September 23, 2016Click to enlarge. FX Rates As Nassim Taleb instructed, we should not be fooled by randomness. If you see six red results in a row at a roulette table, do not conclude the game is rigged. If you flip a coin, and it is tails six consecutive times, the contest is not necessarily rigged. Today has the making of the sixth consecutive Friday that the dollar gains against the euro...

Read More »FX Daily, September 22: Swiss Franc Strongest Currency Again

Swiss Franc Once again the Swiss Franc was the strongest. The EUR/CHF depreciated to 1.0875. As said yesterday, the reasons: the Fed and the strong Swiss trade balance. Click to enlarge. FX Rates The US dollar has lost another 0.5% against most of the major currencies today, as Asia and Europe respond to the Fed’s decision. There are few exceptions to this generalization. The Norwegian krone has gained nearly...

Read More »FX Daily, September 21: BOJ Can’t Weaken Yen, Fed keeps Rates Unchanged, CHF Stronger

Swiss Franc The EUR/CHF accelerated its decline since yesterday’s strong Swiss trade balance data. The second reason was certainly the Fed decided to keep rates unchanged. We know that the Swiss Franc has similar “counter-dollar” status as gold. Click to enlarge. Japan Much of what the Bank of Japan announced today had been largely leaked. While there was a sizeable response in the asset markets, the dollar’s...

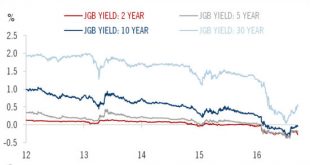

Read More »BoJ turns towards yield-curve control

While possibly helping to alleviate margin pressure on banks, raising inflation expectations remains a difficult task The Bank of Japan (BoJ) today shifted its monetary stimulus framework towards yield-curve control and away from rigid targeting of asset purchases. In essence, the BoJ will purchase sufficient Japanese government bonds (JGBs) to ensure that 10-year JGB yields are capped at about zero. The BOJ also announced that it aims to overshoot its 2% inflation target, committing itself...

Read More »Negative govvies: why would ya?

A question worth asking considering the rather large amount of them knocking about at the moment. According to JPM, the total universe of government bonds traded with a negative yield was $3.6tr last week or 16 per cent of the JPM Global Government Bond Index. It’s an answer in itself, really. Anyway, here’s a list of those willing/ forced to buy those negative yielding government bonds from JPM’s Niko...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org