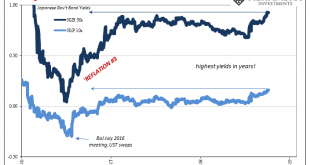

Since I don’t speak Japanese, I’m left to wonder if there is an intent to embellish the translation. Whoever is responsible for writing in English what is written by the Bank of Japan in Japanese, they are at times surely seeking out attention. However its monetary policy may be described in the original language, for us it has become so very clownish. At the end of last July, BoJ’s governing body made a split...

Read More »Bond Curves Right All Along, But It Won’t Matter (Yet)

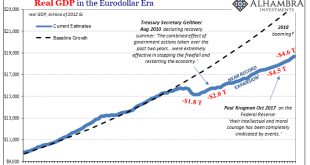

Men have long dreamed of optimal outcomes. There has to be a better way, a person will say every generation. Freedom is far too messy and unpredictable. Everybody hates the fat tails, unless and until they realize it is outlier outcomes that actually mark progress. The idea was born in the eighties that Economics had become sufficiently advanced that the business cycle was no longer a valid assumption. The mantra,...

Read More »Insight Japan

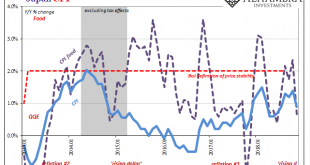

As I wrote yesterday, “In the West, consumer prices overall are pushed around by oil. In the East, by food.” In neither case is inflation buoyed by “money printing.” Central banks both West and East are doing things, of course, but none of them amount to increasing the effective supply of money. Failure of inflation, more so economy, the predictable cost. In yesterday’s article the topic in the East was China. Today,...

Read More »Economics Is Easy When You Don’t Have To Try

The real question is why no one says anything. They can continue to make these grossly untrue, often contradictory statements without fear of having to explain themselves. Don’t even think about repercussions. Even in front of politicians ostensibly being there on behalf of the public, pedigree still matters more than results. It’s actually worse than that since all that I’m talking about means it is these guys who...

Read More »FX Daily, August 01: Trade and Japan Drive Markets Ahead of Stand Pat Fed

Swiss Franc The Euro has risen by 0.11% to 1.1588 CHF. EUR/CHF and USD/CHF, August 01(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Investors recognize the risks to growth posed by the tariffs and counter-tariffs being imposed, but the way the US is going about it is also disconcerting. Within a few hours of signals that the US and China were looking to re-engage...

Read More »FX Daily, July 31: BOJ Prepares for QE Infinity

Swiss Franc The Euro has risen by 0.15% to 1.1582 CHF. EUR/CHF and USD/CHF, July 31(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The Japanese yen has been sold following the adjustments to policy and outlook by the BOJ that will allow the unconventional policies continue for an “extended period of time.” Cross rate pressure and month-end demand have lifted the...

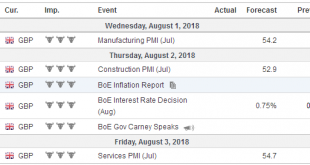

Read More »FX Weekly Preview: Three Central Bank Meetings and US Jobs data

The week ahead sees three major central bank meetings and the US employment report. It will likely be the most important work before a hiatus that runs through the end of August. Of course, and perhaps more than ever, market participants are well aware that the US President’s communication and penchant for disruption is a bit of a wild card. That said, the equity market has learned to take individual company references...

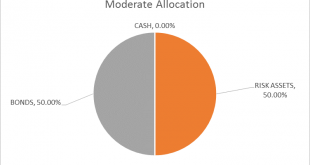

Read More »Global Asset Allocation Update

Note: This will be a short update. We are shifting the timing of some of our reports. The monthly Global Asset Allocation update will now be published in the first week of the month, aiming for the first of each month. I’ll put out a full report next week. The Bi-Weekly Economic Review is shifting to a monthly update, published on the 15th of each month. We are doing this to make room for some new reports, podcasts and...

Read More »FX Daily, July 26: Equities like EU-US Trade Truce more than the Euro

Swiss Franc The Euro has fallen by 0.29% to 1.1597 CHF. EUR/CHF and USD/CHF, July 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The dollar is mostly firmer. The Australian dollar is off the most (~0.35%, ~$0.7425), after peaking a little above $0.7460. The price action reinforces the $0.7300-$0.7500 range. The yen is the strongest of the majors. Near JPY110.80, the yen...

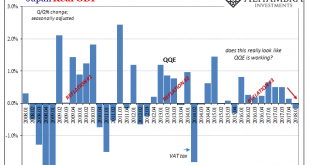

Read More »And Now For Something Completely Different

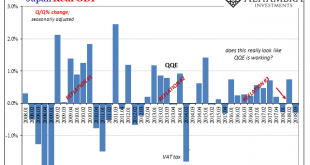

Back in February, Japan’s Cabinet Office reported that Real GDP in Japan had grown in Q4 2017 for the eighth consecutive quarter. It was the longest streak of non-negative GDP since the 1980’s. Predictably, this was hailed as some significant achievement, a true masterstroke of courage and perseverance. It was taken as a sign that Abenomics and QQE was finally working (never mind the four years). Those making that...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org