There is little doubt after the Federal Reserve Chairman Powell’s testimony last week and the FOMC minutes that a rate cut will be delivered at the end of the month. Similarly, after comments by several ECB officials and the record of their recent meetin.g confirms it too is prepared to adjust policy. The timing of the ECB’s move is more debatable, an adjustment at the July 25 meeting appears to have increased. While a...

Read More »Effective Recession First In Japan?

For a lot of people, a recession is two consecutive quarters of negative GDP. This is called the technical definition in the mainstream and financial media. While this specific pattern can indicate a change in the business cycle, it’s really only one narrow case. Recessions are not just tied to GDP. In the US, the Economists who make the determination (the NBER) will tell you recessions aren’t always so...

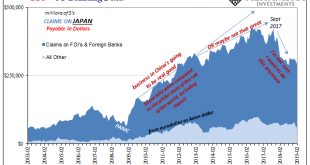

Read More »What Tokyo Eurodollar Redistribution Really Means For ‘Green Shoots’

Last April, monetary officials in Japan were publicly contemplating ending asset purchases under QQE. This April, they are more quietly wondering what other financial assets they might have to buy just to keep it all going a little longer. I’d suggest something like the clouds passing over the islands or the ocean water surrounding them. Nobody would notice either way and it would be equally as effective. Before the...

Read More »FX Daily, April 25: Equities Waiver, the Dollar Does Not

Swiss Franc The Euro has fallen by 0.12% at 1.1364 EUR/CHF and USD/CHF, April 25(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After closing at record highs on Tuesday, the S&P 500 slipped yesterday, and the Dow Jones Stoxx 600 snapped an eight-session advance. Asia followed suit, with the Shanghai Composite posting its biggest loss (~2.4%) in over a...

Read More »FX Daily, April 23: Oil Extends Gains While Markets Await Fresh Incentives

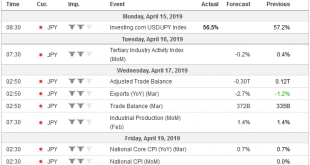

Swiss Franc The Euro has risen by 0.15% at 1.1447 EUR/CHF and USD/CHF, April 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Financial centers that have been closed for the extended holiday have re-opened, but the news stream is light and market participants are digesting developments and positioning for this week’s central bank meetings and the first look at Q1...

Read More »Cool Video: Discussion of the Deflationary Risks in Japan and Brexit

[embedded content] I joined CNBC Asia’s Amanda Drury and Sri Jegarajah via Skype earlier today as the new week was beginning in Asia. In this three minute clip, we discuss the outlook for the BOJ and sterling. Most of the rise in Japan’s inflation is due to food and energy prices. Despite an aggressive balance-sheet expansion effort, the BOJ has missed its target by a long shot. It appears to have all but given up on...

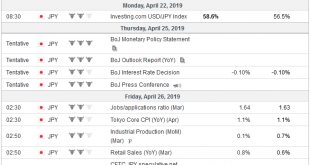

Read More »FX Weekly Preview: Six Events to Watch

The divergence thesis that drives our constructive outlook for the dollar received more support last week than we expected. A few hours after investors learned that Japan’s flash PMI remained below the 50 boom/bust level, Europe reported disappointing PMI data as well. And a few hours after that the US reported that retail sales surged in March by the most in a year and a half (1.6%). This coupled with the new cyclical...

Read More »FX Weekly Preview: Dollar Super Cycle Revisited

In the big picture, we argue that the dollar’s appreciation is part of the third significant dollar rally since the end of Bretton Woods. The first was the Reagan-Volcker dollar rally, spurred by a policy mix of tight monetary and loose fiscal policies. The rally ended with G7 intervention to knock it down in September 1985. After a ten-year bear market, a second dollar rally took place. It can be linked to the tech...

Read More »FX Daily, March 12: Wave of Optimism Sweeps through the Capital Markets

Swiss Franc The Euro has fallen by 0.03% at 1.1361 EUR/CHF and USD/CHF, March 12(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Last minutes statements meant to clarify what many MPs find to be the most odious part of the Withdrawal Bill, the backstop for the Irish border is goosed global equity markets even though it does not seem as if the Withdrawal Bill...

Read More »Something Different About This One

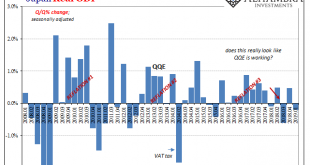

In Japan, they call it “powerful monetary easing.” In practice, it is anything but. QQE with all its added letters is so authoritative that it is knocked sideways by the smallest of economic and financial breezes. If it truly worked the way it was supposed to, the Bank of Japan or any central bank would only need it for the shortest of timeframes. That would be powerful stuff. Instead, in June last year the narrative...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org