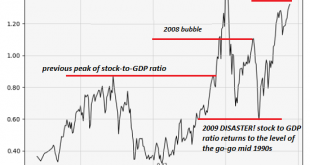

The Most Comprehensive Collection of Charts Relevant to Gold is Here Our friends from Incrementum (a European asset management company) have just released the annual “In Gold We Trust” chart book, which collects a wealth of statistics and charts relevant to gold, with extensive annotations. Many of these charts cannot be found anywhere else. The chart book is an excellent reference work for anyone interested in the...

Read More »How Dangerous is the Month of October?

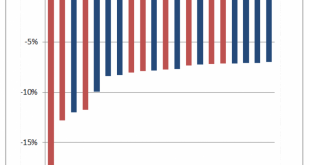

A Month with a Bad Reputation A certain degree of nervousness tends to suffuse global financial markets when the month of October approaches. The memories of sharp slumps that happened in this month in the past – often wiping out the profits of an entire year in a single day – are apt to induce fear. However, if one disregards outliers such as 1987 or 2008, October generally delivers an acceptable performance....

Read More »US Stocks and Bonds Get Clocked in Tandem

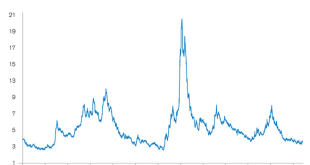

A Surprise Rout in the Bond Market At the time of writing, the stock market is recovering from a fairly steep (by recent standards) intraday sell-off. We have no idea where it will close, but we would argue that even a recovery into the close won’t alter the status of today’s action – it is a typical warning shot. Here is what makes the sell-off unique: 30 Year Bond and 10 Year Note Yields, Nov 2016 - Oct 201830 year...

Read More »Switzerland, Model of Freedom & Wealth Moving East – Interviews with Claudio Grass

Sarah Westall Interviews Claudio Grass Last month our friend Claudio Grass, roving Mises Institute Ambassador and a Switzerland-based investment advisor specializing in precious metals, was interviewed by Sarah Westall for her Business Game Changers channel. Sarah Westall and Claudio Grass There are two interviews, both of which are probably of interest to our readers. The first one focuses on Switzerland with its...

Read More »Video with Michael Strobaek: Discussing economic growth and investment strategies

What shape are the markets in right now? This month, Credit Suisse Global CIO Michael Strobaek discusses growth in the global and Swiss economies and explains the right investment strategies during the growth phase. Global economic growth. Switzerland is doing well too. It is encouraging that the global economy is in good shape despite the disparate growth rates in the various regions this year. The Swiss economy is...

Read More »Four trouble spots. Four pleasant surprises.

August looks back on positive economic and market developments. In retrospect, the first half of the year was soothed by many pleasant surprises, including much-discussed trouble spots that never flared. Read about four perceived market crises. Perceived market crisis 1: Explosion of credit spreads A regular hot-button issue for investors is the perceptibly explosive credit risks that our economy poses. It’s nice to...

Read More »Digging into Wealth and Income Inequality

That changes our perspective on the wonderfulness of ever-expanding household wealth. The assets of U.S. households recently topped $100 trillion, yet another sign that everything is going swimmingly in the U.S. economy. Let’s take a look at the Federal Reserve’s Household Balance Sheet, which lists the assets and liabilities of all U.S. households in very big buckets (real estate: $25 trillion). (For reasons unknown,...

Read More »Jayant Bhandari – The US Dollar vs. Other Currencies and Gold

Maurice Jackson Speaks with Jayant Bhandari About Emerging Market Currencies, the Trade War, US Foreign Policy and More Maurice Jackson of Proven & Probable has recently conducted a new interview with our friend and occasional contributor to this site, Jayant Bhandari, who is inter alia the host of the annual Capitalism and Morality seminar. Maurice Jackson (left) and Jayant Bhandari (right) A wide range of...

Read More »A Fake Brexit and the “Noble Dream” – Claudio Grass Speaks With Godfrey Bloom

Introductory Remarks: The “Anti-Politician” Godfrey Bloom, by PT Most of our readers will probably remember former UKIP chief whip and European Parliament representative Godfrey Bloom. As far as we know, he is the only politician who ever raised the issue of the workings of the fractionally reserved central bank-directed monetary system in the EU parliament. This system is of course central to the phenomenon of the...

Read More »Anticipating How Welcome This Second Deluge Will Be

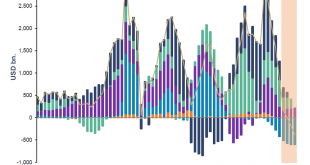

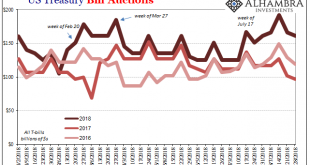

Effective federal funds (EFF) was 1.92% again yesterday. That’s now eight in a row just 3 bps underneath the “technically adjusted” IOER. If indeed the FOMC has to make another one to this tortured tool we know already who will be blamed for it. The Treasury Department announced yesterday that it will be auctioning off $65 billion in 4-week bills this week (today). The results showed that dealers submitted $152 billion...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org