August looks back on positive economic and market developments. In retrospect, the first half of the year was soothed by many pleasant surprises, including much-discussed trouble spots that never flared. Read about four perceived market crises. Perceived market crisis 1: Explosion of credit spreads A regular hot-button issue for investors is the perceptibly explosive credit risks that our economy poses. It’s nice to know that the financial markets are relativizing this fear. The last three years have shown high-yielding risk premiums, primarily resulting from stability. Speads of high-yield securities in US dollars in percent - Click to enlarge Perceived market crisis 2: Sudden outflow of capital

Topics:

Burkhard Varnholt considers the following as important: 7) Markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

August looks back on positive economic and market developments. In retrospect, the first half of the year was soothed by many pleasant surprises, including much-discussed trouble spots that never flared. Read about four perceived market crises.

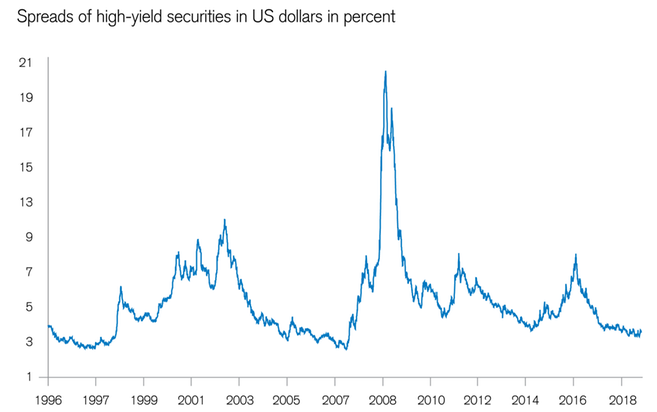

Perceived market crisis 1: Explosion of credit spreadsA regular hot-button issue for investors is the perceptibly explosive credit risks that our economy poses. It’s nice to know that the financial markets are relativizing this fear. The last three years have shown high-yielding risk premiums, primarily resulting from stability. |

Speads of high-yield securities in US dollars in percent |

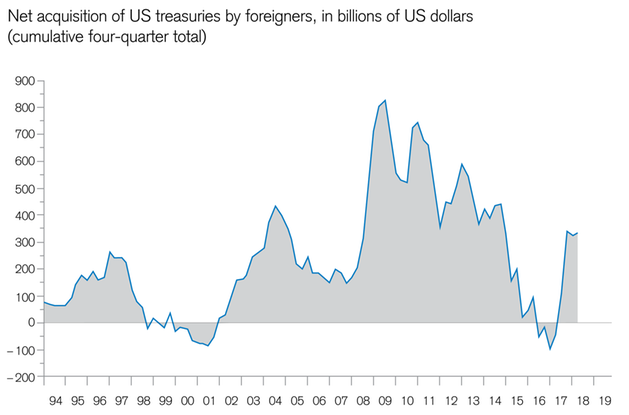

Perceived market crisis 2: Sudden outflow of capitalMany people are worried that foreign investors might one day decide to withdraw from US securities markets. The central banks of China and Japan are the United States’ two largest foreign creditors – and have by no means withdrawn their capital. Quite the opposite – the Fed’s most recent analysis indicates that purchases of US government bonds are even on the rise. During the last four quarters, foreign investors purchased a total of USD 674 billion worth of US bonds – including USD 332 billion in government bonds. These purchases contradict the common claim that the US might soon run out of favorable foreign capital. |

Foreign investors buying an increasing amount of US government bonds |

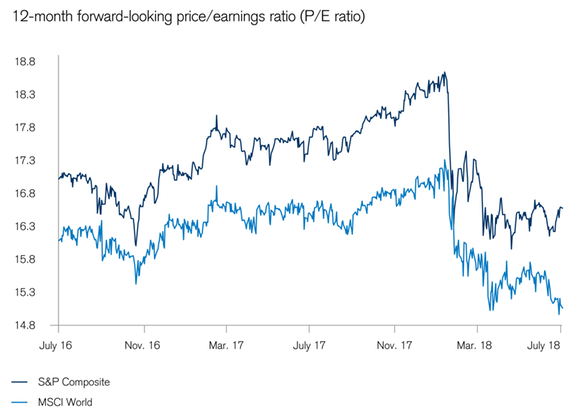

Perceived market crisis 3: InflationFrom January 23 to February 9, a panic attack in stock markets around the world was triggered by a US labor market statistic – one which was later determined to be an outlier. Naturally, the financial media gratefully accepted the specter of inflation. Because as you know, fear spreads like wildfire. But reality didn’t follow the playbook. In Europe, inflation fears equate to “much ado about nothing.” Interest and inflation rates have been falling for years in most emerging markets. Having an inflation debate in Japan seems about as adventurous as jumping out of a basement window. At the beginning of May, returns on ten-year government bonds in the US still reached a high of 3.11 percent. However, this was less the result of inflation and more a boost from the tax reform. Since then, returns have fallen back below 3 percent. Growth, full employment, trade conflicts, record high central bank balance sheets: None of these things create inflation. This shows that the best protection against inflation is the invisible hand of free competition. |

In January 2018, fears of inflation led to tumbling share valuations |

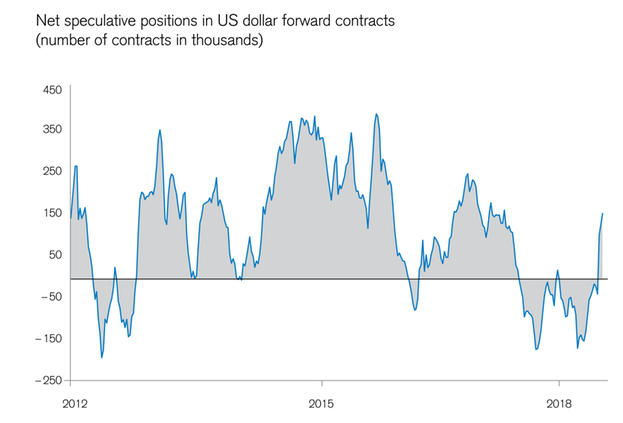

Perceived market crisis 4: US dollar under pressureThe greenback often raises the question of how the US can go on living beyond its means – i.e. what effects will follow the US economy’s current account deficit and the overall debt? The strong dollar – which no one expected – is just one of the reasons why the US has not faced inflation this year despite trade tariffs. To an extent, it offsets the impact of import tariffs and for the economy, and arrives at just the right time, leading to a nice surprise for the US. The financial markets are not seeing any “poetic justice,” whoever defined this. Relevant categories of the investment strategy are probability assessments, not value judgments. But despite the change in attitude brought on by the dollar, it is shown that a rise in speculative dollar positions has already reached an advanced stage and double deficits remain cause for concern. Now the matter is whether the currency is already overbought. |

Speculative USD positions on the rise |

Tags: Featured,newsletter