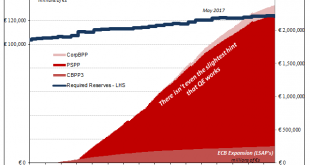

The concept of bank reserves grew from the desire to avoid the periodic bank runs that plagued Western financial systems. As noted in detail starting here, the question had always been how much cash in a vault was enough? Governments around the world decided to impose a minimum requirement, both as a matter of sanctioned safety and also to reassure the public about a particular bank’s status. Later on, governments...

Read More »“Sell In May And Go Away” – A Reminder: In 9 Out Of 11 Countries It Makes Sense To Do So

A Truism that is Demonstrably True Most people are probably aware of the adage “sell in May and go away”. This popular seasonal Wall Street truism implies that the market’s performance is far worse in the six summer months than in the six winter months. Numerous studies have been undertaken in this context particularly with respect to US stock markets, and they confirm that the stock market on average exhibits...

Read More »Gold and Gold Stocks – Conundrum Alert

Moribund Meandering Earlier this week, the USD gold price was pushed rather unceremoniously off its perch above the $1300 level, where it had been comfortably ensconced all year after its usual seasonal rally around the turn of the year. For a while it seemed as though the $1,300 level may actually hold, but persistent US dollar strength nixed that idea. Previously many observers (too many?) expected gold to finally...

Read More »Global Turn-of-the-Month Effect – An Update

In Other Global Markets the “Turn-of-the-Month” Effect Generates Even Bigger Returns than in the US The “turn-of-the-month” effect is one of the most fascinating stock market phenomena. It describes the fact that price gains primarily tend to occur around the turn of the month. By contrast, the rest of the time around the middle of the month is typically far less profitable for investors. The effect has been studied...

Read More »Scorn and Reverence – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Shill Alarm One well-known commentator this week opined about the US health care industry: “…the system is designed the churn and burn… to push people through the clinics as quickly as possible. The standard of care now is to prescribe some medication (usually antibiotics) and send people on their way without taking the...

Read More »House View, May 2018

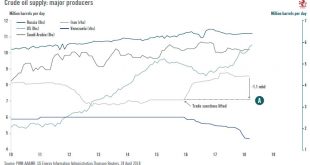

Pictet Wealth Management’s latest positioning across asset classes and investment themes. Asset Allocation In spite of a certain loss of momentum in positive surprises, a strong Q1 earnings season continues to justify our bullish stance on equities in most regions. We reiterate our negative view on core government bonds and remain short duration. Volatility is still higher than last year, and has increased noticeably in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org