By Joe Ciolli – BusinessInsider.com Leuthold Group has sounded the alarm on a valuation metric that shows the S&P 500 is twice as expensive as it was at the peak of the tech bubble. This development could have large implications for stock investors of all types, particularly value traders who make their living by finding discounts in the market. With the stock market within shouting distance of an all-time high,...

Read More »Goldman: You Are Asking The Wrong $1 Trillion Question

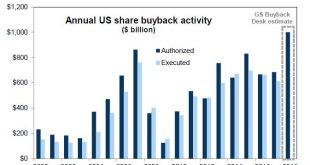

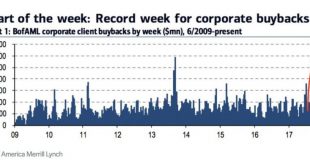

After several months of heated market speculation, to Amazon’s chagrin the question of which stock would be the first to reach $1 trillion in market capitalization was answered when Apple reported strong Q2 results (which included $21 billion in stock buybacks) and its stock soared 9% this week, rising above the very round number and elevating its YTD gain to 23% (Amazon, with a market cap of just under $900 billion,...

Read More »Stock Market Manias of the Past vs the Echo Bubble

The Big Picture The diverging performance of major US stock market indexes which has been in place since the late January peak in DJIA and SPX has become even more extreme in recent months. In terms of duration and extent it is one of the most pronounced such divergences in history. It also happens to be accompanied by weakening market internals, some of the most extreme sentiment and positioning readings ever seen...

Read More »Spotlight on the HUI and XAU Gold Stock Indexes

Probably the two best known gold mining stock indexes in the world’s financial markets are the HUI and the XAU. HUI is the ticker symbol for the NYSE Arca Gold BUGS Index. XAU is the ticker symbol for the Philadelphia Gold and Silver Index. Both of these monikers make an appearance on many gold related websites and many general financial market websites as well, so its worth knowing briefly what these indexes are and...

Read More »Separating Signal from Noise

Claudio Grass in Conversation with Todd “Bubba” Horwitz Todd Horwitz is known as Bubba and is chief market strategist of Bubba Trading.com. He is a regular contributor on Fox, CNBC, BNN, Kitco, and Bloomberg. He also hosts a daily podcast, ‘The Bubba Show.’ He is a 36-year member of the Chicago exchanges and was one of the original market makers in the SPX. Before you listen to the podcast, I would like to provide...

Read More »US Money Supply and Fed Credit – the Liquidity Drain Becomes Serious

US Money Supply Growth Stalls Our good friend Michael Pollaro, who keeps a close eye on global “Austrian” money supply measures and their components, has recently provided us with a very interesting update concerning two particular drivers of money supply growth. But first, here is a chart of our latest update of the y/y growth rate of the US broad true money supply aggregate TMS-2 until the end of June 2018 with a...

Read More »The Gold Sector Remains at an Interesting Juncture

Technical Divergence Successfully Maintained In an update on gold and gold stocks in mid June, we pointed out that a number of interesting divergences had emerged which traditionally represent a heads-up indicating a trend change is close (see: Divergences Emerge for the details). We did so after a big down day in the gold price, which actually helped set up the bullish divergence; this may have felt...

Read More »Gold – Macroeconomic Fundamentals Improve

A Beginning Shift in Gold Fundamentals A previously outright bearish fundamental backdrop for gold has recently become slightly more favorable. Ironically, the arrival of this somewhat more favorable situation was greeted by a pullback in physical demand and a decline in the gold price, after both had defied bearish fundamentals for many months by remaining stubbornly firm. The eternal popularity contest… - Click to...

Read More »“Stock Markets Look Ever More Like Ponzi Schemes”

Authored by Richard Murphy via Tax Research UK blog, The FT has reported this morning that: Debt at UK listed companies has soared to hit a record high of £390bn as companies have scrambled to maintain dividend payouts in response to shareholder demand despite weak profitability. They added: UK plc’s net debt has surpassed pre-crisis levels to reach £390.7bn in the 2017-18 financial year, according to analysis from Link...

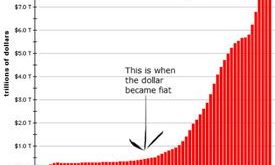

Read More »Sound Money Needed Now More Than Ever

The sound money movement reemerged on the national political scene a decade ago. In 2008, the financial crisis brought in a fresh wave of U.S. gold and silver investors. Ron Paul and the Tea Party advocated for limiting government and ending the Federal Reserve system. Sound money advocates made real inroads in recruiting Americans to their cause based on evidence that the nation is headed for bankruptcy. The...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org