Worldwide Liquidity Drought – Money Supply Growth Slows Everywhere This is a brief update on money supply growth trends in the most important currency areas outside the US (namely the euro area, Japan and China) as announced in in our recent update on US money supply growth (see “Federal Punch Bowl Removal Agency” for the details). The liquidity drought is not confined to the US – it is fair to say that it is a global...

Read More »Swiss stock exchange could lose EU access in January

EU Commission Vice-President Valdis Dombrovskis. (Keystone) An EU Commission document has revealed that, for now, not enough progress on the Swiss-EU framework agreement has been made to renew the ‘financial equivalency’ status of the Swiss stock exchange in Europe. According to a note sent on Tuesday by Commission Vice-President Valdis Dombrovskis, it seems that patchy progress in ongoing talks between Bern and...

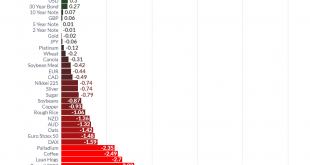

Read More »Gold and Silver Hold Firm as Stocks and Oil Lower in to US Holiday Weekend

Key Gold and Precious Metals News, Commentary and Charts This Week Gold and silver traded sideways this week as we saw stock markets take some heat and undo most of the recent recovery from the October sell off. Oil has sold off and is now at levels that we haven’t seen since 2017. While the US markets are quiet due to Thanksgiving all eyes are focused on Europe and the continuing debacle that is Brexit. With the...

Read More »The Intolerable Scourge of Fake Capitalism

Investment Grade Junk All is now bustle and hubbub in the late months of the year. This goes for the stock market too. If you recall, on September 22nd the S&P 500 hit an all-time high of 2,940. This was nearly 100 points above the prior high of 2,847, which was notched on January 26th. For a brief moment, it appeared the stock market had resumed its near decade long upward trend. Chartists witnessed the take...

Read More »Pushing Past the Breaking Point

Schemes and Shams Man’s willful determination to resist the natural order are in vain. Still, he pushes onward, always grasping for the big breakthrough. The allure of something for nothing is too enticing to pass up. Systems of elaborate folly have been erected with the most impossible of promises. That prosperity can be attained without labor. That benefits can be paid without taxes. That cheap credit can make...

Read More »Eastern Monetary Drought

Smug Central Planners Looking back at the past decade, it would be easy to conclude that central planners have good reason to be smug. After all, the Earth is still turning. The “GFC” did not sink us, instead we were promptly gifted the biggest bubble of all time – in everything, to boot. We like to refer to it as the GBEB (“Great Bernanke Echo Bubble”) in order to make sure its chief architect is not forgotten....

Read More »You Can’t Eat Gold – Precious Metals Supply and Demand

You Actually Can Eat Gold, But Its Nutritional Value is Dubious “You can’t eat gold.” The enemies of gold often unleash this little zinger, as if it dismisses the idea of owning gold and indeed the whole gold standard. It is a fact, you cannot eat gold. However, it dismisses nothing. This gives us an idea. Let us tie three facts together. One, you can’t eat gold. Two, gold is in backwardation in Switzerland. And three,...

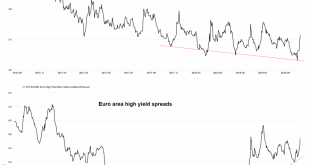

Read More »Are Credit Spreads Still a Leading Indicator for the Stock Market?

A Well-Established Tradition Seemingly out of the blue, equities suffered a few bad hair days recently. As regular readers know, we have long argued that one should expect corrections in the form of mini-crashes to strike with very little advance warning, due to issues related to market structure and the unique post “QE” environment. Credit spreads are traditionally a fairly reliable early warning indicator for stocks...

Read More »Special Edition: Markets Under Pressure (VIDEO)

[embedded content] What does Alhambra Investments think about the 1300 point drop in the Dow Jones Average this week? Alhambra CEO Joe Calhoun has some thoughts. Related posts: Cool Video: Bloomberg Clip from Discussion on Emerging Markets Cool Video: Emerging Markets Continue to Sell-Off FX Daily, August 13: Turkey Drives Risk-Off, but Pressure...

Read More »The Gold Standard: Protector of Individual Liberty and Economic Prosperity

A Piece of Paper Alone Cannot Secure Liberty The idea of a constitution and/or written legislation to secure individual rights so beloved by conservatives and among many libertarians has proven to be a myth. The US Constitution and all those that have been written and ratified in its wake throughout the world have done little to protect individual liberties or keep a check on State largesse. Sound money vs. a piece of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org