The New Annual Gold Report from Incrementum is Here We are happy to report that the new In Gold We Trust Report for 2019 has been released today (the download link can be found at the end of this post). Ronnie Stoeferle and Mark Valek of Incrementum and numerous guest authors once again bring you what has become the reference work for anyone interested in the gold market. Gold in the Age of Eroding Trust This year’s...

Read More »The Transitory Story, I Repeat, The Transitory Story

Understand what the word “transitory” truly means in this context. It is no different than Ben Bernanke saying, essentially, subprime is contained. To the Fed Chairman in early 2007, this one little corner of the mortgage market in an otherwise booming economy was a transitory blip that booming economy would easily withstand. Just eight days before Bernanke would testify confidently before Congress, the FOMC had met to...

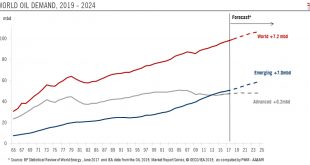

Read More »Oil prices supported by OPEC+ cuts…before market risks being flooded again

Increased US export capacity would probably force OPEC+ to change its current tactics. After last year’s collapse, oil prices have found support since the beginning of this year for several reasons. At this stage, the main question is whether the recent surge in prices is sustainable or whether we will see renewed oil price volatility, with the possibility of a repeat of 2018. The recent release of the International...

Read More »Phugoid Dollar Funding

On August 12, 1985, Japan Airways flight 123 left Tokyo’s Haneda Airport on its way to a scheduled arrival in Osaka. Twelve minutes into the flight, the aircraft, a Boeing 747, suffered catastrophic failure when an aft pressure bulkhead burst. The airplane had been improperly repaired from a tailstrike (the tail of the aircraft actually hitting the runway pavement) seven years earlier, and therefore wasn’t sufficiently...

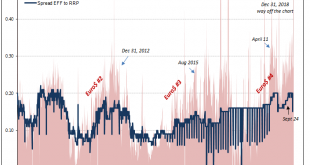

Read More »The Real End of the Bond Market

These things are actually quite related, though I understand how it might not appear to be that way at first. As noted earlier today, the Fed (yet again) proves it has no idea how global money markets work. They can’t even get federal funds right after two technical adjustments to IOER (the joke). But as esoteric as all that may be, recent corporate statements leave much less doubt at least as to the primary effect....

Read More »Bitcoin Bottom Building

Defending 3,800 and a Swing Trade Play For one week, bulls have been defending the 3,800 USD value area with success. But on March 4th they had to give way to the constant pressure. Prices fell quickly to the 3,700 USD level. These extended times of range bound trading are typical for Bitcoin Bottom Building in sideways ranges. This 60 minute chart of Bitcoin shows (represented by the yellow candlestick wicks) how the...

Read More »FOMC Minutes: The New Narrative Takes Shape

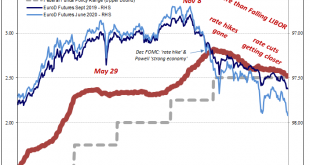

Nothing the Fed did today, or has done up to today, has changed the curves. Eurodollar futures and UST’s, they are both still inverted. The former sharply inverted. The only thing that has changed since early January is the narrative – and not in a charitable way. It is treated as a positive when it is a pretty visible signal about deteriorating circumstances. Interpretations matter. Conventional wisdom seems settled...

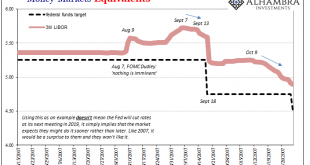

Read More »LIBOR Was Expected To Drop. It Dropped. What Might This Mean?

Everyone hates LIBOR, until it does something interesting. It used to be the most boring interest rate in the world. When it was that, it was also the most important. Though it followed along federal funds this was only because of the arb between onshore (NYC) and offshore (mainly London, sometimes Caymans) conducted by banks between themselves and their subs (whichever was located where). Unsecured markets used to be...

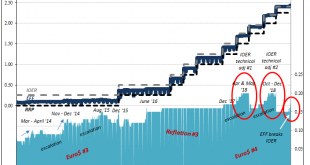

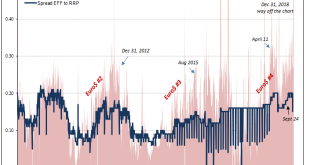

Read More »Insane Repo Reminds Us

It was only near the quarter end, that’s what made it so unnerving. We may have become used to these calendar bottlenecks over the years, but they still remind us what they are. Late October 2012 was a little different, though. On October 29, the GC repo rate for UST collateral (DTCC) surged to 52.6 bps. The money market floor, so to speak, was zero at the time and IOER (the joke) 25 bps. We also have to keep in mind...

Read More »The Bear Market Hook

Has a Bear Market in Stocks Begun? The stock market correction into late December was of approximately the same size as the mid 2015/early 2016 twin downturns, so this is not an idle question. Moreover, many bears seem quite confident lately from an anecdotal perspective, which may invite a continuation of the recent upward correction. That said, there is not much confirmation of said confidence in data that can be...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org