Listen to the audio version of this article here. Here at Monetary Metals we love providing investors with A Yield on Gold, Paid in Gold®. So when we heard that German artist Niclas Castello designed a 186 kilogram pure 24-karat gold cube called the “Castello Cube” as an art installation in the middle of Central Park we couldn’t help but start doing a little math on Mr. Castello’s art piece. How Much is the Gold Cube Worth? Most people when they see the gold cube...

Read More »This is Not The Silver Breakout You’re Looking For!

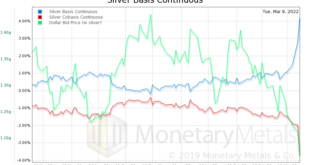

To listen to the audio version of this article click here. Every once in a while, one regrets not acting sooner, or not acting soon enough. In our case, we did not publish this Tuesday evening. We should have. Today the price is down, and others may also call for lower silver prices. Oh well. Our consolation is that they most likely are not calling for lower silver prices based on the same indicator we observe. The basis. Here is the chart. Silver Price Basis Chart...

Read More »How Not to Think About Gold

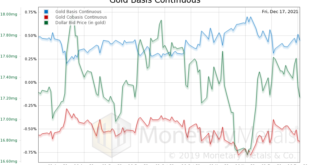

Monetary Metals has been covering gold and silver markets for over ten years. Throughout that time, there’s been no shortage of new and old commentators talking about the drivers of gold and silver prices. Unfortunately, the vast majority of this analysis is just plain wrong. Whether it’s a company trying to sell you something, or a big investment bank. Gold and silver defy conventional commodity analysis. And plotting the gold price against the money supply, or...

Read More »Episode 26: Gold in the Time of Coronavirus

This week’s episode of the Gold Exchange Podcast, Keith Weiner interviews independent precious metals advisor Claudio Grass. Claudio explains his sound money origin story and how the rest of the world understands gold vs Americans’ understanding. The wide ranging conversation spans everything from history, to covid lockdowns, to how societies change, to our relationship to money and even political principles and philosophy. Highlights from the episode include:...

Read More »Monetary Metals Completes Gold Lease to European Refiner L’Orfebre

Scottsdale, Ariz – January 11, 2022 – Monetary Metals has leased gold to L’Orfebre, a European precious metals refiner. The lease expands Monetary Metals’ gold and silver lease portfolio to include five industry verticals: bullion, jewelry, manufacturers, miners, and now refiners, on four continents. Investor demand for the lease was substantial, resulting in an oversubscription of the offering. Investors earn a return on their gold, paid in gold instead of...

Read More »Reflections Over 2021

In March, I flew for the first time since the start of Covid health theater. I was invited to speak at the Austrian Economics Research Conference in Auburn, AL. My talk covered Jimi Hendrix, and an infamous bridge collapse. In other words, I discussed my theory of interest and prices. At the end of November, I flew to London for two weeks of business meetings. This was my first international trip since the Covid lockdown. I offer three comments. One, the UK...

Read More »Gold Under the Mattress vs Gold Investments

“If you can’t hold it in your hand, you don’t own it.” That’s one of the most common refrains we hear from gold and silver investors. And while there is a kernel of truth in this saying, investing by these words alone could prove a costly mistake. This popular phrase conflates and entangles two different concepts. Gold owned for emergency use or as a financial insurance policy Gold owned for investment purposes In this article, we’ll untangle those ideas and offer a...

Read More »The Zombie Ship of Theseus

To listen to the audio version of this article click here. The Ship of Theseus is an old philosophical thought experiment. It asks a question about identity. Suppose you replace all of the boards of a ship with new ones—is it still the same ship? We are not going to try to resolve this millennia-old paradox. Instead, we are going to add one more element, and then tie it to the monetary system. The additional element is what if the replacement boards are adulterated...

Read More »Inflation and Gold: What Gives?

Listen to the audio version of this article here! In the last Supply and Demand update, we discussed some different theories which attempt to explain what causes the gold and silver prices to move. We mentioned the: “…attempt to hold up a famous buyer of metal, while ignoring the thousands of not-famous sellers who sold the metal to said famous buyer.” Since then, Ireland has bought gold for the first time in over a decade. And predictably, most voices in the gold...

Read More »Episode 25: The Origins and Machinations of the Federal Reserve

This week’s episode of the Gold Exchange Podcast explores the topic of Central Banks, most notably the US Federal Reserve. Monetary Metals’ CEO Keith Weiner explores why the Fed was created and what deleterious effects it has on our economy including inflation, boom bust cycles and monetary debasement in this recorded talk given to investment bankers. In this talk Keith discusses:[embedded content] Additional Resources Episode Transcript John Flaherty: Hello, again,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org