Monetary Metals CEO Keith Weiner was back on the Palisades Gold Radio podcast being interviewed by Tom Bodrovics. Keith revealed one key feature that gold has, which bitcoin does not. [embedded content] First, Keith discusses how economists and experts tend to say the strangest things and most of their statements don’t pass basic scrutiny, what Keith calls the “sniff test”. Gold has been accumulated for the last 5000 years. As a result physical scarcity is not...

Read More »Transitory Inflation and Useless Ingredients

Can you remember back to when you were two or three years old? Toddlers often think that there are little people inside the TV (or maybe this was only true when the TV was about as deep as it was wide—and maybe kids today don’t think this when looking at a 60-inch flatscreen…) Anyways, it’s normal to grow out of this naïve view of television. No one believes it past the age of eight, much less into adulthood. Purchasing Power and Intrinsicism This is a simple...

Read More »Silver Crash Makes Silver Trash?

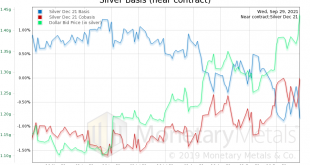

The price of silver dropped a dollar, or over 4% on Wednesday. Some voices in the precious metals press want you to think that there is only one conceivable cause. We should coin a term for this form of logical fallacy: argumentum ad ignorantia. This is an argument of the form: “the cause must be XYZ, as I cannot conceive of anything else.” The Same Old Song and Dance In this case, XYZ is that the alleged cartel, the bullion banks and/or central banks, sold silver...

Read More »Gold and Silver Price Fundamentals Update

This time, we start with the gold-silver ratio. Let’s revisit something we said on 23 August: “…the supply and demand fundamentals of silver are stronger here than they have been since the Covid crisis. … physical silver is scarcer than gold.” This corresponds to the peak where we have drawn an arrow on the gold-silver ratio chart. Soon after we said that, the ratio moved down about 5% (i.e. in favor of silver). And now we see a similar pattern in the ratio of the...

Read More »Gold and Silver Price Fundamentals Update

This time, we start with the gold-silver ratio. Let’s revisit something we said on 23 August: “…the supply and demand fundamentals of silver are stronger here than they have been since the Covid crisis. … physical silver is scarcer than gold.” This corresponds to the peak where we have drawn an arrow on the gold-silver ratio chart. Soon after we said that, the ratio moved down about 5% (i.e. in favor of silver). And now we see a similar pattern in the ratio of the...

Read More »How Do They Get Away With It?

Picture, if you will, a government that deliberately inflicts bad policy on the people. I know this sounds crazy, and could never happen, but please bear with me. Suppose the government criminalizes hiring someone who produces less than an arbitrary threshold. Or it forces the closure of all businesses deemed to be non “essential”. Or it makes all employers obtain government permission for a long and growing list of things, and then denies permission arbitrarily and...

Read More »Where do gold and silver prices go from here?

[unable to retrieve full-text content]One way to look at the price of gold, is that it dropped from its high around $1,900 in early June. Another way is to zoom out, and look at the big picture. Here is a 10-year chart of gold and silver prices. For over four years, after the peak around $1,900 ten years ago (early September 2011), the price of gold moved down. By December 2015, it was just over $1,000. Then it was a sideways market until three years ago (August 2018), when the price was well...

Read More »What Trick did Tricky Dicky Pull 50 Years Ago Today?

Sometimes, bad luck can strike. But other times, a catastrophe comes from a series of bad decisions, each the reaction to the consequences of the previous one. On August 15, 1971, President Nixon decreed that the US dollar would no longer be redeemable for the gold owed, even to foreign governments. This bad decision is the latter, a desperate attempt to avoid the consequences of previous bad decisions. Tricky Dicky’s Catastrophe Richard “Tricky Dicky” Nixon...

Read More »Is the Gold Standard the Economists’ Punching Bag?

The following article was written by Keith Weiner, CEO of Monetary Metals, as a counterpoint to this article, POINT: Should the US Return to the Gold Standard? No It was originally published at InsideSources, here: COUNTERPOINT: Is the Gold Standard the Economists’ Punching Bag? In many gyms, there is a punching bag in the corner. When someone feels frustrated or wants to show off, he can hit it. The gold standard is the punching bag in the economists’ gym. In an...

Read More »Gold Price Smashdown vs Gold on Fire

No sooner did we write Silver Rorschach Test, than the price of gold flash-crashed, or was smashed down. On Sunday afternoon in Arizona—i.e. Monday morning in Australia and Asia—the gold price dropped sharply. Gold bug sources claim that the drop was $100, but as we can see from the price graph included in this report, the actual crash itself was about $70. Some of these sources were very quick to assert that the drop was caused by naked selling of gold futures...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org