Scottsdale, Ariz, April 1, 2021— Monetary Metals® announces that it has issued a gold token. Unlike the company’s other products, this one is not designed to pay a yield. In a sign of the times, the company intends this product to generate big speculative gains. It is designed to GO UP! It is (at issue date) 2,000 fine bucks of gold. However, some guy predicted it would go up to 4,000 or maybe even 5,122 fine bucks of gold. “It’s magical,” gushed Monetary Metals CEO...

Read More »Episode 17: Why Fedcoin?

Our recent article on Fedcoin – a digital currency being considered by the Federal Reserve – revealed the sinister and pernicious reasons behind such a move. This week’s episode of The Gold Exchange Podcast explores the topic further. In it, John Flaherty and CEO Keith Weiner discuss: Addl description of episode A little-realized distinction between Fed credit and banking credit The Fed’s stated reasons for considering Fedcoin Why central banks will eventually have...

Read More »The Fedcoin is Coming, 8 March

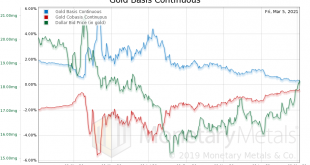

Before we talk about Fedcoins, let’s look at the old school non-digital, non-blockchain, coin. Gold. And silver. Since January 4, the price has dropped about $244. And the price of silver has fallen about $4. Are these buying opportunities? Or the end of the brief gold bull market of 2020 (i.e. Covid)? It helps to return to the idea that gold is the unit of measure of value. Not as a rhetorical device to sell gold, but because it gives a clearer picture. If one...

Read More »Episode 14: Unexpected Insights On Fractional Reserve Banking

Our previous episode on “money printing” veered into fractional reserve banking at a few points, so this week John Flaherty and Monetary Metals CEO Keith Weiner dive into that topic. In this episode, you’ll discover: 4 traits that determine legitimate credit, versus counterfeit credit What many alarmists incorrectly presume about this system The concept of ‘ceiling’ vs an absolute multiplier How nearly everyone today suffers confusion between money and credit A...

Read More »Episode 13: The Pressing Problem With “Money Printing”

The phrase “money printing” conjures images of a giant printing press spitting out sheets of hundred dollar bills somewhere in the basement of the Fed. But is that what’s actually happening lately? Absolutely not. Join John Flaherty and Monetary Metals CEO Keith Weiner for a conversation that will likely make you say “WOW!” or “Whaaat?” or maybe even “Oh, NOW I get it…” [embedded content] Episode Transcript John: Hello again and welcome to the Gold Exchange podcast....

Read More »Episode 12: The Yield Purchasing Power Paradigm

Most people think in terms of purchasing power: how much can one’s cash buy? In this week’s episode, CEO Keith Weiner & John Flaherty discuss an alternate perspective. Instead of spending your capital, what if you invested it to earn a return? What can that return buy? Along the way you’ll learn: The concept of yield purchasing power & its impact on investing decisions How the Fed keeps us stuck in the purchasing power paradigm The perverse incentives...

Read More »Episode 11: The Common Ground Between Bitcoin & Gold

Is there common ground the among proponents of gold and bitcoin? John Flaherty and CEO Keith Weiner take on that question in this episode. They also discuss: What bitcoin has been able to accomplish that gold hasn’t What gold and bitcoin have in common A billionaire’s comments regarding a bitcoin bubble Why ‘engineered money’ may give people pause [embedded content] Episode Transcript John Flaherty: Hello and welcome again to The Gold Exchange podcast. I’m John...

Read More »Monetary Metals Renews Financing to Investopedia’s Best Online Gold Dealer

Scottsdale, Ariz, February 5, 2021—Monetary Metals® announces the renewal and expansion of its gold, silver & platinum leases to Money Metals Exchange, to finance the Idaho-based business’ bullion inventory. Money Metals Exchange (no relationship to Monetary Metals) was recently named “Best Overall Online Gold Dealer” for 2021 by Investopedia. Monetary Metals has a disruptive model, obtaining precious metals from investors and leasing it to qualified companies...

Read More »Reddit Residue on Silver, 3 February

The price of silver is going up and down like a yo-yo. On Sunday and into the first part of Monday, the price skyrocketed on news that Reddit was touting the metal. But as the data clearly showed, the price was not driven up by retail buying of physical metal. To be sure, there was retail buying. But even if they depleted the finite inventories of Eagles and Maples, they were not the buyers that pushed the price up to $30. That would be the futures speculators....

Read More »Ruh Roh Silver

Sometimes you can count on the manipulation conspiracy theorists to get it exactly wrong. Not just a little bit wrong, nor halfway wrong. Not even mostly wrong. Totally wrong, backwards. Michael Crichton, in talking about the Gell-Mann Amnesia Effect said this: “You open the newspaper to an article on some subject you know well. In Murray’s [Gell-Mann] case, physics. In mine, show business. You read the article and see the journalist has absolutely no understanding...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org