In March, I flew for the first time since the start of Covid health theater. I was invited to speak at the Austrian Economics Research Conference in Auburn, AL. My talk covered Jimi Hendrix, and an infamous bridge collapse. In other words, I discussed my theory of interest and prices. At the end of November, I flew to London for two weeks of business meetings. This was my first international trip since the Covid lockdown. I offer three comments. One, the UK government forces you to get a Covid test to visit the country and the US government forces you to get another test to be allowed to board a flight back home. Yes, even US citizens. No, I do not think this is constitutional (but who cares about that old document). Two, by the way, having a stick jammed up your

Topics:

Keith Weiner considers the following as important: 6a.) Monetary Metals, 6a) Gold & Monetary Metals, blog, Featured, newsletter

This could be interesting, too:

Clemens Schneider writes Café Kyiv

Clemens Schneider writes Germaine de Stael

Clemens Schneider writes Museums-Empfehlung National Portrait Gallery

Clemens Schneider writes Entwicklungszusammenarbeit privatisieren

In March, I flew for the first time since the start of Covid health theater. I was invited to speak at the Austrian Economics Research Conference in Auburn, AL. My talk covered Jimi Hendrix, and an infamous bridge collapse. In other words, I discussed my theory of interest and prices.

At the end of November, I flew to London for two weeks of business meetings. This was my first international trip since the Covid lockdown. I offer three comments. One, the UK government forces you to get a Covid test to visit the country and the US government forces you to get another test to be allowed to board a flight back home. Yes, even US citizens. No, I do not think this is constitutional (but who cares about that old document).

Two, by the way, having a stick jammed up your nose is an unpleasant experience.

Three, there is a difference in the UK and US cultures, when it comes to responding to government mandates for vaccines and masks. The US is populated by the descendants of people who risked their lives, rather than bow to kings. We still have that attitude. In the US, people break into two camps. Both are passionate, but on opposite sides.

One side is against mandates. If it helps fight mandates, they will attack the Covid vaccine, vaccines as such, pharmaceuticals in general, and even the germ theory of disease and medical science. The other side is against Covid. If it helps fight the virus, they will attack your right to control what you put in your body, your right to be on US soil, and even individual rights in general.

Both sides are vocal and tireless. And yes, I am being charitable to both sides.

In the UK, it seemed to me that the people are more accustomed to pervasive government. For example, all real controversy of their socialized medicine scheme ended decades ago. Even successful and wealthy entrepreneurs will defend the National Health Service to the death. Brits, much more than Americans, are told “stand here, don’t stand there.” So being told “wear this,” is just another rule, added to a long list of rules. Compliance, whether paying a BBC tax on your TV, or wearing a mask, is part of the bureaucracy mindset. In the UK, I saw no heated emotions about mask mandates. Not even directed towards the mask refuseniks who flouted the rule with which everyone else was complying. Compared to the Portlanders I saw, when I visited Oregon in October, it’s day and night.

The British gave us Americans many things: common law, language, and lots of great music. I hope that we Americans can give them one thing in return: the fighting spirit to push back on government overreach.

***

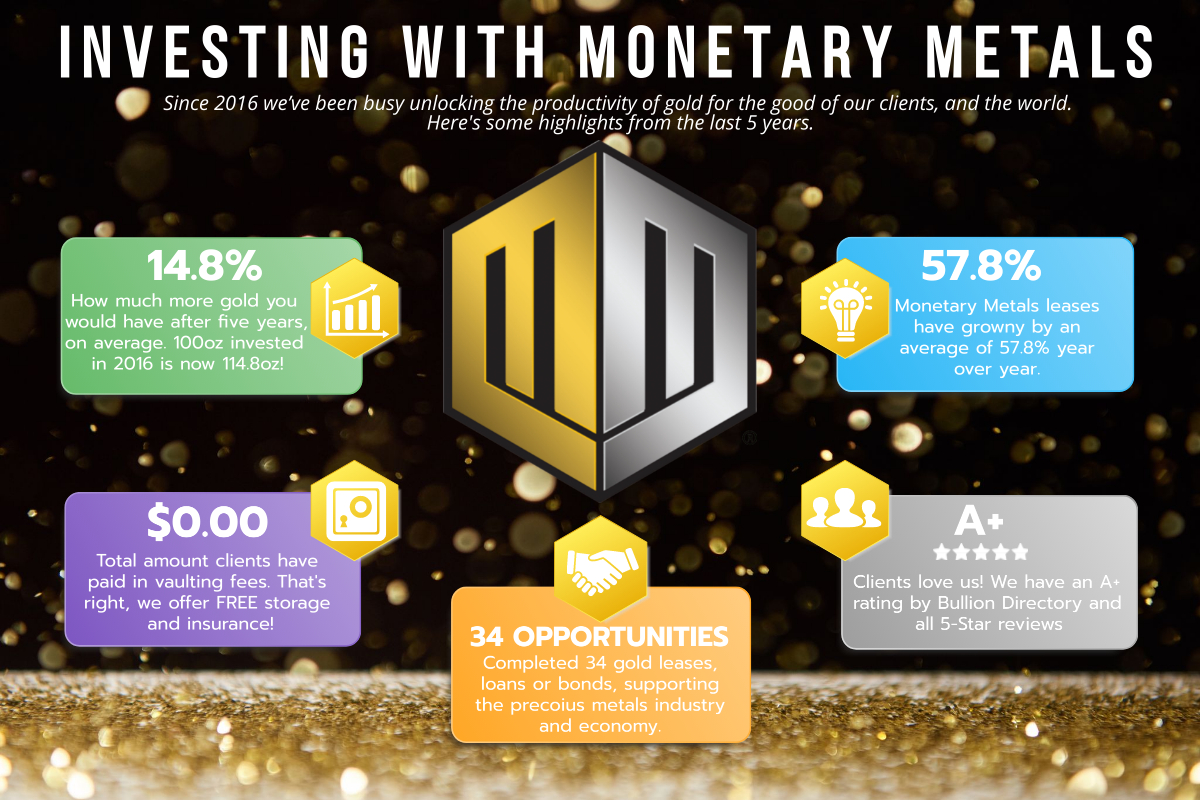

It was a great year for my company, Monetary Metals. We grew gold under management, we hired some talented and passionate people, we developed steady flow of lease deals. The first gold bond in 87 years matured, and investors were repaid their principal plus interest. As of year’s end, we are raising equity capital to scale.

My last company, DiamondWare, had a very cool technology. It was disruptive and could change communications (and now, 13 years after I sold the company, major companies are promoting 3D voice technology). But if there was a challenge, it was that it was hard to talk about in a way that people could understand. Even CTO’s of technology companies often did not get it.

What I love about Monetary Metals is that it is not hard to explain. We pay interest on gold. There, now you know what we do. We do it by leasing or lending the gold to productive businesses. There, now you know how we do it. Easier to explain means it takes less time trying to educate prospective customers. DiamondWare could have been a billion-dollar business. Monetary Metals can be many millions of ounces.

DiamondWare was making the world a better place. There was a big contrast between the low-fidelity monaural audio of conventional phone calls, vs. the popular conception of communications in the future thanks to science fiction. Or even a contrast to the rising quality of video that existed at the time. 3D allowed for new paradigms, which is why Nortel acquired it.

Monetary Metals is making the world a better place, by giving disenfranchised savers a better choice. Conventional banks offer basically zero. Or else people can speculate on whatever asset. From real estate to virtual tokens, maybe they can make big capital gains. Or maybe they lose their capital. People need to earn interest on their savings. Civilization depends on entrepreneurs borrowing to finance the production of all the goods which we now enjoy.

Today, this finance is not working for the savers. And bitcoin does not fix this, as it does not finance anything productive (even crypto companies borrow dollars when they need growth capital). So productive enterprise has no choice but to use dollars. And then they are in the position of having to work harder and harder, to produce more and more, to sell to raise dollars to service their mounting debts.

Monetary Metals is serving gold businesses, while we serve gold savers (silver too). As more people come to grips with the impossibility of saving in dollars, we look forward to serving them with their newly acquired gold savings as well.

I can’t imagine anything else I’d rather be doing.

***

I don’t watch much TV (other than Lord of the Rings once a year, this year in 4K HDR—wow what a difference both 4K and HDR make, the images are more detailed, more beautiful, and also much brighter and much darker!) But when I do, it’s often a documentary on science or history. One show was about an old Nazi underground airplane factory.

As the Allies gained air superiority over Germany, they could bomb anything they wanted. Such as factories making munitions. So the Nazis tried to build them underground. These projects took time to build. The Allies watched them divert massive resources away from fighting. Once the Nazis completed construction, then the Allies bombed these sites into ruin.

Hitler had to know, long before D-Day, that the war was lost. Not only could the Allies work their way through the Nazi targets, but the Nazis would never be able to build anything that required large-scale factories.

It was all over, but the dying.

And then it clicked for me. You don’t become a mass-murderous dictator out of love for the people of the country under your fist. It’s not merely that the dictator hates the ostensible enemy. He hates his own people—whom he kills in large numbers. He kills them to make them obey, to stay in power. And he kills them in making them kill the enemy.

Hitler and his generals knew that by continuing to fight past the point of hopelessness, that not only would more British military personnel get killed, and more British civilians. He also had to know that more German soldiers would die, and more German civilians. And he decided to keep fighting, knowing he would kill more of his own people, and still inevitably lose.

This is something to keep in mind, as we see populists and wannabe dictators rise today. They don’t just hate whatever group they use as a scapegoat. They will harm and kill their own people. It brings a new light to the idea of the collective, of the concept of a dictator’s own people. It’s own as in ownership. Not any kind of love, brotherhood, common interest, or solidarity.

***

There is something I had to make my peace with. Otherwise, I could not go on with what I do. And that is that I may be alone in my anger at injustice in the monetary realm. I have to able to be comfortable with being alone in this fight.

I am happy to be alone, if necessary, in being angered by the sentiment expressed in this little exchange which I shall quote from Twitter, below. The people involved in this would, no doubt, claim to support sound money. I am left thinking, “you say that word sound, I do not think that that word means what you think that it means.” (Due apologies to the Inigo Montoya).

Describing postwar inflation, someone said:

“…inflation served an important function in those circumstances. There was a huge overhang of excess cash accumulated during WW2 with few goods available to spend on. Inflation was an effective method of mopping up the excess cash.”

Let’s take this apart. By inflation, of course, he means the diminishing value of everyone’s savings. That prices go up, and in their view, this means that the value of money goes down. This inflicts harm on everyone. But not evenhandedly. Those who borrowed are beneficiaries (in the short-term way that anyone ever benefits from free goodies that he did not earn, which are taken from someone else). But those who prudently saved are robbed.

Talk about perverse incentives sorry, er, umm… by rewarding borrowing over saving, the central planners can encourage consumption and business expansion, and to make the economy grow!

Next, we get to the problematic concept of excess. Cash saved is deemed to be excess. What does that even mean? With something like eating, there is a clear definition: when you gain weight in the form of fat. And this is measured relative to the ideal amount for the long-term health of the body. But with cash savings, it is meaningless to declare it to be excess.

Also note that someone has to be empowered to Decide that you have too much cash. So this nonsense term serves to carry the baggage of a central planner. A technocrat who gets to sit there, and judge your bank balance with respect to a magic formula or political expediency. Speaking of baggage, the word overhang serves only to carry more baggage. Like your cash is some kind of Sword of Damocles, hanging over someone’s head—the head of the body economic?

Cash is, somehow, a threat. And therefore this Decider, this central planner, has to mop it up! This rubbish term smuggles the idea that your cash is their mess. Messes need to be cleaned up, do they not?

All it needs to be hammered into the mind of the victim is an appeal to the public interest. This is not your interest. It is not the interest of those who have savings that the Deciders have deemed to be excess. It is the interest of no one, just the nameless public as a faceless collective. And in the name of this alleged interest of no one in particular, the government is to mop up your cash. That is, loot your savings. And notice how the term mop up is a very vague, approximate understanding of what happened. It serves to conceal the truth.

Don’t object, this cash was excess anyways, so they Decided that you didn’t need it.

Yes, I am seriously pissed-off! And let me tell you what I really think.

I think that economic arguments need to be addressed with economic arguments. I can and do discuss capital accumulation, incentives, and the other topics relevant to this idea of deliberate devaluation. Without economic argument, one concedes to the dirigistes that central planning is practical, that it works, that it achieves—or at least in theory could achieve—its stated objective.

But in addition, one has a moral obligation to make the moral argument as I just did. We need to show a clear picture of what this is. The language offered by our would-be central planners is antiseptic, and often abstract or academic. By stripping away the mealy-mouthed phraseology, by not letting them frame the issue in terms of generic aggregate statistics, by objecting to the vague hand-waving of the public interest, we can help people see what it really means.

Mopping up the excess cash is a sloppy word soup. Each word is designed to deceive. And as a phrase, it means, can only mean, one thing. Looting. They want to loot you. Yes, even the otherwise-free-marketers who can explain what’s wrong with minimum wage laws, why we should not restrict imports, how rent control causes housing shortages, and why healthcare regulation reduces quality and increases costs. Even these folks, when they speak of mopping up your savings, mean what they say. They know what it means, even while carefully picking words that misdirect you.

What is in need of mopping up, is the central planning school and its propaganda. It is long past time to stop the central planning apologia.

***

I make no predictions in my annual Reflections essay (I save those for the Monetary Metals Gold Outlook, the 2022 edition is coming soon). However, I’d like to express a few hopes.

My first hope, if it wasn’t clear at the start of this essay, is that enough people get mad enough at health theater to effectively call for its end. We need to release the restrictions on social and commercial activities, and we need to do it yesterday.

I understand that zero interest rate policy forces people to speculate, as a surrogate for earning a yield on savings. Regulation cannot stop it, nor economics education, nor volatility. People seek capital gains, when they cannot attain their goals via compound interest. But my second hope, is that a certain kind of smug (pseudo) certainty that is prevalent in the bitcoin community will end. I don’t know whether the price action in 2022 will force this. But I do know that no good comes out of attacking people personally, over a disagreement. I refer to malevolent comments such as “have fun staying poor” and “you’re not gonna make it.” Come on, people. Do you really want to see all the people who didn’t buy bitcoin perish? Would you want to live in that sort of world?

I will have more to say about bitcoin in our annual Gold Outlook Report for 2022.

So called Modern Monetary Theory (which is not modern, does not describe money, and is not a theory) is on the rise. Like Keynesianism before it, it has a certain inevitability. That is, if people accept the ideas of collectivism, of need, of the public interest, and of free mana from Heaven—then MMT is a more consistent set of beliefs and policy recommendations. My third hope is that a proper intellectual opposition develops. And to be clear, advocates of various flavors of Monetarism, the otherwise-free-marketers, are not a proper opposition. They’ve already conceded on collectivism and central planning. Therefore it is inevitable that they will lose, as MMT is a more consistent version of the same basic ideas. I wrote one article to show why MMT is a cargo cult, and plan to write more as time permits.

Finally, I hope that 2022 is a better year than the last two. I hope that my friends have more reasons to be hopeful as we go forward. 2020 brought us to a dark place, with astonishing speed that I could not have imagined beforehand. I hope that we are ready to move forward, to a brighter place.

Cheers!

© 2022 Keith Weiner

Tags: Blog,Featured,newsletter