Mickey Fulp, aka the Mercenary Geologist, interviewed Monetary Metals’ CEO Keith Weiner to discuss the maturity of Monetary Metals’ recent gold bond. Gold bonds are denominated in gold, with principal and interest payable in gold. Mickey and Keith have a wide ranging discussion which covers the history of gold as money in the United States, including the history of gold bonds, which were commonplace until 1933. Listen to their conversation below. [embedded content]...

Read More »What’s In Your Loan?

To listen to the audio version of this article click here Opposing Monetary Directions “Real estate is the future of the monetary system,” declares a real estate bug. Does this make any sense? We would ask him this. “OK how will houses be borrowed and lent?” “Look at this housing bond,” he says, pointing to a bond denominated in dollars, with principal and interest paid in dollars. “What do you mean ‘housing’ bond’,” we ask, “it’s a bond denominated in dollars!”...

Read More »Monetary Metals Proves Marketplace for Gold Yield with Valaurum Gold Lease

Scottsdale, Ariz – November 16, 2021 – Monetary Metals is pleased to announce a new gold lease to Valaurum to expand production of the Aurum®, their physical gold currency product. The lease size has grown by 800%. Example of the Aurum®. Investors in the Monetary Metals gold lease are earning 2.25% interest on gold to finance production of the Aurum®, Valaurum’s physical gold currency product. “We’re thrilled to get a new gold lease with Monetary Metals to scale up...

Read More »Perversity Thy Name is Dollar

[unable to retrieve full-text content]Breaking Down the Dollar Monetary System If you ask most people, “what is money?” they will answer that money is the generally accepted medium of exchange. If you ask Google Images, it will show you many pictures of green pieces of paper. Virtually everyone agrees that money means the dollar.

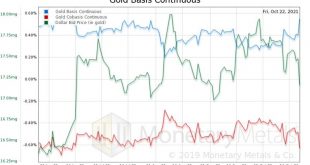

Read More »Rising Fundamentals of Gold and Silver

[unable to retrieve full-text content] Prices move up and down, in the restless churn of our irredeemable monetary system. There are several schools of thought whose theories attempt to describe, if not predict, the next price move.

Read More »Why a Yield on Gold Matters

Picture, if you can, a world in which gold circulates as the medium of exchange. People pay for everything, from groceries to rent, in gold. Employers pay wages in gold. Productive enterprises borrow gold to finance everything from food production to constructing apartment buildings. In other words, picture a world where there’s abundant opportunities to earn a yield on gold and finance productive businesses in gold. What Happened to Gold After the Gold Standard? It...

Read More »Why Isn’t Gold Going Up with Inflation?

Many voices in the gold community are making a simple point. Look at the prices of oil, copper, and other commodities. They are skyrocketing. The mainstream explanation—shared by Keynesians, Monetarists, and many Austrians—is that the cause of this skyrocketing is the increase in the quantity of what is called “money”. The price of gold has not been going up. The inference is that it should be going up (note the word “should” is very dangerous in trading). The...

Read More »Can Interest on Gold Outpace Inflation?

Yield. It’s on the tip of every investor’s tongue, but it’s much harder to find than it used to be. A long time ago, in a galaxy far, far away (like the early 1980’s) one could simply open a savings account, purchase a CD or US 10-year notes, and earn between 7% to 14%. The idea of earning 14% on treasurys seems the stuff dreams are made of. And you must be dreaming if you think you can find that kind of yield today. Interest rates are at zero, near zero, or negative...

Read More »How to Invest in Gold Better than Ray Dalio

Ray Dalio made waves earlier this year when he acknowledged that Bridgewater bought an undisclosed amount of bitcoin. In a recent interview, however, Dalio made it clear that his love for gold is still greater. “If you put a gun to my head, and you said, ‘I can only have one,’” says Dalio. “I would choose gold.” (Source of Quote) We agree with Dalio’s decision to choose gold over bitcoin, but we think it’s high time that he explores some better ways of owning gold....

Read More »Episode 24: Destructive Profit vs Productive Profit

This week’s episode of the Gold Exchange Podcast explores the idea of profits, and why it matters how you get them. Much of the financial world has confused the idea of profit with price appreciation. Or as we like to say, they confuse investment with speculation. Investment is deploying capital productively in a business for a yield. Speculation is betting one’s capital on an asset price rising. There’s a reason why this confusion exists. Central Banks have...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org