The last few days of trading in silver have been a wild ride. On Wednesday morning in New York, six hours before the Fed was to announce its interest rate hike, the price of silver began to drop. It went from around $22.65 to a low of $22.25 before recovering about 20 cents. At 2pm (NY time), the Fed made the announcement. The price had already begun spiking higher for about two minutes. As an aside, we wonder a bit about how they keep privileged traders from peeking...

Read More »Monetary Metals Completes Latest Capital Raise

Scottsdale, Ariz –May 5, 2022 Monetary Metals® has recently closed a $4.5 million equity capital raise, bringing the total funds raised to over $8.5 million. The goal of the capital raise is to support the company to scale up. This round was oversubscribed, like all previous rounds. The company aimed to raise $3 million. The founder and CEO of Monetary Metals, Keith Weiner commented, “We had strong investor interest in our company during this equity raise, because...

Read More »Ask Keith Anything, Part III

Welcome to the third installment of our Ask Keith Anything video series. We published the call for questions far and wide to our readership, and the response was overwhelming! We received questions from all over the world. Now we’ve published the results! In this episode, Keith answers your questions on Bitcoin, supply chain bottlenecks, banking, book recommendations, the gold and silver markets and so much more![embedded content] Additional Resources Ask Keith...

Read More »Time for a Silver Trade?

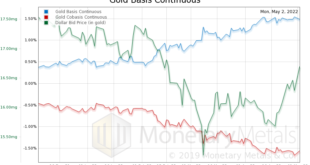

The price of silver has been going down, and then down some more. From over $28 a year ago, and over $26.50 a month ago, it’s now at a new low under $22.50. Four bucks down in a month. However, it’s been behaving differently than gold behind the scenes. Let’s look at the gold and silver basis charts to see. Gold Fundamentals – Gold Basis Analysis The gold basis (i.e. abundance to the market) was humming along around 0.5%. Then, as the price began to rise, it rose...

Read More »It’s Time for TINA to Retire

To listen to the audio version of this article click here. In the world of trends, history repeats more than it rhymes. Things which were considered “in” decades ago, reemerge as cool again decades later. From mom jeans to vinyl records and even Marxist ideology. The spotlight of today turns to things—both good and bad—once forgotten. Inflation is the latest trend to reemerge. But this isn’t the kind and considerate inflation which hummed quietly in the background...

Read More »AKA Part I

Thanks for all of those great questions you submitted! Make sure you follow us on Twitter, Facebook and LinkedIn and are subscribed to our YouTube Channel so you can submit question and check out all of our audio articles, media appearances, podcasts episodes and more. A Gold Mine of Show Notes Ukraine and inflation Famous Buyer and Seller Fallacy Monetary Metals fundamental gold price World Gold Council estimates on amount of gold mined The Dawn of Gold by Philip...

Read More »Oil, the Ruble and Gold Walk into a Bar…Part III

Part III – Gold Standards, the good, the bad, and the ugly. Gresham’s law and gold. Is it even possible to return to a gold standard today? Is Russia leading the push, or do we need something else? What A Gold Standard Isn’t Can we all recognize the simple fact that every government price-fixing scheme, ever, has failed? For example, banana republics have declared their pesos to be worth $1. But when the market decides to redeem pesos for dollars 1-to-1, the...

Read More »Oil, the Ruble, and Gold Walk into a Bar…

[unable to retrieve full-text content]Part I – Unpacking the narrative of how Russia is going to change the global monetary system. There is a Narrative about Russia and how it will change the monetary system. Many analysts in the gold community are promoting this story. There’s just one problem with this Narrative. It is like how Michael Crighton described the Gell-Mann Amnesia Effect, stating that the newspaper is full of stories explaining how “wet streets cause...

Read More »Keith Weiner on the Gold Market and How to Replace Government Paper Money

Keith Weiner is founder and CEO of Monetary Metals, an investment firm that pays interest on gold, and the founder of the Gold Standard Institute USA. Weiner’s mission is to provide entrepreneurial services and education to help restore gold as the world’s money par excellence. Mentioned in the Episode and Other Links of Interest: The YouTube version of this interview Keith Weiner’s bio at Monetary Metals Weiner’s Forbes article on gold and silver coins not...

Read More »Human Action in the Silver Market

Sorry, I've looked everywhere but I can't find the page you're looking for. If you follow the link from another website, I may have removed or renamed the page some time ago. You may want to try searching for the page: Search Searching for the terms %3Futm+source%3Drss%26utm+medium%3Drss%26utm+campaign%3Dweiner+human+action+silver+market ...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org