This week’s episode of the Gold Exchange Podcast, Keith Weiner interviews independent precious metals advisor Claudio Grass. Claudio explains his sound money origin story and how the rest of the world understands gold vs Americans’ understanding. The wide ranging conversation spans everything from history, to covid lockdowns, to how societies change, to our relationship to money and even political principles and philosophy. Highlights from the episode include:...

Read More »Monetary Metals Completes Gold Lease to European Refiner L’Orfebre

Scottsdale, Ariz – January 11, 2022 – Monetary Metals has leased gold to L’Orfebre, a European precious metals refiner. The lease expands Monetary Metals’ gold and silver lease portfolio to include five industry verticals: bullion, jewelry, manufacturers, miners, and now refiners, on four continents. Investor demand for the lease was substantial, resulting in an oversubscription of the offering. Investors earn a return on their gold, paid in gold instead of...

Read More »Reflections Over 2021

In March, I flew for the first time since the start of Covid health theater. I was invited to speak at the Austrian Economics Research Conference in Auburn, AL. My talk covered Jimi Hendrix, and an infamous bridge collapse. In other words, I discussed my theory of interest and prices. At the end of November, I flew to London for two weeks of business meetings. This was my first international trip since the Covid lockdown. I offer three comments. One, the UK...

Read More »Gold Under the Mattress vs Gold Investments

“If you can’t hold it in your hand, you don’t own it.” That’s one of the most common refrains we hear from gold and silver investors. And while there is a kernel of truth in this saying, investing by these words alone could prove a costly mistake. This popular phrase conflates and entangles two different concepts. Gold owned for emergency use or as a financial insurance policy Gold owned for investment purposes In this article, we’ll untangle those ideas and offer a...

Read More »Alabama to Consider Extending Sales Tax Exemption on Sound Money

. (Birmingham, AL, USA – January 10, 2022) – Alabama currently exempts precious metals from state sales tax, however this exemption is set to expire in 2022. A senator in the Yellowhammer State hopes to extend this popular exemption. Introduced by Senator Tim Melson (1-R), and supported by the Sound Money Defense League, Senate Bill 13 maintains current law by extending the existing sales tax exemption on the purchases of precious metals purchases If Senate Bill 13...

Read More »Gold Price News: Gold Down 1% in Wake of More Hawkish Federal Reserve Meeting Minutes

Gold price fell to $1,808 an ounce in the wake of the release of the minutes of the December Federal Reserve meeting, having hit an intra-day high of $1,829. Silver price fell to $22.72 an ounce from an intra-day high of $23.26. Gold and silver have continued to sell off this morning with gold trading as low as $1,794 and silver trading down to $22.14. The FOMC minutes showed a much more hawkish Fed than markets had been expecting. The minute suggests that the Fed...

Read More »Why Did the World Choose a Gold Standard Instead of a Silver Standard?

Among those who support the end of government fiat money, it’s not uncommon to hear and see claims that gold is “the best money” or “natural money” or the only substance that’s really suited to be commodity money. In many of these cases, when they say “gold” they mean gold, and not silver, platinum, or any other precious metal. Naturally, one can expect to encounter these claims among those who have made a living out of promoting gold and gold-related investments for...

Read More »The Zombie Ship of Theseus

To listen to the audio version of this article click here. The Ship of Theseus is an old philosophical thought experiment. It asks a question about identity. Suppose you replace all of the boards of a ship with new ones—is it still the same ship? We are not going to try to resolve this millennia-old paradox. Instead, we are going to add one more element, and then tie it to the monetary system. The additional element is what if the replacement boards are adulterated...

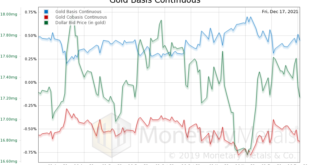

Read More »Inflation and Gold: What Gives?

Listen to the audio version of this article here! In the last Supply and Demand update, we discussed some different theories which attempt to explain what causes the gold and silver prices to move. We mentioned the: “…attempt to hold up a famous buyer of metal, while ignoring the thousands of not-famous sellers who sold the metal to said famous buyer.” Since then, Ireland has bought gold for the first time in over a decade. And predictably, most voices in the gold...

Read More »How the Classical Gold Standard Fueled the Rise of the State

Throughout much of the past century, the idea of a gold standard for national currencies has been routinely linked with laissez-faire economics and “classical liberalism”—also known as “libertarianism.” It’s not difficult to see why. During the second half of the nineteenth century—as free-market liberalism was especially influential in much of Western Europe—it was the liberals who pushed for the adoption of the system we now know as the classical gold standard...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org