We welcome Travis Kimmel, AKA the Dollar Fatalist, the Wizard of Web1, the Crusher of Cryptocurrency dreams, and our favorite moniker, the illustrious BearLord, onto the Gold Exchange Podcast! Travis joins Keith to talk about Bitcoin acolytes’ underlying Marxist philosophy, interest rate hikes, balance sheets, and so much more. Listen in to hear what the famous BearLord thinks about whether a recession cometh, and why it’s insanity to hike rates in this market. This...

Read More »Speaker Boehner Readies Final Sellout As Debt Ceiling Debacle Looms

It’s campaign season, and that means non-stop media coverage of candidate polls, quips, gaffes, tweets, emails, controversies, lies, and scandals. It all makes for a good soap opera. Unfortunately, it’s almost all irrelevant in the big picture. The media prefer to focus on the sideshow rather than the 800-pound gorilla in the room: the looming debt crisis. Nothing that comes out of a pundit’s mouth or a Hillary Clinton email will close the $210 trillion long-term...

Read More »Analysis Featured In Gold We Trust Report 2022

For well over a decade, Ronnie Stoeferle has written the annual In Gold We Trust Report. Since 2013 it has been co-authored by his partner Mark Valek and has provided a holistic assessment of the gold sector and the most important factors influencing it, including interest rates, debt, central bank policy and fundamental analysis. This years report undertakes a comprehensive macroeconomic analysis and examines the fundamental workings of the financial and economic...

Read More »Monetary Metals CEO Keith Weiner Interviewed on RealVision

CEO of Monetary Metals Keith Weiner sat down with Michael Green of RealVision to discuss how Monetary Metals increases gold’s value proposition by paying interest on gold and silver holdings and the inevitable debasement of fiat currencies. Keith and Mike discuss the inherent volatility of Bitcoin, Costco’s ability to maintain its price point, and the colossal meltdown of the Terra stablecoin. In addition to exploring all things gold, Keith and Mike get into the...

Read More »The Silver Chart THEY Don’t Want You to See!

On Thursday May 12, the price of silver fell about a buck. As with every one of these big price moves, the question is: what really happened? Below is a chart of the day’s action, with price overlaid with basis. Basis = future – spot. It is a great (i.e. the only) indicator of abundance or scarcity of metal to the market. However, here we are using it for a different, simpler purpose. We want to see the relative moves in the spot price and the near futures contract...

Read More »Monetary Metals is Hiring an Associate Account Manager

Monetary Metals is growing, and we’re looking for our next key hire: Associate Account Manager. We’re giving an ounce of gold to whoever refers the successful candidate. If you know the perfect candidate for this role, please follow these instructions: Email [email protected] with “I have a Golden Candidate” in the subject line In the body of the email include: Your name, email address, and phone number Applicant’s name, email address,...

Read More »Is Gold Starting to Behave Itself?

Gold is doing what it is supposed to do! Equity markets are tumbling, “NASDAQ 100 Rout Erases $1.5 Trillion in Market Value in 3 Days” reads one Bloomberg headline. The big names such as Apple lost over US$225 billion, Microsoft almost US$200 billion, Amazon and Tesla each lost US$175 billion market value over the three trading days from May 4 to May 9. Bonds are also declining in value as yields are rising. The market selloff has been the most extreme in the tech...

Read More »The War on Gold Ensures the Dollar’s Downfall

Last month was the 89th anniversary of one of America’s biggest blunders on her descent from honest, sound money into weaponized political money: Executive Order 6102. Signed on April 5, 1933, U.S. President Franklin Delano Roosevelt required all persons holding more than five ounces of gold to deliver their “gold coin, gold bullion, and gold certificates, now owned by them to a Federal Reserve Bank, branch or agency, or to any member bank of the Federal...

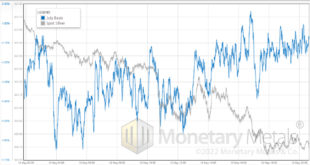

Read More »Forensic Analysis of Fed Action on Silver Price

The last few days of trading in silver have been a wild ride. On Wednesday morning in New York, six hours before the Fed was to announce its interest rate hike, the price of silver began to drop. It went from around $22.65 to a low of $22.25 before recovering about 20 cents. At 2pm (NY time), the Fed made the announcement. The price had already begun spiking higher for about two minutes. As an aside, we wonder a bit about how they keep privileged traders from peeking...

Read More »Monetary Metals Completes Latest Capital Raise

Scottsdale, Ariz –May 5, 2022 Monetary Metals® has recently closed a $4.5 million equity capital raise, bringing the total funds raised to over $8.5 million. The goal of the capital raise is to support the company to scale up. This round was oversubscribed, like all previous rounds. The company aimed to raise $3 million. The founder and CEO of Monetary Metals, Keith Weiner commented, “We had strong investor interest in our company during this equity raise, because...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org