(Richmond, Virginia – April 12, 2022) – By signing sound money legislation last night, Virginia Governor Glenn Youngkin has ended Virginia’s discriminatory practice of assessing sales taxes on smaller purchases of gold, silver, platinum, and palladium bullion and coins. Virginia’s House Bill 936, originally introduced by Del. Amanda Batten, was considered by multiple House and Senate committees before passing overwhelmingly out of both chambers and reaching the...

Read More »Inflation Protection Strategies You Need to Implement Now

This week on GoldCore TV, Dave Russell welcomes Tim Price of Price Value Partners. Tim sees the current inflationary pressures as simply the beginning of a bigger move that could end in a new monetary system. [embedded content] Make sure you don’t miss a single episode… Subscribe to our YouTube channel [embedded content] You Might Also Like Gold Price Today – Gareth Soloway 2022-03-24...

Read More »Oil, the Ruble and Gold Walk into a Bar…Part III

Part III – Gold Standards, the good, the bad, and the ugly. Gresham’s law and gold. Is it even possible to return to a gold standard today? Is Russia leading the push, or do we need something else? What A Gold Standard Isn’t Can we all recognize the simple fact that every government price-fixing scheme, ever, has failed? For example, banana republics have declared their pesos to be worth $1. But when the market decides to redeem pesos for dollars 1-to-1, the...

Read More »Oil, the Ruble, and Gold Walk into a Bar…

[unable to retrieve full-text content]Part I – Unpacking the narrative of how Russia is going to change the global monetary system. There is a Narrative about Russia and how it will change the monetary system. Many analysts in the gold community are promoting this story. There’s just one problem with this Narrative. It is like how Michael Crighton described the Gell-Mann Amnesia Effect, stating that the newspaper is full of stories explaining how “wet streets cause...

Read More »Can Russia Evade Sanctions via the Gold or Bitcoin Trades?

Can Russia Evade Sanctions via the Gold and Bitcoin Trades? [embedded content] [embedded content] You Might Also Like Gold Price Today – Gareth Soloway 2022-03-24 Dave Russell of GoldCore TV welcomes back Gareth Soloway of InTheMoneyStocks.com where we ask if the bull market for stocks is back and if $2,500 on gold is still on the cards for 2022? The Fed Has No Idea...

Read More »Human Action in the Silver Market

Sorry, I've looked everywhere but I can't find the page you're looking for. If you follow the link from another website, I may have removed or renamed the page some time ago. You may want to try searching for the page: Search Searching for the terms %3Futm+source%3Drss%26utm+medium%3Drss%26utm+campaign%3Dweiner+human+action+silver+market ...

Read More »Gold Price Today – Gareth Soloway

Dave Russell of GoldCore TV welcomes back Gareth Soloway of InTheMoneyStocks.com where we ask if the bull market for stocks is back and if $2,500 on gold is still on the cards for 2022? What role does the inversion of the yield curve play in signaling a US recession? [embedded content] [embedded content] You Might Also Like Gold Gives You Personal Sovereignty 2022-03-09 Dave Lukas of Misfit...

Read More »The Fed Has No Idea What’s Coming Next!

We will let you know what we are doing once we know what we are doing was the message from the Federal Reserve statement and Chair Powell’s press conference that followed. The Fed, as widely expected did raise their short-term rate, known as the fed funds rate, by .25% to a range of 0.25% to 0.50%. This was the first increase since 2018. Along with the statement FOMC (Federal Open Market Committee) participants also released their Summary of Economic Projections....

Read More »How Much is the Gold Cube Worth?

Listen to the audio version of this article here. Here at Monetary Metals we love providing investors with A Yield on Gold, Paid in Gold®. So when we heard that German artist Niclas Castello designed a 186 kilogram pure 24-karat gold cube called the “Castello Cube” as an art installation in the middle of Central Park we couldn’t help but start doing a little math on Mr. Castello’s art piece. How Much is the Gold Cube Worth? Most people when they see the gold cube...

Read More »This is Not The Silver Breakout You’re Looking For!

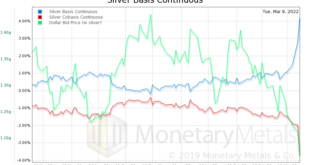

To listen to the audio version of this article click here. Every once in a while, one regrets not acting sooner, or not acting soon enough. In our case, we did not publish this Tuesday evening. We should have. Today the price is down, and others may also call for lower silver prices. Oh well. Our consolation is that they most likely are not calling for lower silver prices based on the same indicator we observe. The basis. Here is the chart. Silver Price Basis Chart...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org