In what has become a four-part series, we are looking at the monetary science of China’s potential strategy to nuke the Treasury bond market. In Part I, we gave a list of reasons why selling dollars would hurt China. In Part II we showed that interest rates, being that the dollar is irredeemable, are not subject to bond vigilantes. In Part III, we took on the Quantity Theory of Money head-on, and showed the...

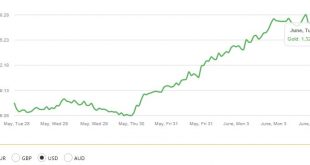

Read More »Gold Hits 10 Week High At $1,328/oz as Trade Wars Spur Safe Haven Demand

Gold has consolidated on yesterday’s gains and is marginally higher as risk aversion creeps back into markets. Gold rose 1.5% yesterday to its highest level in more than three months. Concerns that trade wars look set to escalate globally and fears that President Trump’s threat of tariffs on Mexico will hurt the global economy are spurring safe haven demand. Gold had a fourth straight session gain yesterday, settling at...

Read More »Dollar Supply Creates Dollar Demand, Report 2 June

We have been discussing the impossibility of China nuking the Treasury bond market. We covered a list of challenges China would face. Then last week we showed that there cannot be such a thing as a bond vigilante in an irredeemable currency. Now we want to explore a different path to the same conclusion that China cannot nuke the Treasury bond market. To review something we have said many times, the dollar is borrowed....

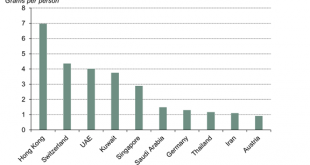

Read More »Gold Investment In Switzerland Remains Very Popular

Investors in Switzerland like gold and it is the second most popular investment after property or real estate 20% plan to invest in gold in the next 12 months Almost two-thirds buy or invest in precious metals at their bank; fewer than one-in-ten buy gold online by Alistair Hewitt of the World Gold Council There’s no doubt about it: the Swiss like gold. Switzerland has the second-highest per capita gold demand in the...

Read More »The Crime of ‘33, Report 27 May

Last week, we wrote about the impossibility of China nuking the Treasury bond market. Really, this is not about China but mostly about the nature of the dollar and the structure of the monetary system. We showed that there are a whole host of problems with the idea of selling a trillion dollars of Treasurys: Yuan holders are selling yuan to buy dollars, PBOC can’t squander its dollar reserves If it doesn’t buy another...

Read More »China’s Nuclear Option to Sell US Treasurys, Report 19 May

There is a drumbeat pounding on a monetary issue, which is now rising into a crescendo. The issue is: China might sell its holdings of Treasury bonds—well over $1 trillion—and crash the Treasury bond market. Since the interest rate is inverse to the bond price, a crash of the price would be a skyrocket of the rate. The US government would face spiraling costs of servicing its debt, and quickly collapse into bankruptcy....

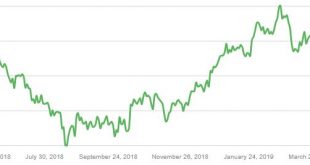

Read More »Gold Tops $1,300/oz As Trade Wars Escalate and Increased Risk of U.S. War With Iran

* Gold sees safe haven demand push it to highest in one month as it breaches key $1,300/oz and £1,000/oz levels * U.S. China trade wars escalates as China retaliates and imposes tariffs on $60 billion of U.S. goods * Increased risk of war in Middle East after U.S. alleges Iran bombed Saudi oil vessels destined for the U.S. Gold prices held steady near one-month highs today as an escalation in Sino-U.S. trade war saw...

Read More »The Monetary Cause of Lower Prices, Report 12 May

We have deviated, these past several weeks, from matters monetary. We have written a lot about a nonmonetary driver of higher prices—mandatory useless ingredients. The government forces businesses to put ingredients into their products that consumers don’t know about, and don’t want. These useless ingredients, such as ADA-compliant bathrooms and supply chain tracking, add a lot to the price of every good. Of course...

Read More »New Federal Legislation Requires Full Audit of America’s Gold Reserves

Congressman Alex Mooney (R-WV) Washington, DC (May 8, 2019) – U.S. Representative Alex Mooney (R-WV) introduced legislation this week to provide for the first audit of United States gold reserves since the Eisenhower Administration. The Gold Reserve Transparency Act (H.R. 2559) – backed by the Sound Money Defense League and government accountability advocates – directs the Comptroller of the United States to conduct a...

Read More »Nonmonetary Cause of Lower Prices, Report 5 May

Over the past several weeks, we have debunked the idea that purchasing power—i.e. what a dollar can buy—is intrinsic to the currency itself. We have discussed a large non-monetary force that drives up prices. Governments at every level force producers to add useless ingredients, via regulation, taxation, labor law, environmentalism, etc. These are ingredients that the consumer does not value, and often does not even...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org