China increased its gold reserves for a third straight month in February, data from the People’s Bank of China (PBOC) showed this morning. The value of China’s gold reserves rose slightly to .498 billion in February from .319 billion at the end of January, as the central bank increased the total amount of gold reserves to 60.260 million fine troy ounces from 59.940 million troy ounces. The People’s Bank of China (PBOC) did not explain why it bought more gold. It is almost ertaintly in large part due to concerns about the Chinese, U.S. and global economic outlook and the outlook for the dollar in the coming months and years. China’s foreign exchange (fx) reserves rose to their highest in six months in February.

Topics:

Mark O'Byrne considers the following as important: 6) Gold and Austrian Economics, 6a) Gold & Bitcoin, Daily Market Update, Featured, GoldCore, newsletter

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

|

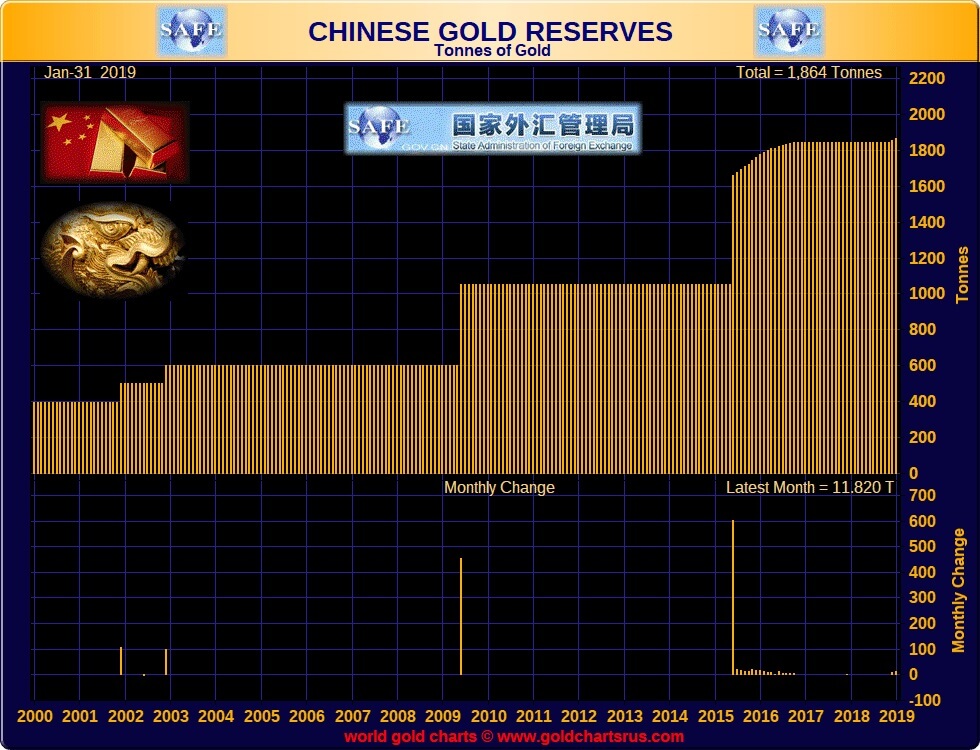

China increased its gold reserves for a third straight month in February, data from the People’s Bank of China (PBOC) showed this morning. The value of China’s gold reserves rose slightly to $79.498 billion in February from $79.319 billion at the end of January, as the central bank increased the total amount of gold reserves to 60.260 million fine troy ounces from 59.940 million troy ounces. The People’s Bank of China (PBOC) did not explain why it bought more gold. It is almost ertaintly in large part due to concerns about the Chinese, U.S. and global economic outlook and the outlook for the dollar in the coming months and years. China’s foreign exchange (fx) reserves rose to their highest in six months in February. There are growing concerns over U.S.-China trade talks and the potential for trade wars and the impact of this on their respective economies. |

Chinese Gold Reserves 2000-2019 |

| Chinese foreign exchange (fx) reserves, the world’s largest, rose by $2.26 billion in February to $3.090 trillion, central bank data showed on Thursday, marking the highest level since August 2018. The U.S. trade deficit hit its highest in a decade in 2018, in a resounding failure for President Donald Trump’s global trade offensive, U.S. government data showed yesterday.

It is important to realise that the PBoC still have a very meager 2.4% of its foreign exchange reserves in gold, so their gold diversification is likely in it’s infancy. John Reade of the World Gold Council notes on Twitter that the last time the PBoC reported regular monthly increases in gold holdings, it continued for 24 months. We have long pointed out two other entities, besides the PBOC, have also been buying gold – the State Administration of Foreign Exchange (SAFE) and the China Investment Corporation (CIC). These potentially sizeable sources of demand are not included in the PBOC figures. China may be adopting the Russian strategy of being very public in announcing their increasing gold reserves as they attempt to position the yuan as an alternative reserve currency to the world’s current reserve currency the dollar. |

|

Tags: Daily Market Update,Featured,newsletter