Last week, I ranted about the problem with our monetary system and trajectory: falling interest rates is Keynes’ evil genius plan to destroy civilization. This week, I continue the theme—if in a more measured tone—addressing the ideas predominant among the groups who are most likely to fight against Keynes’ destructionism. They are: the capitalists, the gold bugs, and the otherwise-free-marketers. I do not write this to attack any particular people, nor indeed as an attack at all. My purpose comes from my belief that to fix a problem, one must understand the nature of the problem. I highlight these groups because, if there is ever to be a real movement to reform our monetary system, it would come from one of these

Topics:

Keith Weiner considers the following as important: 6) Gold and Austrian Economics, 6a) Gold & Bitcoin, Basic Reports, Featured, Friedman, gold bug, Keynes, newsletter, otherwise-free-marketer

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Last week, I ranted about the problem with our monetary system and trajectory: falling interest rates is Keynes’ evil genius plan to destroy civilization. This week, I continue the theme—if in a more measured tone—addressing the ideas predominant among the groups who are most likely to fight against Keynes’ destructionism. They are: the capitalists, the gold bugs, and the otherwise-free-marketers. I do not write this to attack any particular people, nor indeed as an attack at all. My purpose comes from my belief that to fix a problem, one must understand the nature of the problem.

I highlight these groups because, if there is ever to be a real movement to reform our monetary system, it would come from one of these groups, or ideally an alliance among all three. However, that is not in the cards today. Let’s look at why not.

The Capitalists

First are the capitalists. By capitalist, I do not mean those who advocate an unregulated, unshackled, unfettered, unrestricted, uncontrolled laissez-faire social system in which each man is free to produce and trade with others. I mean those who make money, who enjoy making money, and defend the making of money. This group is represented by Wall Street, the One Percent, or the Fat Cats.

Indelibly seared into my own brain is the Q&A with then-President of the Dallas Federal Reserve, Dick Fisher. Someone asked him about the wealth effect (the term economists use to describe the increase in spending, and hence GDP, when asset prices rise). He said expansively, “well, let me just say that the wealthy have been … very affected!” The room, full of one-percenters and aspiring one-percenters, gave a nice bit of applause to this statement.

For all that many Wall Streeters play at criticizing the Fed, they want the same thing that the Fed wants. They want smoothly rising asset prices, so they can safely use maximum leverage to make their bets, and maximize their profits.

They will happily use—and thereby reinforce—whatever measures paint a picture of a good economy. Because a good economy justifies rising asset prices. For example, if GDP goes up then that should be good for stocks and real estate.

It needs to be said. If you break a window, or the government borrows money to dole out welfare, it adds to GDP! This is not a recommendation for breaking windows or doling welfare. It is a damning indictment of GDP as a measure of the economy.

Unfortunately, the capitalists are not receptive to this argument (or the discussion of Keynes’ evil plan above). Upton Sinclair explains why not:

“It is difficult to get a man to understand something, when his salary depends upon his not understanding it!”

Also, and this is a not-inconsiderable force, no one likes to be told that the basis of his career is to profiteer on an illegitimate regime. It is much easier to deny the illegitimacy (i.e. argue it’s legitimate) than to confront that uncomfortable truth.

The Gold Bugs

Let’s move on to the gold bugs. Are the gold bugs among the one in a million who see the root of the problem? Or do they see the capitalists getting rich, and want the same for themselves? They see stocks and bonds and real estate going up, and the capitalists profiteering from it. They just want their preferred asset, gold, to go up. They confuse the gold standard with gold going up.

As the capitalists traffic in the collectivist faux-measures like GDP, the gold bugs traffic in the conspiracy theories such as Libya was going to lead an African gold standard, China is about to make the yuan gold-backed, the world is rejecting the dollar as reserve currency, or the International Monetary Fund is going to impose a new global currency that will be partially gold-backed.

The capitalists promote GDP because they think it will help conventional asset prices go up. The gold bugs promote conspiracy theories because they think it will help gold go up.

I will conclude this section with a headline (as I recall it) that made the rounds a year or two ago: “Nuclear war in Korea will be good for gold.” Those who traffic in such views are not thinking about reforming the monetary system (or horrors of nuclear war!). They are thinking of getting rich—gaining more of the very dollars they tell you will be worthless by tomorrow morning.

The Otherwise-Free-Marketers

Last, let’s look at the otherwise-free-marketers. I use this term for people who advocate free markets—except in money and credit. Milton Friedman was the archetype. Here is Friedman in The Case for Flexible Exchange Rates:

“The argument for a flexible exchange rate is, strange to say, very nearly identical with the argument for daylight savings time. Isn’t it absurd to change the clock in summer when exactly the same result could be achieved by having each individual change his habits? All that is required is that everyone decide to come to his office an hour earlier, have lunch an hour earlier, etc. But obviously it is much simpler to change the clock that guides all than to have each individual separately change his pattern of reaction to the clock, even though all want to do so. The situation is exactly the same in the exchange market. It is far simpler to allow one price to change, namely, the price of foreign exchange, than to rely upon changes in the multitude of prices that together constitute the internal price structure.”

This was a few pages after he declared that “Wage rates tend to be among the less flexible prices.” So, the man who is widely believed to stand for people being “free to choose” is arguing in essence that it’s better for the Ministry of Time to change the public’s clock, than for people be free to choose what time to open their offices.

He, and his ideological successors today, may stand for eliminating tariffs, lower minimum wages, and repealing rent control, but when it comes to money and credit, they have a huge blind spot when it comes to an actual free market.

They think a free banking system can be built on top of a base of fiat currency and a central bank (as one prominent economist said to an audience in which I sat). The only real debate among the otherwise-free-market economists is whether the central bank should adhere to a fixed rate of increase of the quantity of dollars (what Friedman called the K% Rule), whether it should have a strict policy of price stability (an Orwellian phrase which means chronic 2% rising prices), whether it should have its current dual manage of prices and unemployment, whether it should follow some more complex formula such as the Taylor Rule, or whether it should follow an alternative simple rule such as maintaining a fixed rate of GDP growth.

Why do they hold this assumption—that money depends on government, unlike food and clothing and medicine and iPhones which obviously don’t? It’s not that there is no theory of money that argues that money is not a product of the state.

The assumption derives, in part, from an unshakeable faith in the so-called business cycle. This view holds that a free market is prone to cycles of boom followed by bust. In this view a free market, free from all government interference (which is commonly, but not exclusively, monetary—and monetary interference is commonly, but not exclusively by a central bank) has an intrinsic tendency to excesses of both growth and contraction.

Central Planning to Correct Capitalism’s Boom Bust Cycle

This view, that capitalism has an inherent cycle, was promoted by Leninist economist Nikolai Kondratiev. When Lenin died, and Stalin took over, Kondratiev’s idea got him into trouble. Though a Marxist, his view of cycles was against the orthodoxy. A true Stalinist communist believes that capitalism collapses once and finally. It does not recover for more cycles. So comrade Kondratiev was sent to gulag (and eventually killed).

This same view of cycles is promoted today by the otherwise-free-marketers. The idea of cycles does not necessarily mean a central planner must smooth out such cycles. However, it is an important justification and tends to lead most adherents to that view. If cycles come from free markets, then surely the central planner can smooth them out somehow?

It was for this reason that they created the Federal Reserve in 1913. And it is for this reason that the Fed and its interference in markets are still justified today.

Most of the otherwise-free-marketers are against gold. They sense (as do the overt socialists and central planners) that gold stands in opposition to central planning. As Alan Greenspan wrote in 1966, “that gold and economic freedom are inseparable, that the gold standard is an instrument of laissez-faire and that each implies and requires the other.”

However, let’s move on to a group promotes a synthesis of central planning and gold. Their root economic error is to mistake redemption for purchase. Back in the days of the gold standard, one deposited a dollar’s worth of gold and had the right to redeem a dollar’s worth of gold. This was not a price. It was merely the standard for coins and bank deposits. It is akin to an Internet standard that says a certain kind of packet should be 512 bytes. It is not dictating the length of a message, just that longer messages must be broken up (for the sake of efficient handling by Internet routers).

But this group seeks to have the Fed impose, not a constant rate of inflation, nor to create a constant rate of growth, but a constant price of gold. Like all price-fixing schemes, it will fail when the market moves against it.

The otherwise-free-marketers do not address any of the allegations I have made against the regime of irredeemable currency. I have written tens of thousands of words arguing that debt necessarily grows exponentially. And tens of thousands more on the unhinged interest rate, which rose relentlessly until 1981, and which has been falling ever since. The falling interest rate causes many ills, and is the embodiment of Keynes brilliantly evil plan to destroy the capitalist order, euthanize the rentier (i.e. savers and investors), and lull the capitalists into supporting it because the process makes them feel richer and richer, as they consume their capital in an endless orgy of endlessly rising asset prices.

If somebody doesn’t do something, we will reach Keynes’ long run. That’s when, he conceded, “we’re all dead.”

Monetary Metals is doing something. Paying interest on gold is the path to once again using gold as a medium of exchange.

Supply and Demand Fundamentals

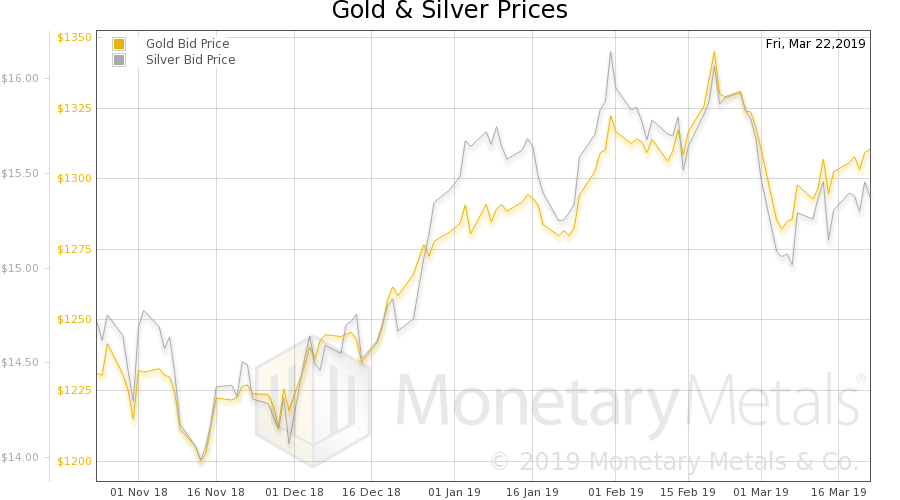

The prices of the monetary metals rose $11 and ¢27 this week,

The supply and demand fundamentals is the shortest section of this Report. This is because the actual data can be seen in a simple chart for each metal. If central banks were really buying mass quantities of gold in anticipation of a new gold-based global monetary system, or India were really importing all marketable gold, or the mainstream American public were desperately trading its dollars for gold, or China were really buying up all the physical gold to prepare for a gold-backed yuan (while selling paper gold, natch)…

…then the data would show this.

Mount Saint Helens was quiescent for a long time, until all of a sudden in 1980 it went wild with activity. There was an earthquake, then steam venting, then the side of the mountain began to bulge, then a second earthquake triggered that side to collapse. Then the volcano finally exploded.

The time from the first earthquake to the massive eruption was two months. We haven’t done the research, but we’d bet an ounce of fine gold against a soggy dollar bill that there were plenty of indications shown by sensitive seismographs for months prior the earthquake.

It is the same with gold price skyrocketing, which is just another way of saying dollar collapse. You won’t need to read about improbabilities like the world’s central banks desiring to give up power and move to gold, or mechanically impossible things like China retroactively declaring its currency to be gold-backed. You will see it in the rumbling that becomes a sea change of attitudes, the earthquake of numerous big bankruptcies, and then the collapse of many (dollar-derivative) currencies.

One day, the volcano will explode. However, “today is not that day!” said Aragorn.

In the meantime, we can watch the seismograph, which is the gold basis. And there are other seismographs, like the spread between junk and Treasury bonds. Which has been moving up since the start of the month, and is now close to the high made at the start of the year. If this spread is rising, it signals growing fear that high yield bonds will actually pay the investors’ capital back. So you see selling of junk / buying of Treasurys. And Treasury bond yields are falling, falling back into their decades-long trend. Which is a falling trend (sorry, we had to go for the pun).

A 10-year Treasury now pays 2.5% (while 10-year German Japanese government bonds pay negative, that is you pay to lend euros or yen to them). 10-year British gilts are now down to 1%. The Swiss yield is the most negative of all.

The capitalists and otherwise-free-marketers will tell you, “well, you see, actually, what had happened was, actually you should look at real yields aren’t negative.” To which the gold bugs will say “oh yes they are!”

We must say that, whatever the word for a hypothetical construct which does not exist, “real” is not that word. The interest rate that lenders are paid is negative. Who cares what a dismal model produced by the dismal science says?

So the fact remains. Keynesian rot has advanced beyond where Keynes predicted or perhaps intended. He said yield should be zero (and even generously allowed a tiny positive number to compensate the manager for his investment efforts). And now it’s negative in several major currencies. Euthanasia occurs even faster at negative yields than at zero.

At some point the sepsis of this disease will matter. We are not merely saying “what goes up must come down” which is an expression of a malevolent universe premise. There is no economic law that says achievement must be undone, successful must lead to failure, production must turn to ruin. The economic law is that if you render destruction profitable, then sooner or later you hollow out too much of the capital on which your civilization depends.

Gold and Silver PriceAnyways, let’s look at the only true picture of the supply and demand fundamentals of gold and silver. But, first, here is the chart of the prices of gold and silver. |

Gold and Silver Price(see more posts on gold price, silver price, ) |

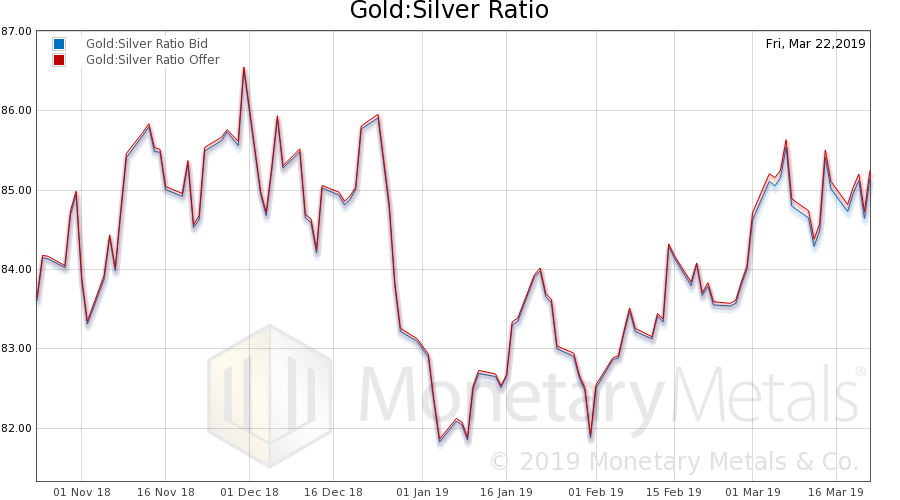

Gold:Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It was down a hair this week. |

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

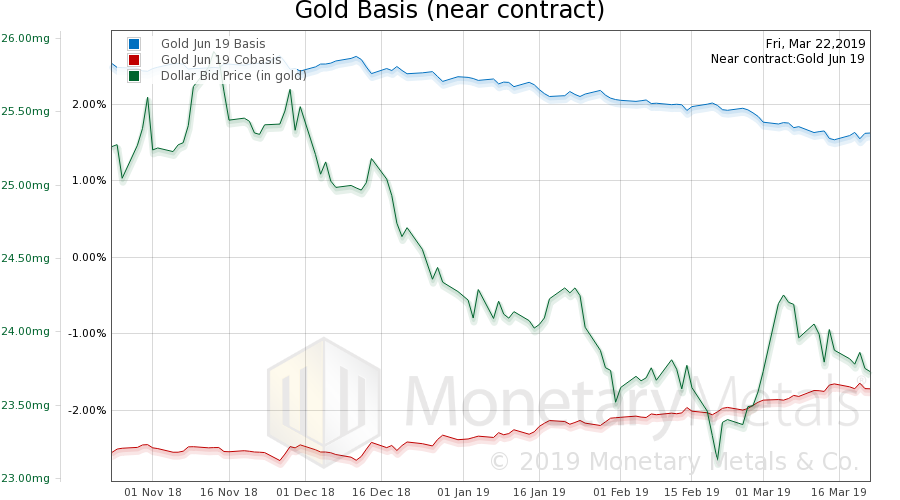

Gold Basis and Co-basis and the Dollar PriceHere is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. The scarcity (cobasis) of gold did not rise. So whatever buying drove up the price was not a pyroclastic flow of the biggest volcano in American history. It was a tepid little flow of an ordinary creek wending its way. Still, the Monetary Metals Gold Fundamental Price eked out another gain, up $15 to $1,512. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

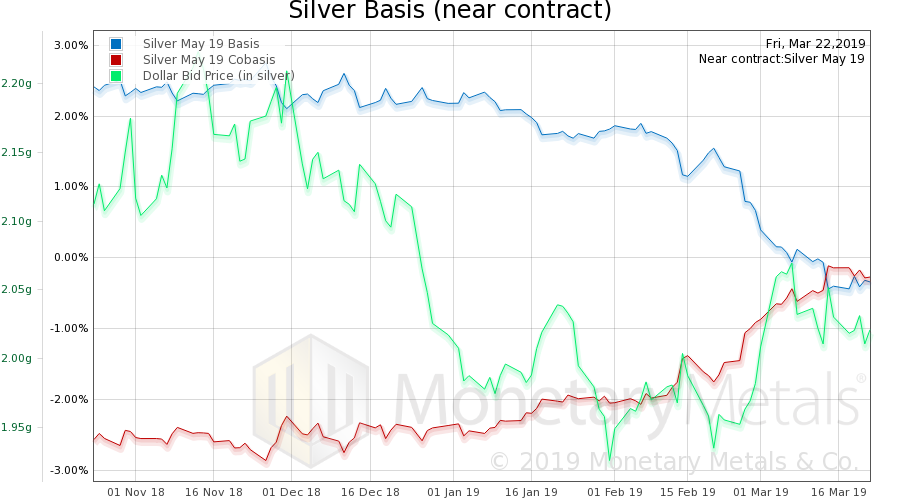

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. If the scarcity of gold did not rise, that of silver fell noticeably. And the Monetary Metals Silver Fundamental Price fell 31 cents to $15.99. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

| We read, this week, a story touting a big sale of silver to China. If it were true at all, then it could mean that a large seller of silver was looking for a bid to dump the metal on. Every transaction has a buyer and a seller. There’s a common fallacy to assume that the big, famous party is the one driving the deal. But what really matters is whether the buyer took the offer price, or the seller accepted the bid.

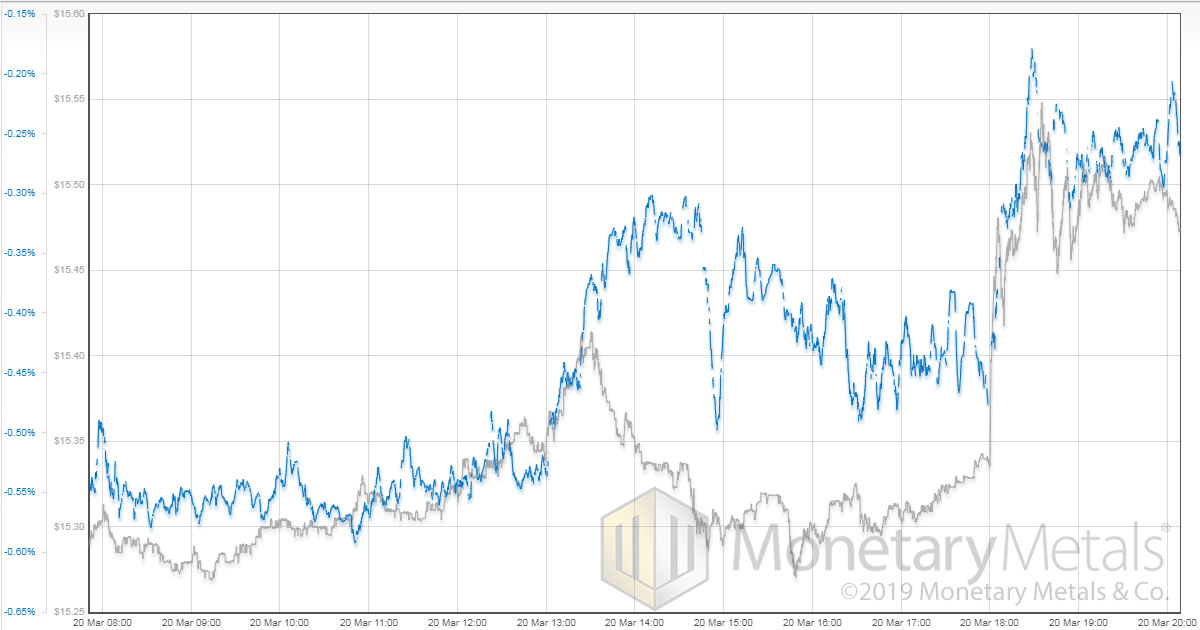

Wednesday was a big day for silver, with the price moving up around ¢20 at 2pm EDT, or 18:00 in London. It seems the Fed surprised everyone said what we have been saying for years that they will stop hiking rates. Of course they will. What choice have they got? Here is a graph of Wednesday’s action in both price and basis for silver. Hours prior to the big price Fed announcement and price move, we see the basis rising. First (starting around 12:00 GMT) there is rising price and basis. Speculators may have been getting ahead of the Fed’s anticipated announcement. Then (at 13:300) price drops back down but basis continues to rise. Folks, this is selling of physical metal. Do the math basis = future – spot. How else to explain falling price and rising basis? Then when Fed announcement hit, price shoots up rapidly, and basis—which had been subsiding—shoots up to a new level with the price. The price move was buyers in the futures market. The day began with silver at $15.30 and the basis at -55bps. It ends at $15.50 and -25bps. |

Silver price vs basis, May 29 |

© 2019 Monetary Metals

Tags: Basic Reports,Featured,Friedman,gold bug,Keynes,newsletter,otherwise-free-marketer