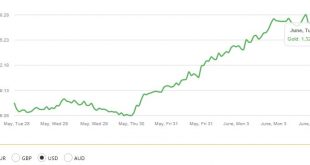

Gold has consolidated on yesterday’s gains and is marginally higher as risk aversion creeps back into markets. Gold rose 1.5% yesterday to its highest level in more than three months. Concerns that trade wars look set to escalate globally and fears that President Trump’s threat of tariffs on Mexico will hurt the global economy are spurring safe haven demand. Gold had a fourth straight session gain yesterday, settling at...

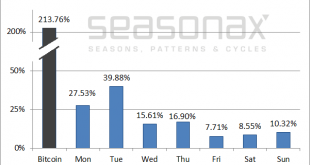

Read More »Bitcoin: What is the Best Day of the Week to Buy?

Shifting Patterns In the last issue of Seasonal Insights I have discussed Bitcoin’s seasonal pattern in the course of a year. In this issue I will show an analysis of the returns of bitcoin on individual days of the week. It seems to me that Bitcoin is particularly interesting for this type of study: it exhibits spectacular price gains, it is a very new instrument and it is unregulated. Moreover, it trades around the...

Read More »Dollar Supply Creates Dollar Demand, Report 2 June

We have been discussing the impossibility of China nuking the Treasury bond market. We covered a list of challenges China would face. Then last week we showed that there cannot be such a thing as a bond vigilante in an irredeemable currency. Now we want to explore a different path to the same conclusion that China cannot nuke the Treasury bond market. To review something we have said many times, the dollar is borrowed....

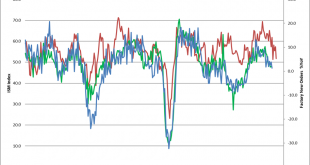

Read More »US Money Supply Growth and the Production Structure – Signs of an Aging Boom

Money Supply Growth Continues to Decelerate Here is a brief update of recent developments in US true money supply growth as well as the trend in the ratio of industrial production of capital goods versus consumer goods (we use the latter as a proxy for the effects of credit expansion on the economy’s production structure). First, a chart of the y/y growth rate of the broad US money supply TMS-2 vs. y/y growth in...

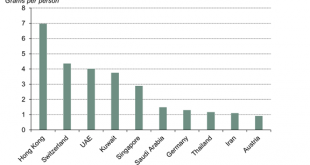

Read More »Gold Investment In Switzerland Remains Very Popular

Investors in Switzerland like gold and it is the second most popular investment after property or real estate 20% plan to invest in gold in the next 12 months Almost two-thirds buy or invest in precious metals at their bank; fewer than one-in-ten buy gold online by Alistair Hewitt of the World Gold Council There’s no doubt about it: the Swiss like gold. Switzerland has the second-highest per capita gold demand in the...

Read More »THE PENALTY FOR SAVING

In previous articles, we have outlined in great detail the many faults of the current monetary policy direction of major central banks and the large-scale economic impact of keeping interest rates artificially low. Among the worst offenders is the ECB, that is unapologetically persistent on continuing this exercise in absurdity that are negative interest rates. Over the last few years, the effects of this decision have...

Read More »In Gold We Trust 2019

The New Annual Gold Report from Incrementum is Here We are happy to report that the new In Gold We Trust Report for 2019 has been released today (the download link can be found at the end of this post). Ronnie Stoeferle and Mark Valek of Incrementum and numerous guest authors once again bring you what has become the reference work for anyone interested in the gold market. Gold in the Age of Eroding Trust This year’s...

Read More »The Crime of ‘33, Report 27 May

Last week, we wrote about the impossibility of China nuking the Treasury bond market. Really, this is not about China but mostly about the nature of the dollar and the structure of the monetary system. We showed that there are a whole host of problems with the idea of selling a trillion dollars of Treasurys: Yuan holders are selling yuan to buy dollars, PBOC can’t squander its dollar reserves If it doesn’t buy another...

Read More »China’s Nuclear Option to Sell US Treasurys, Report 19 May

There is a drumbeat pounding on a monetary issue, which is now rising into a crescendo. The issue is: China might sell its holdings of Treasury bonds—well over $1 trillion—and crash the Treasury bond market. Since the interest rate is inverse to the bond price, a crash of the price would be a skyrocket of the rate. The US government would face spiraling costs of servicing its debt, and quickly collapse into bankruptcy....

Read More »The Monetary Cause of Lower Prices, Report 12 May

We have deviated, these past several weeks, from matters monetary. We have written a lot about a nonmonetary driver of higher prices—mandatory useless ingredients. The government forces businesses to put ingredients into their products that consumers don’t know about, and don’t want. These useless ingredients, such as ADA-compliant bathrooms and supply chain tracking, add a lot to the price of every good. Of course...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org