Towards the end of 2017, Bitcoin — and with it other cryptocurrencies — experienced a real hype. Within a few months, prices shot through the ceiling. The euphoria was ginormous and in hindsight pure madness. With the new year, the disillusionment arrived. The market capitalization of all cryptocurrencies fell by more than half and prices plunged. This somewhat harsh consolidation was expected to bring the crypto world...

Read More »Bitcoin: les causes de la chute historique sous la barre des 6 000$.

juin 27, 2018 par LHK Bitcoin : les causes de la chute historique sous la barre des 6 000$. 2 articles de Adrien Pittore/ Entreprise news Bitcoin Horrific CrashesLes soldes ne commencent que mercredi. Et pourtant, la valeur du Bitcoin, plus généralement des cryptomonnaies, a accusé un sacré coup de rabais jeudi 21 juin. Alors qu’il était plutôt bien stabilisé, le cours du Bitcoin s’attaquait à la barre symbolique...

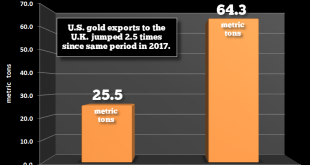

Read More »Gold Exports To London From U.S. Surge 152 percent In 2018

Gold Exports To London From U.S. Surge 152% In 2018 – U.S. gold exports to UK (primarily) London jumped over 150% from 25.5 metric tons to 64.3 mt in the first four months of 2018 (yoy)– Largest countries receiving U.S. gold exports are China/ Hong Kong, Switzerland and the UK – U.S. gold exports to London (UK) alone nearly as much as total U.S. gold production – Gold flowing from weak hands in West to strong hands in...

Read More »The Wealth Effect, Report 24 Jun 2018

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Last week, we discussed Social Security, a Ponzi scheme that is inevitably approaching its default. That leads us to another point in our broader discussion of capital destruction. Let’s illustrate with an example. The Fraudulent Promise Suppose Eric works for wages. He is 50 years old. His house is paid off, he has no...

Read More »Manipulation of Gold and Silver Is “Undeniable”

Manipulation of Gold and Silver by Bullion Banks Is “Undeniable” by David Brady via ZeroHedge Manipulation in precious metals is undeniable Now so chronic that it is obvious and therefore predictable Central banks around the world are repatriating their gold from the U.S. in preparation for some major event to come I want to be long … “when that event occurs” Silver Change - Click to enlarge As a former...

Read More »Merger Mania and the Kings of Debt

Another Early Warning Siren Goes Off Our friend Jonathan Tepper of research house Variant Perception (check out their blog to see some of their excellent work) recently pointed out to us that the volume of mergers and acquisitions has increased rather noticeably lately. Some color on this was provided in an article published by Reuters in late May, “Global M&A hits record $2 trillion in the year to date”, which...

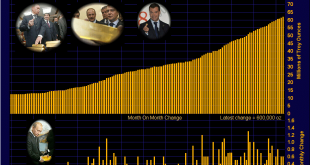

Read More »Russia Buys 600,000 oz Of Gold In May After Dumping Half Of US Treasuries In April

Russia adds another 600,000 oz to it’s gold reserves in May Holdings of U.S. government debt slashed in half to $48.7 billion in April ‘Keeping money safe’ from U.S. and Trump – Danske Bank Trump increasing the national debt by another 6% to $21.1 trillion in less than 18 months Asian nations accumulating gold as shield against dollar devaluation and trade wars Russia dumps Treasuries for gold and in a Trade war China...

Read More »“Perfect Environment For Gold” As Fed To Weaken Dollar and Create Inflation

“Fed is tightening into weakness and will eventually over-tighten and cause a recession” “More inflation and a weaker dollar” is “the perfect environment for gold” Geopolitical shocks will return when least expected and gold will soar in flight to safety The Fed raised rates yesterday, as I predicted months ago. I don’t say this to pat myself on the back. The point is, I use a rigorous scientific method to analyze and...

Read More »In Gold, Silver and Bitcoin We Trust? Goldnomics Podcast with Ronald-Peter Stoeferle

In Gold, Silver and Bitcoin We Trust? Goldnomics Podcast (Episode 5) interview with Ronald-Peter Stoferle We interview our friend Ronald-Peter Stoeferle, partner in Incrementum in Liechtenstein and author of the must read, annual gold report ‘In Gold We Trust’ in this the fifth episode of the Goldnomics Podcast. There are 3 key “tides of change” that Ronni has analysed and he warns that the “liquidity party” of the...

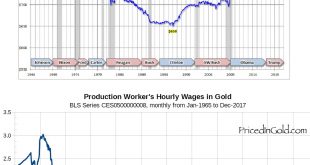

Read More »The Fed’s “Inflation Target” is Impoverishing American Workers

Redefined Terms and Absurd Targets At one time, the Federal Reserve’s sole mandate was to maintain stable prices and to “fight inflation.” To the Fed, the financial press, and most everyone else “inflation” means rising prices instead of its original and true definition as an increase in the money supply. Rising prices are a consequence – a very painful consequence – of money printing. Fed Chair Jerome Powell...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org