Interview with Dimitri Speck Given the massive intervention and monetary manipulation experiment by central banks over the last decade, the amount of distortions created in the market, as well as the record debt accumulation at all levels of the economy, have given rise to considerable risks for investors. For a more detailed understanding of these issues and for his outlook, I turned to Dimitri Speck, a renowned expert...

Read More »New Federal Legislation Requires Full Audit of America’s Gold Reserves

Congressman Alex Mooney (R-WV) Washington, DC (May 8, 2019) – U.S. Representative Alex Mooney (R-WV) introduced legislation this week to provide for the first audit of United States gold reserves since the Eisenhower Administration. The Gold Reserve Transparency Act (H.R. 2559) – backed by the Sound Money Defense League and government accountability advocates – directs the Comptroller of the United States to conduct a...

Read More »Nonmonetary Cause of Lower Prices, Report 5 May

Over the past several weeks, we have debunked the idea that purchasing power—i.e. what a dollar can buy—is intrinsic to the currency itself. We have discussed a large non-monetary force that drives up prices. Governments at every level force producers to add useless ingredients, via regulation, taxation, labor law, environmentalism, etc. These are ingredients that the consumer does not value, and often does not even...

Read More »Money Metals Exchange Lease #1 (silver)

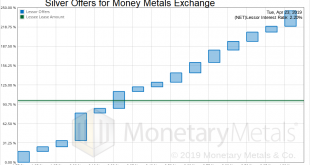

Monetary Metals leased silver to Money Metals Exchange, to support the growth of its gold and silver bullion business. The metal is held in the form of inventory in its vault. For more information see Monetary Metals’ press release. Metal: Silver Commencement Date: May 1, 2019 Term: 1 year Lease Rate: 2.2% net to investors Silver Offers for Money Metals Exchange - Click to enlarge...

Read More »Monetary Metals Leases Silver to Money Metals Exchange

Scottsdale, Ariz, May 3, 2019—Monetary Metals® announces that it has leased silver to Money Metals Exchange® to support the growth of its business of selling gold and silver at retail and wholesale. Investors earn 2.2% on their silver, which is held in Money Metals’ vault in the form of silver products. Monetary Metals has a disruptive model, leasing gold and silver from investors who own it and providing it to...

Read More »The Spreads Blow Out, Update 1 May

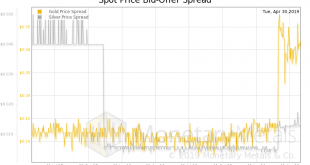

The bid-ask spread of both (spot) gold and silver has blown out. Both, on March 1. In gold, the spread had been humming along around 13 cents—gold is the most marketable commodity, and this is the proof, a bid-ask spread around 1bps—until… *BAM!* It explodes to around 35 cents, or two and half times as wide. On the same day, silver went from half a cent to 1.5 cents, or about triple. We zoomed out far enough—it does...

Read More »Is Keith Weiner an Iconoclast? Report 28 Apr

We have a postscript to our ongoing discussion of inflation. A reader pointed out that Levis 501 jeans are $39.19 on Amazon (in Keith’s size—Amazon advertises prices as low as $16.31, which we assume is for either a very small size that uses less fabric, or an odd size that isn’t selling). Think of the enormity of this. The jeans were $50 in 1983. After 36 years of relentless inflation (or hot air about inflation), the...

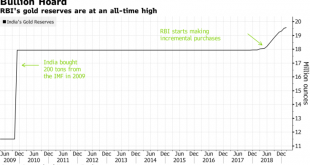

Read More »World’s Central Banks Want More Gold – India May Buy 1.5M Ounces In 2019

Royal Bank of India (RBI) may buy another 1.5 million oz this year according to OCBC Many other central banks including large creditor nations Russia and China are also adding to gold holdings via Bloomberg India’s central bank is likely to join counterparts in Russia and China scooping up gold this year, adding to its record holdings and lending support to worldwide gold bullion demand as top economies diversify their...

Read More »SWOT Analysis:Venezuela Sells $400 Million Worth Of Gold Bullion

Strengths The best performing metal this week was palladium, up 3.52 percent as CPM Group noted that the price could climb to $1,800 on supply constraints. Gold traders and analysts switched from bullish to mostly neutral or bearish on the yellow metal this week, according to the weekly Bloomberg survey. Turkey’s gold reserves reversed this week by rising $227 million from the previous week. The central bank’s holdings...

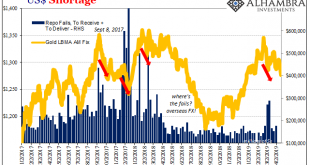

Read More »COT Blue: Distinct Lack of Green But A Lot That’s Gold

Gold, in my worldview, can be a “heads I win, tails you lose” proposition. If it goes up, that’s fear. Nothing good. If it goes down, that’s collateral. In many ways, worse. Either way, it is only bad, right? Not always. There are times when rising gold signals inflation, more properly reflation perceptions. Determining which is which is the real challenge. Corroboration and consistency are paramount. Gold had been...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org