In Other Global Markets the “Turn-of-the-Month” Effect Generates Even Bigger Returns than in the US The “turn-of-the-month” effect is one of the most fascinating stock market phenomena. It describes the fact that price gains primarily tend to occur around the turn of the month. By contrast, the rest of the time around the middle of the month is typically far less profitable for investors. The effect has been studied...

Read More »Scorn and Reverence – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Shill Alarm One well-known commentator this week opined about the US health care industry: “…the system is designed the churn and burn… to push people through the clinics as quickly as possible. The standard of care now is to prescribe some medication (usually antibiotics) and send people on their way without taking the...

Read More »Oil price highest in 3 years, gold ready to follow

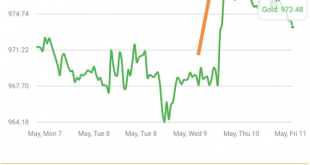

U.S. withdraws from Iran nuclear deal Oil jumps past $70 Argentina hikes interest rates to 40% S. 10 year disparity Western buying returns to gold Gold and silver both ended slightly up in a week dominated by heightening geopolitical news, weakening inflation data, and emerging market concerns.With gold closing the week at $1,318 (up 0.28%), €1,104 (0.37%), and £973 (0.2%). In sterling, gold was up strongly on Thursday...

Read More »How to Get Ahead in Today’s Economy

“Literally On Fire” This week brought forward more evidence that we are living in a fabricated world. The popular story-line presents a world of pure awesomeness. The common experience, however, falls grossly short. There are many degrees of awesomeness, up to total awesomeness – which is where we are these days, in the age of total awesomeness, just a short skip away from the Nirvana era. - Click to enlarge What is...

Read More »Gold Mining Supply Looks Set To Decline

Global demand for gold is increasing while new discoveries of gold remain small Gold mining output in Australia is forecast to decrease by 50% in the next eight years Decline in global gold mining supply makes a price increase almost certain The demand for gold is increasing, yet new discoveries of the precious metal have not kept pace with the demand. Funds for exploration are historically high, $54.3 billion, up 60...

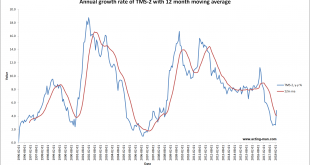

Read More »US Money Supply Growth Jumps in March , Bank Credit Growth Stalls

A Movie We Have Seen Before – Repatriation Effect? There was a sizable increase in the year-on-year growth rate of the true US money supply TMS-2 between February and March. Note that you would not notice this when looking at the official broad monetary aggregate M2, because the component of TMS-2 responsible for the jump is not included in M2. Let us begin by looking at a chart of the TMS-2 growth rate and its...

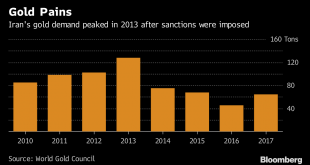

Read More »Iran’s Gold Demand May Surge On Trump Sanctions

Iran’s gold demand will probably be “strong” for the next few months and then gradually decline as U.S. sanctions start to take effect, according to the researcher who covers the country for Metals Focus Ltd. After a previous set of sanctions was imposed on Iran in 2012, it took two years for the country’s gold demand to start falling, according to data from the World Gold Council. It sank to only 45.1 tons by 2016, the...

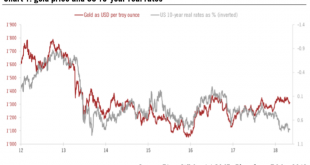

Read More »Gold price to remain trendless

The recent strength of the US dollar coupled with the rise of the US 10-year Treasury yield has weighed on the price of gold and silver. Since 19 April, gold has lost roughly 2.3%, while silver lost almost 4.5% in USD terms. At the start of the year, these two drivers were sending conflicting signals: higher US real rates were weighing on non-yielding gold, but the decline in the greenback was acting as a tailwind for...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org